-

The Pasadena, Calif., firm also reported growth in the number of active prepaid cards for the first time since the second quarter of 2015. Profits rose by 24%.

May 9 -

The acquirer of the failed Guaranty Bank took a pass on the latter’s 107 in-store branches, leading to their shutdown and a disruption in service for many low-income customers.

May 9 -

Despite a categorical denial this week by Wells Fargo CEO Tim Sloan, former employees like Yesenia Guitron say trawling for immigrants was routine.

May 4 -

At a minimum, federal lawmakers should fully fund the Community Development Financial Institutions Fund and support the CDFIs that provide economic opportunity where it is needed most.

May 1 National Community Investment Fund

National Community Investment Fund -

Big data is a key for banks to better understand what financial products underbanked consumers and small businesses need.

May 1 Accion

Accion -

Kosta Peric, deputy director of digital payments and financial services for the poor at the Gates Foundation, discusses his efforts to expand access to low-cost financial services in developing countries.

April 25 -

We asked microfinance organizations around the country about the challenges they face, what they wish banks would do differently, and even what they are reading. Here are some of their responses.

April 24 -

The marketplace for services to help struggling families balance their short-term and long-term financial needs is improving, but is still insufficient.

April 24 NYU Wagner Graduate School of Public Service

NYU Wagner Graduate School of Public Service -

Income volatility is a persistent problem for millions of U.S. households. Banks and fintech companies are trying to help consumers cope — but the industry can do more.

April 24 -

Digit's decision to charge a monthly fee for its savings help speaks to the challenge of making fintech profitable.

April 13 -

Banks can make a difference by helping to alleviate customers’ individual financial stress, the cancerlike scourge behind thousands of suicides. But this requires a certain mindset about the industry’s mission.

April 4 MX

MX -

Google Play and CFSI aim to improve use of financial health apps through a storefront organized by consumers' needs and by publishing a guide for app developers.

March 27 -

The Ollo card has the backing of former Citi CEO Vikram Pandit and several other big names in finance.

March 27 -

The underbanked rely on mobile access more than online or in-person contact. Therefore, the U.S. must follow developing countries’ leads and let consumers sign up for mobile-only accounts.

March 21 Oracle Financial Services Software

Oracle Financial Services Software -

President Trump’s proposed cuts to programs providing credit options for low-income and underserved communities would have a particularly negative effect in states that voted for him.

March 20

-

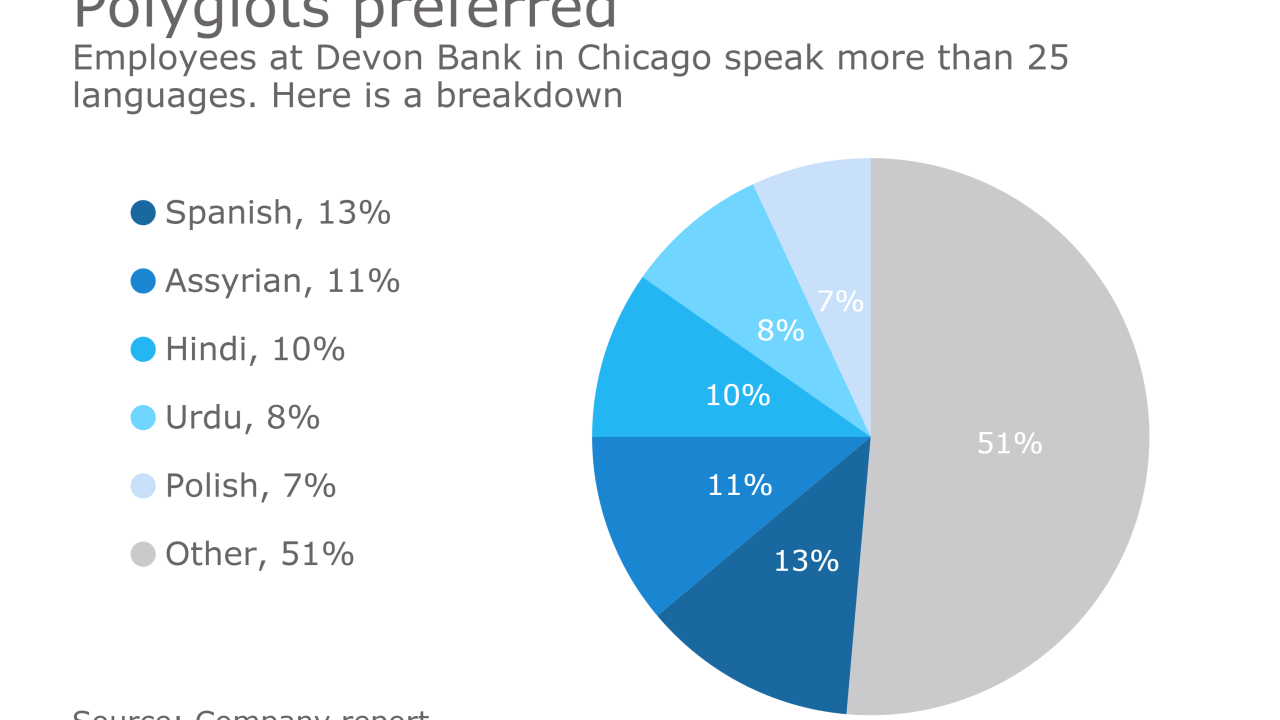

Devon Bank in Chicago has a long history serving immigrant groups in one of the nation's most diverse neighborhoods. Right now, its clients are worried about President Trump's actions on immigration and deportation.

March 16 -

When one considers the available data on bank lending, there is a lot more to the story. The solid loan growth at commercial banks in recent years has been concentrated in some of the sectors that appear least in need of credit.

March 16 Bank Policy Institute

Bank Policy Institute -

State Bank of Texas, which bought the failed Seaway Bank in January, is selling nine branches to Self-Help Credit Union.

March 10 -

By relying heavily on where a borrower went to college, online lenders may run afoul with regulators and could be missing out on good credits.

March 9 -

Startups in the payday lending space say their use of artificial intelligence is allowing them to make better loans at lower rates with fewer defaults.

March 7