During Thursday's earnings call, CEO Michael Miebach said the payment company is partnering with large technology firms and offering consulting for the emerging form of artificial intelligence, attempting to expand a strategy to draw revenue beyond card processing.

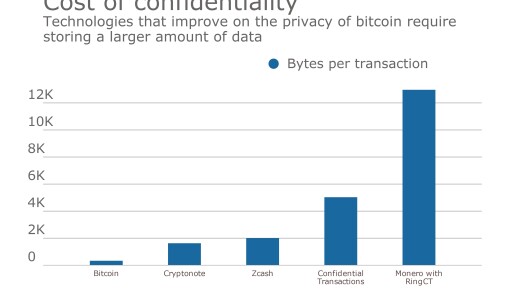

A previously unreleased paper lays out the pros and cons for banks of technologies designed to restore confidentiality on shared ledgers.

-

The Federal Reserve released the volume of activity on its instant payments network since its launch last summer, showing a surge in usage between July and August.

-

A punitive tax on payments sent overseas to the families of immigrants would have a cascading set of consequences — all of them bad.

-

The niche buy now/pay later firm is looking for differentiation in a crowded market with recognizable brands like Klarna, Affirm and Afterpay.

Among other things, Kai, the insurance firm's AI assistant, will tell customers how to avoid the bank's monthly fee.

The largest U.S. bank by assets has elevated Jennifer Piepszak to chief operating officer, in preparation for Daniel Pinto's retirement in 2026. But Piepszak is not interested in being CEO, the company said.

Upgrading its anti-money-laundering controls is the Canadian bank's top priority following historic failures that led to a $3.1 billion penalty and a U.S. asset cap.

-

The bureau is threatening to change its stance and classify EWA programs as loans. This is unwise and will harm consumers.

-

As virtual assistants become central to banking, financial institutions of all sizes must embrace and leverage this transformation to redefine the customer experience.

-

Characterizing them as 'schemes' unfairly impugns a service that cash-strapped consumers value and have come to count on.

-

In an environment of persistent economic unease, banks have a unique opportunity to help small businesses, Sekou Kaalund, U.S. Bank's head of branch and small business banking, said at American Banker's 2025 Small Business Banking conference.

-

A national bank charter will help UBS Bank USA to expand offerings for wealth management clients, according a company memo.

-

The New York-based bank, which works with many Democratic campaigns, faces investor concerns that it might be targeted by the Trump administration. CEO Priscilla Sims Brown says the bank's "strong profitability" is its best shield from political threats.

-

The Ohio bank is working with Alloy Partners to build startups in fintech, payments and wealth management even as it acquires multiple banks this year.

-

Huntington's $7.4 billion acquisition of Cadence would give the Ohio-based bank a top-five market share in both Dallas and Houston. It comes just a week after Huntington closed its last Texas acquisition.

-

In an expanded partnership announced Monday, the card network and payment fintech will enable hundreds of millions of consumers and tens of millions of merchants to use new forms of artificial intelligence for shopping and payments.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

While banks welcome the "whole-of-government" approach that led the effort, private sector takedowns remain difficult without federal warrants.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global