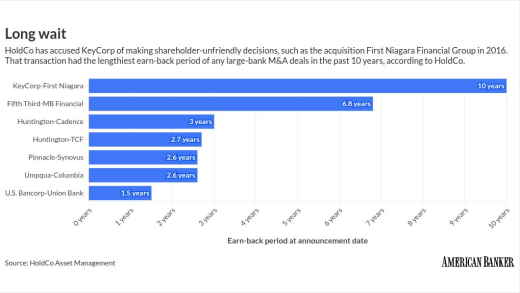

The activist investor HoldCo Asset Management said Monday that it doesn't plan to pursue proxy battles this spring at either Key or Eastern. It had been agitating publicly over the banks' M&A strategies.

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

Federal Reserve Gov. Christopher Waller said comments from banks and fintech firms reveal sharply different priorities in the creation of the central bank's proposed "skinny" master accounts.

-

Jack Dorsey's payments company also laid off employees early in 2025 and 2024 following a self-imposed employee cap of 12,000 in November 2023.

-

Fintech and crypto groups said in comment letters to the Federal Reserve that the proposed "skinny" master account is too limited and could keep firms dependent on banks. Banking groups asked for more time to comment.

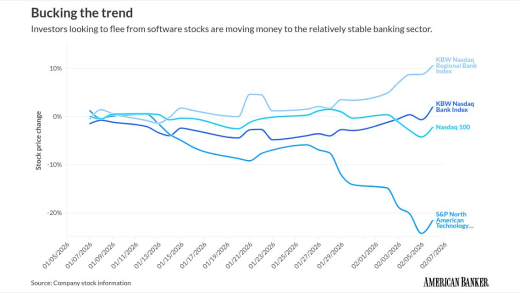

Artificial intelligence developments are stoking investor fears about software companies. Banks' limited exposure to the sector and general stability is proving attractive to investors.

Prosperity Bancshares finalizes the second of three acquisitions it's announced since July; Sumitomo Mitsui Banking Corporation appoints a new chief information security officer for its American operations; Huntington Bancshares, Third Coast Bancshares and Heritage Financial completed acquisitions; and more in this week's banking news roundup.

To address a budget deficit, the state of Washington has begun taxing credit unions that buy banks. Critics say there's just one problem: The tax will deter any such acquisitions from happening.

-

In a future world where AI agents transacting in stablecoins are a major factor in the U.S. economy, the Fed's traditional metrics for identifying an economic downturn will leave policymakers dangerously behind the curve.

-

Being a good CFO does not always translate into being a good CEO. Ken Thomas identifies ten different kinds of CFOs who just aren't chief executive officer material.

-

Two years on from a federal report recommending the creation of a resolution fund to guard against disorderly bankruptcies, concentration among nonbank mortgage companies has only increased. Congress must take action to avoid a crisis.

-

Fifteen banks have failed since November 2019, with the most recent one occurring on Jan. 30.

-

Threat group ShinyHunters claimed responsibility for the attack, which reportedly targeted third-party platforms rather than Betterment's own systems.

-

While the e-commerce giant has deemphasized the technology, banks and payment firms are testing the biometric option.

-

By pairing its real-time transfer app with China's UnionPay card, Visa is pursuing business in the huge country, where shifting regulations create hurdles for outside companies.

-

Renat Abramov, a former relationship manager in Brooklyn, bypassed know-your-customer protocols to open accounts for shell companies involved in a $14.6 billion scheme.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado