Under Stewart's leadership, the bank's commercial banking services gained 8% year-over-year growth in middle-market loans.

As sexy as decentralized systems and automation are these days, human involvement is still necessary in many areas.

-

Santander joins Iberpay as the first supporters of the European Payment Council's instant account-to-account network, Australian lawmakers approved bills to create a federated digital identity system, and more.

-

These three payment firms are working to grow revenue by pivoting to new markets and technologies, all while waiting for a turnaround in the industry.

-

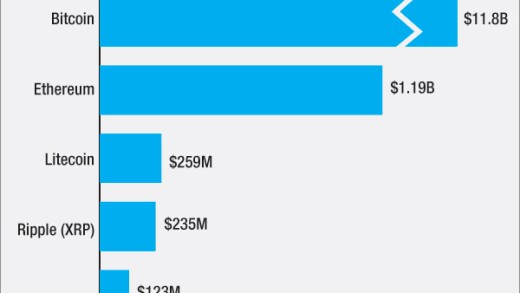

Regulation and other factors are creating friction for banks and consumers that want to transact in crypto.

Banks such as Citigroup, Regions and TD have decided they need to offer mobile customers truly customized experiences. They are experimenting with different ways of doing so that come across as helpful without being intrusive.

After hikes pinched profits across the industry, a move in the opposite direction could be the start of a more promising trend. But bankers caution that the immediate effects of a September rate cut figure to be small.

Former Chicago City Council member Patrick Daley Thompson may have made "misleading" statements about more than $200,000 in loans, the high court ruled — but they weren't "false."

-

To strengthen the industry, large regional banks should be subjected to heightened supervision and the Federal Deposit Insurance Corp. should change how it assesses deposit insurance premiums.

-

Pledges to get to net-zero funded emissions by 2050 appear to be falling by the wayside as oil companies expand their fossil fuel extraction operations.

-

Try keeping quiet and listening instead of talking, suggests the journalist Dan Lyons in his new book, "STFU." Doing so can lead to a host of benefits, from career advancement to a better marriage.

-

Her ability to communicate with markets, employees and investors is what these unprecedented times call for, something Martin takes in stride while pressing ahead.

-

Since joining HSBC in 2023, Oden has been focused on expanding its wealth business in the U.S.

-

Knowing what to acquire and what to let go are proving to be growth engines for S&P, and Cheung's just getting started.

-

Despite a schedule that always has her in the air and on the road, Aiyengar always makes time to meet with the bank's employees.

-

As head of TIAA's $955 billion retirement business, Gibson said that Americans are facing "a perfect storm in retirement security."

-

In addition to swiping exchange business from rival NYSE, Friedman has diversified with compliance software and anti-financial crime offerings for banks and securities firms.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The fintech SpringFour has partnered with financial institutions to connect individuals to community resources in a record-long U.S. government shutdown.

The 23rd annual ranking of women leaders in the banking industry.

-

- Partner Insights from Temenos

-

-