-

Switching core banking systems has long been done face to face, but the pandemic has driven the process into the digital arena. The change could be permanent.

July 14 -

Switching core banking systems has long been done face to face, but the coronavirus has driven the process into the digital arena. The change could be permanent.

July 14 -

The coronavirus pandemic has highlighted the issue of millions of Americans lacking access to high-speed internet at their homes. Financial services firms haven't been spared from this challenge.

July 8 -

Our third monthly survey found almost six out of 10 employers report that their plans for the return to work are stymied by uncertainty — specifically, a lack of clarity on the right timing, and persistent questions about how to provide a safe environment for their employees.

July 7 -

Our third monthly survey found almost six out of 10 employers report that their plans for the return to work are stymied by uncertainty — specifically, a lack of clarity on the right timing, and persistent questions about how to provide a safe environment for their employees.

July 7 -

The bank is rethinking its plans for bringing back workers in Texas, Florida and other states where new coronavirus cases are surging.

July 1 -

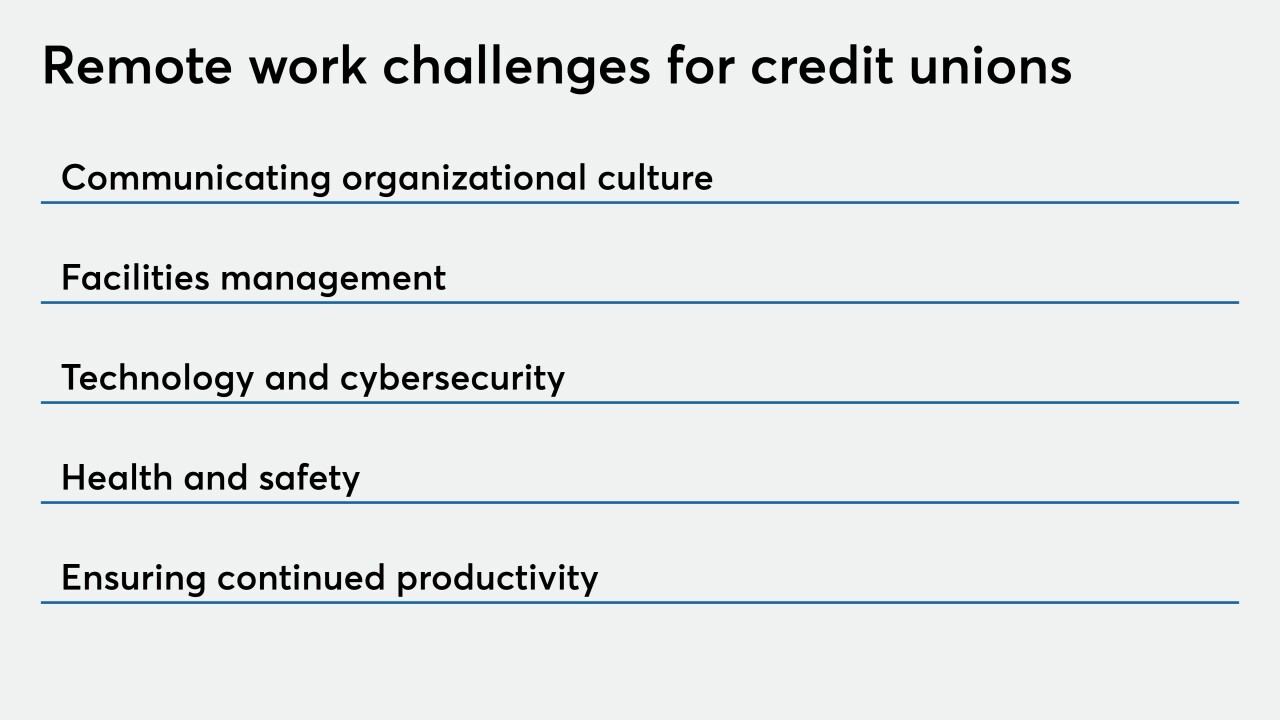

Some of the industry’s biggest institutions intend to keep a significant portion of their staff working from home indefinitely. That’s raising new questions about organizational cultures and how to appropriately utilize credit union facilities.

June 16 -

The bill, which now goes to the Senate, would give small businesses greater flexibility in how they use the funds; not everyone's on board with Otting's signature achievement.

May 29 -

The FHFA says the two government-sponsored enterprises need at least $240 billion of capital before they can go private; Transunion says more than 3% of consumer loans it tracks are in financial hardship.

May 21 -

The German bank’s money laundering controls are still not up to snuff, among other problems; three Democrats say banks may have shortchanged small-business borrowers.

May 14 -

Financial institutions are looking for a way to return some employees to their workplaces while prioritizing safety. The answer may involve contact tracing technology and the automation of a wide range of activities.

May 11 -

Financial institutions have been monitoring workers' productivity at home with tracking software and webcams. Now they're mulling whether to mandate contact-tracing apps, COVID-19 testing and other practices that could raise further privacy issues.

May 6 -

Credit unions moved quickly to reduce branch access as the coronavirus crisis worsened. The harder decision will be when and how to begin lifting those restrictions.

May 4 -

Inside Citigroup's headquarters in Manhattan, executives are trying to solve a problem bedeviling much of Wall Street: How to get employees up elevators.

April 26 -

The popular videoconferencing service has been beset by security issues, and some banks have banned employees from using it. Are they overreacting?

April 23 -

"We've proven we can operate with no footprint," said James Gorman, Morgan Stanley's CEO. "Can I see a future where part of every week, certainly part of every month, a lot of our employees will be at home? Absolutely."

April 16 -

Many credit union employees are currently working from home to slow the spread of COVID-19 but this can invite more attacks from cyber criminals.

April 15 -

Reports from the Singapore office, a coronavirus war room and a hardworking IT staff all helped TD Bank Group get nearly all employees ready to work from home and able to handle a tripling of remote deposit capture activity.

April 15 -

What banks need to know about the coronavirus stimulus package; tech vendor Finastra hit with ransomware attack; bank CIOs confront challenge of so many employees working at home; and more from this week's most-read stories.

March 27 -

CEO Brian Moynihan also said in an interview that the bank is helping clients affected by the coronavirus pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

March 27