Guild said that the rapid acceleration of AI is creating "new, expansive cybersecurity challenges" for banks.

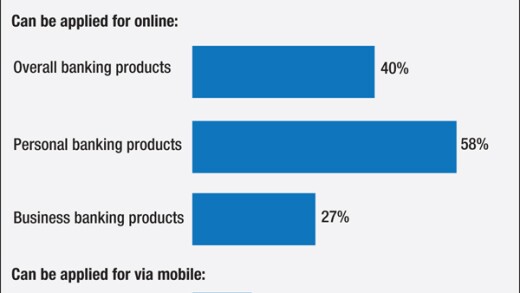

Despite the rise of digital banking, most people still look to physical channels when opening accounts. That's partly due to consumer preference, but banks have a long way to go to make the digital sales experience smooth.

-

The combined company could streamline card payments in a manner similar to American Express' "three party network" — while also doing more with artificial intelligence and other technologies.

-

The blockbuster merger proposal will be reviewed at a time when the Biden administration is expressing skepticism about consolidation. Its analysis will have to account for markets dominated by both big banks and the likes of Visa and Mastercard.

-

Data, volume and potential regulatory carve-outs are among the benefits Capital One Financial would get upon the completion of its deal to buy Discover Financial Services.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

With the Federal Reserve holding interest rates at elevated levels through the first half of the year, analysts are sharpening their collective focus on possible fallout from high deposit and borrowing costs.

Acting Comptroller of the Currency Rodney Hood suggested Tuesday that regulators should consider raising the dollar amount for mandatory suspicious activity reporting and revising the Herfindahl-Hirschman Index to advance bank mergers.

-

The agency is needlessly raising banks' costs at a time of severe economic uncertainty.

-

Rushing to create a central bank digital currency that is not permissionless and private would be dangerous to core American principles, according to a Minnesota Republican.

-

China and other countries are already working on their own central bank digital currency. Creating an American CBDC would ensure the dollar's place as a global reserve currency, a Connecticut Democrat writes.

-

The Federal Open Market Committee's decision to reduce interest rates for the first time in nine months lifted bank stocks Wednesday. The 25-basis-point reduction could lead to net interest income headwinds now, but loan growth later, analysts said.

-

Community Financial in Syracuse has made its biggest investment ever in an outside company, taking a $37.4 million equity stake in an insurance provider that focuses on the rental housing market.

-

St. Cloud Financial Credit Union will be issuing its own stablecoin at the end of this year, becoming one of the first U.S. credit unions to do so.

-

Creditors of the subprime auto lender Tricolor, which filed to liquidate in bankruptcy this month, are staking their claims on the company's remaining assets.

-

The two BNPL giants' pay-over-time loans will now be available for in-store purchases on Apple Pay in a move to capture more sales at brick and mortar stores.

-

State regulator says blockchain tools are key to detecting money laundering and sanctions violations.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The head of the government-sponsored enterprise's oversight agency said the cuts were made to positions that weren't central to mortgages and new home sales.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from ServiceNow

- Sponsor Content from ServiceNow

- Sponsor Content from ServiceNow

- Sponsor Content from ServiceNow