-

Large U.S. banks are directing their venture capital dollars to fintechs in capital markets, wealth management and "future-proofing."

March 29 -

Capital One Financial led a $170 million investment in the startup Hopper as the financial giant seeks to make a deeper push into travel.

March 24 -

MissionOG spots opportunities among firms that provide pandemic-era automation and a route for legacy financial institutions to compete with challenger banks and fintechs.

March 24 -

Rapid changes in payments and regulations have blown open the door to new ideas, creating frontiers for fintech investors. Javier Perez hopes three decades of experience will help him have an early read on startups.

February 18 -

The fintech world is expanding at a sometimes breathtaking pace. Much of that growth is driven by venture capital, but how do VCs decide which companies to invest it in--or not? Join Greycroft partner Will Szczerbiak in a discussion with Olugbenga Agboola, the founder and CEO of Flutterwave, the San Francisco-based startup building the largest payments infrastructure in Africa. Guest host James Ledbetter, editor and publisher of the fintech newsletter FIN, will explore these questions: What are VCs looking for in a fintech startup? What are the hottest fintech sectors in 2021? How has the rise in fintech valuations affected the market? Where will growth be strongest in the next few years?

-

The latest round includes two new investors, Eurazeo Growth and Wellington Management, as well as one returning shareholder, Sprints Capital.

January 19 -

U.K. fintech Rapyd, backed by Stripe, has raised $300 million in a Series D round to fuel its growth through acquisitions in payment processing, card issuing and disbursements.

January 13 -

Walmart's fintech venture with Ribbit Capital allows it to influence more technological developments in the retail industry.

January 12 -

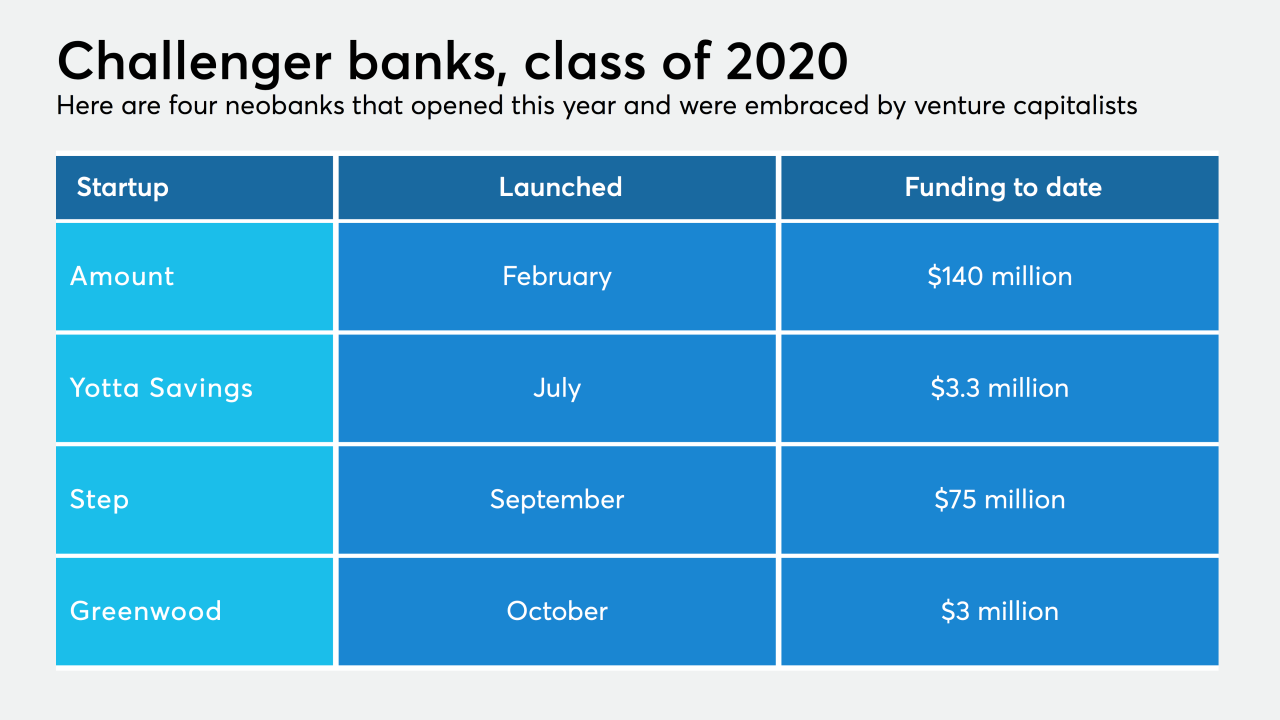

Venture capitalists will shift their focus to fintechs that support financial inclusion, according to Emmalyn Shaw, managing partner of the VC firm Flourish. Meanwhile, challenger banks will continue to grow, she says.

December 21 -

Fintech success stories have encouraged investors to back more startups, but newcomers will be hard-pressed to attract enough customers to compete while keeping expenses down.

December 7 -

E-commerce and digital finance are expanding quickly due to the pandemic, economic downturn and plans for recovery — providing opportunities for VCs that back technology that powers faster, more digital payments.

December 7 -

The new initiative is aimed at boosting credit union innovation through investments in fintech and other areas.

November 4 -

The company's Silicon Valley Bank unit reduced its loan-loss cushion by $52 million. Private-equity and VC clients have warmed to the practice of doing deals virtually, which increases lending opportunities, SVB executives said.

October 23 -

Mexican payments startup Klar has raised $15 million in a Series A round in an effort to challenge traditional banks by expanding access to debit cards and credit lines.

October 20 -

Atlanta-based fintech Greenlight has raised $215 million in a Series C round and announced that it has achieved a valuation of $1.2 billion, giving it unicorn status.

September 24 -

Petal, the credit card aimed at millennials and others with limited credit histories, has raised $55 million in a Series C as main street banks pull back on credit during the COVID-19 crisis.

September 24 -

The new unit plans to connect the startups it backs, such as the global payments network Veem, with experts at the company who can provide business advice.

September 16 -

Bolster, a marketplace for executives who can fill roles on an interim or advisory basis, is expected to fill a key need for the bank’s technology and life science clients.

September 11 -

Betsy Cohen, formerly of The Bancorp Bank, and venture capitalist Ryan Gilbert have created a vehicle to raise hundreds of millions of dollars, purchase a technology company and expand it.

August 27 -

Vanessa Colella, innovation chief at Citi, says remote working has had a democratizing effect. She also touches on the types of technology Citi has been incubating, the startups it’s investing in and her efforts at fostering a culture of generosity.

August 17