-

Banks can make a difference by helping to alleviate customers’ individual financial stress, the cancerlike scourge behind thousands of suicides. But this requires a certain mindset about the industry’s mission.

April 4 MX

MX -

Google Play and CFSI aim to improve use of financial health apps through a storefront organized by consumers' needs and by publishing a guide for app developers.

March 27 -

The Ollo card has the backing of former Citi CEO Vikram Pandit and several other big names in finance.

March 27 -

The underbanked rely on mobile access more than online or in-person contact. Therefore, the U.S. must follow developing countries’ leads and let consumers sign up for mobile-only accounts.

March 21 Oracle Financial Services Software

Oracle Financial Services Software -

President Trump’s proposed cuts to programs providing credit options for low-income and underserved communities would have a particularly negative effect in states that voted for him.

March 20

-

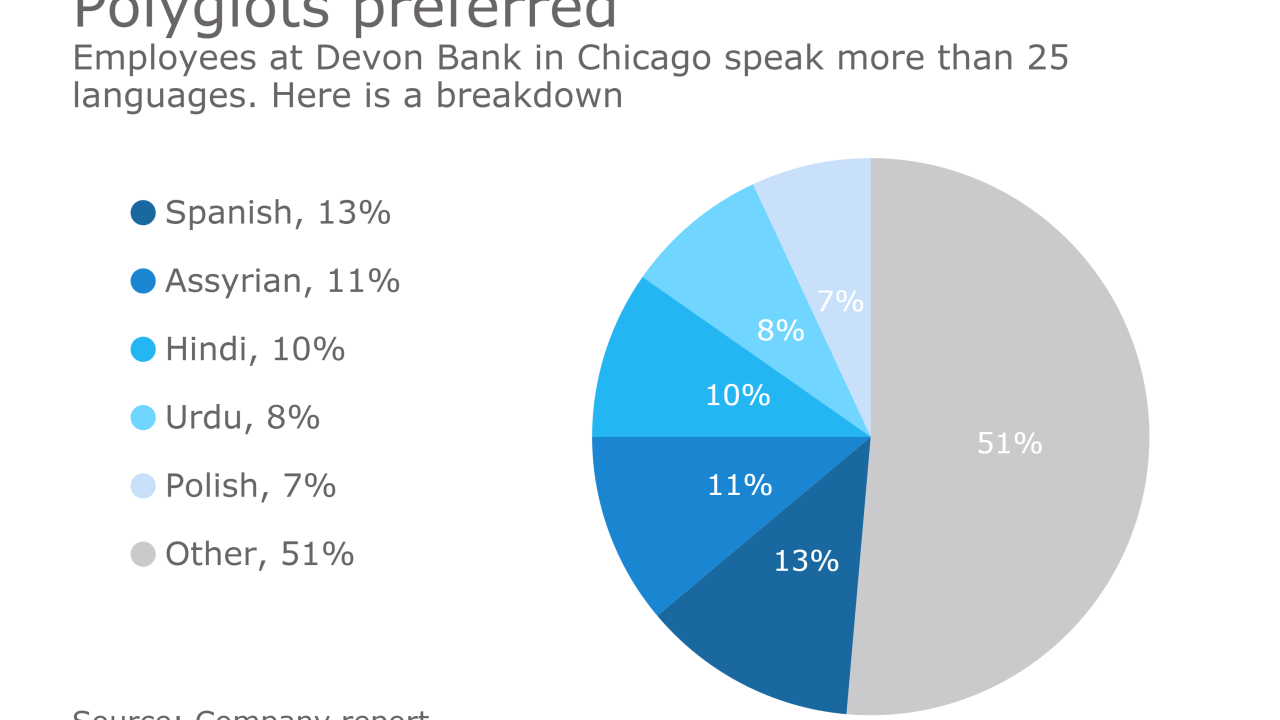

Devon Bank in Chicago has a long history serving immigrant groups in one of the nation's most diverse neighborhoods. Right now, its clients are worried about President Trump's actions on immigration and deportation.

March 16 -

When one considers the available data on bank lending, there is a lot more to the story. The solid loan growth at commercial banks in recent years has been concentrated in some of the sectors that appear least in need of credit.

March 16 Bank Policy Institute

Bank Policy Institute -

State Bank of Texas, which bought the failed Seaway Bank in January, is selling nine branches to Self-Help Credit Union.

March 10 -

By relying heavily on where a borrower went to college, online lenders may run afoul with regulators and could be missing out on good credits.

March 9 -

Startups in the payday lending space say their use of artificial intelligence is allowing them to make better loans at lower rates with fewer defaults.

March 7 -

Quona Capital Management raised $141 million for the Accion Frontier Inclusion Fund, which will invest in companies that provide financial and other services to underserved customers in emerging markets.

March 6 -

The retailer is set to announce Tuesday that it is updating its app to allow its customers to input money transfer information electronically rather than having to fill out paperwork in the store.

February 28 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

February 24 -

The card brand and bank will offer lending and prepaid cards to a traditionally underserved demographic.

February 23 -

The prepaid card issuer has been striving to overcome the setback it suffered from the discontinuation of a popular product in 2015.

February 22 -

Although much of banking is cautiously optimistic about the Trump presidency, the financial firms and organizations that serve the unbanked see the election as a mixed bag at best so far.

February 22 -

Tala, based in Santa Monica, Calif., makes its loan decisions after analyzing data on the mobile phones of users in Kenya and the Philippines.

February 22 -

First half: Brett King says the OCC fintech charter is overdue. Second half: fintech and refugees.

February 20 -

The Consumer Financial Protection Bureau is seeking feedback on the benefits and risks of using alternative data sources, such as rent or utility payments, that would allow lenders to build a credit history for unbanked consumers.

February 16 -

NCUA has opened its first round of CDFI certification for the new year.

February 13