-

A proposal on the agency’s overhead transfer rate would simplify how state- and federally chartered CUs pay for examinations by evenly splitting the costs of safety-and-soundness and insurance-related concerns.

June 23 -

Regulators cited "unsafe and unsound" practices at the credit union, which has assets of more than $76 million and turned a small profit in each of the last two years.

June 22 -

Iowa Governor Kim Reynolds has announced Kim Averill as the new head of the Iowa Division of Credit Unions, replacing retiring JoAnn Johnson.

June 7 -

Auditors performing a review of Ocwen Financial padded time sheets and claimed excessive and improper expenses, including lengthy travel and meals at strip clubs and casinos, according to a lawsuit filed against Fidelity Information Services.

May 30 -

State regulators felt they were strung along by the mortgage servicing giant Ocwen Financial after years of promises that were never fulfilled, resulting in successive enforcement actions against the company.

May 17 -

The accreditaiton period lasts for five years, subject to annual review. This is the fourth reaccreditation for Badger State regulators since 2001.

May 17 -

Johnson has led the Iowa CU regulator’s office since being appointed by the governor in 2011.

May 12 -

Compliance flexibility, state law harmonization and funding transparency requirements are among the regulatory steps that can encourage continued innovation.

May 12

-

In an echo of the rescue deals of 2007 and 2008, New Residential's CEO framed the transaction as something undertaken to benefit the entire industry.

May 1 -

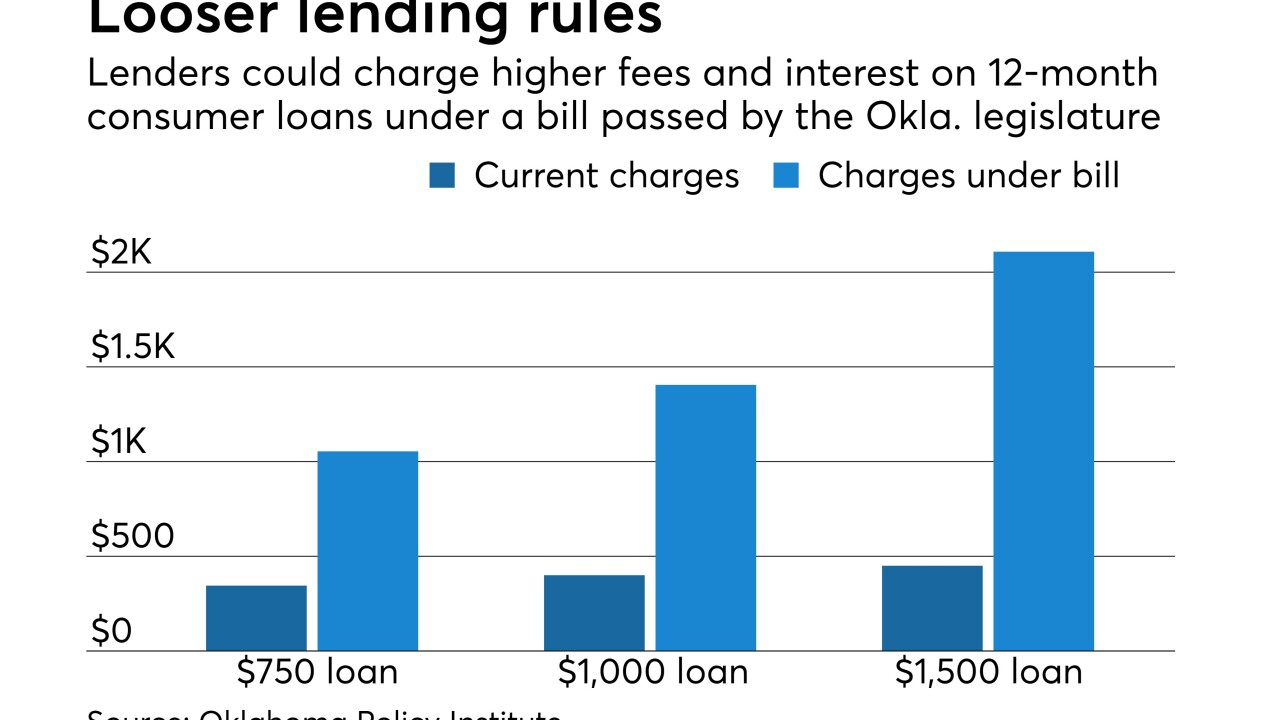

An industry-backed bill that is headed to the desk of Gov. Mary Fallin is seen by critics as an effort to minimize the impact of a potential CFPB crackdown.

April 28 -

The Conference of State Bank Supervisors has sued the OCC before the agency has finalized the requirements for a fintech charter, fueling speculation state regulators are trying to delay deployment or scare away potential applicants.

April 27 -

The Conference of State Bank Supervisors announced a raft of measures Tuesday designed to simplify multistate licensing and regulatory oversight for fintechs and other companies registered as money-services businesses.

April 18 -

Digital lenders have been partnering with banks to get around state-by-state usury caps, but that approach is facing tougher scrutiny.

April 5 -

An improved state-level system could be a tremendous advantage. Working closely with a cooperative regulator, innovators large and small can rapidly test a concept within state lines.

March 30 FinTech Forge

FinTech Forge -

Ocwen Financial is a step closer to the day when it can resume purchases of mortgage servicing rights.

March 28 -

We need to continue the dialogue between state regulators and fintech firms on a broad range of important issues impacting this growing industry.

March 27 Illinois Department of Financial and Professional Regulation

Illinois Department of Financial and Professional Regulation -

The German lender says that the Justice Department closed a criminal inquiry into its currency-trading activities without action, but regulators are said to be in the final stages of their own reviews of that conduct to determine if any fines are in order.

March 21 -

Eleven senators sent a letter to Attorney General Jeff Sessions asking him not to enforce federal pot laws in states that have legalized marijuana.

March 2