Zions Bancorp. is among the latest banks to report material losses due to alleged borrower fraud. Stocks of regional lenders plunged on Thursday.

The Federal Financial Institutions Examination Council reiterated Monday that its cybersecurity assessment tool is voluntary, despite bankers' fears that not using it could put them in hot water with their examiners.

-

Westpac, Capital One and JPMorgan Chase are offering savings accounts and debit cards to children below 10, using financial literacy to get an edge in building consumer relationships.

-

City National Bank of Florida is starting a national capital markets division, Orrstown Financial will close branches in Pennsylvania and Maryland, JPMorgan Chase unit announces in-store biometric payments and more in this week's banking news roundup.

-

International health care is a fast-growing multibillion-dollar industry combining two of the most complex transactions to process: travel and medicine. The card network says its technology builds a foundation to tackle the problem.

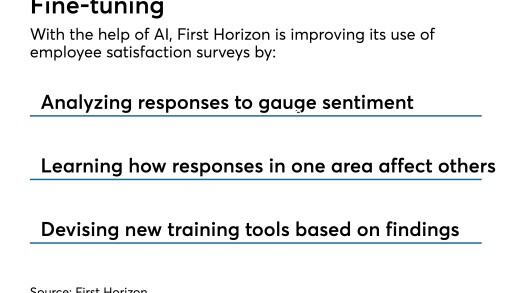

First Horizon is using artificial intelligence software to analyze employee feedback on workplace surveys.

The regulatory scrutiny involves online savings accounts that allegedly deceived consumers into believing they were receiving high rates.

The Buffalo, New York-based bank also said Monday that the commercial real estate lending market has started showing signs of life, but that the renewed competition is crimping its loan growth.

-

Regulators and the public are still concerned about the condition of the banking system. Bankers can't afford to look away.

-

Artificial intelligence is on the cusp of solving some of the most chronic problems facing bank managers. They need to embrace it.

-

From hidden fees to misleading marketing, small businesses face too many challenges when making and receiving cross-border payments.

-

Fintechs and banks are rapidly placing checkout inside apps, e-commerce sites and travel services, standing on the shoulders of a new generation of artificial intelligence and data science to revolutionize customer experience. Some of the bank executives leading the charge spoke with American Banker about the innovation's potential.

-

The "Roughrider" coin, which is scheduled to launch in early 2026, will be the first state stablecoin to launch on Fiserv's digital asset platform.

-

The Accountability Board, a three-year-old-group focused on corporate governance issues, said the bank shouldn't have backtracked on a longstanding policy separating the chairman and CEO roles.

-

New Federal Reserve research reveals that identity theft victims who use extended fraud alerts often see significant and lasting credit improvements.

-

The retail giant is betting on the mainstream appeal of digital assets, while Lloyds' cash-preservation strategy gains steam. That and more in American Banker's global payments and fintech roundup.

-

Federal Reserve Gov. Michael Barr is warning small banks about the growing threat from fraudsters' use of AI-generated deepfakes. But he also says AI may be able to help community banks fight fraud more effectively.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The parent of Crosscountry Mortgage plans to use proceeds to pay down its mortgage-servicing rights line of credit as well as for general corporate expenses.

The West Reading-based bank has opened three offices in California and two in Nevada, continuing its strategy of establishing a presence in high-growth markets around the country, CEO Sam Sidhu said.

The 23rd annual ranking of women leaders in the banking industry.