TD Securities began making OpenAI's ChatGPT available to traders in June and it's become a "massive time save," according to Chief Information Officer Dan Bosman.

With the Office of the Comptroller of the Currency evaluating the possibility of a nationwide charter for certain fintech firms, state regulators are voicing concerns that a charter could cut into their authority.

-

Large and regional banks again proved their resiliency in the Fed's annual exams. But analysts noted that a few lenders faced some negative surprises — a development that may scuttle investor hopes for share buybacks by those banks.

-

When TD Bank launched an audio brand identity across its communication channels early this year, the new jingle triggered a surprising reaction from consumers using the firm's ATMs.

-

The technology company faces fines over potential anti-competition practices; Takis Georgakopoulos is on his way to Fiserv.

Scarlett Sieber will be based in the bank’s Labs division, working on forging partnerships with fintech firms.

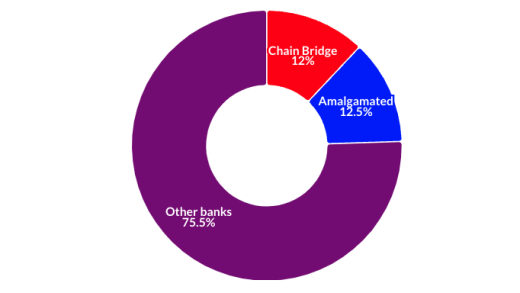

As political campaigns become more expensive and more complicated, meet the banks that have become the preferred financial institutions for the Republican and Democratic parties.

SEC Commissioner Hester Peirce said it was important for the agency to not stifle innovation through its regulatory approach.

-

An executive with the Federal Home Loan Bank of Chicago pushes back on a BankThink article criticizing the Mortgage Partnership Finance program.

-

The SEC chairman's power grab is driving the crypto industry out of the U.S. Eventually, the courts will find that he has exceeded his authority.

-

If the Supreme Court strikes down CFPB regulations by ruling against the constitutionality of the agency's structure, technological innovation will be harder for banks to achieve as regulatory clarity moves further out of reach.

-

The fund is designed to generate a financial return, as well as Community Reinvestment Act credit, for TD. Its inaugural investment is in a mixed-use project that will include 49 affordable housing units.

-

A government shutdown and a single senator's hold prevented the renewal this week of a bipartisan law that helped banks and other firms defend against hackers.

-

Federal Reserve Vice Chair Philip Jefferson said Friday that the economic outlook is uncertain and that he was adopting a cautious approach to gauging whether slowing growth and a softening labor market outweigh inflation pressures from tariffs.

-

The CardWorks subsidiary has officially taken over Ally Financial's Ollo credit card portfolio, ending a five-year dance between the two companies that first had Ally buying CardWorks for $2.7 billion.

-

The Consumer Bankers Association elected Atlantic Union Bank's Maria Tedesco as its 2025 board chair; Banco Santander's Steffen Doyle is leaving the firm; Commerzbank's lawyers allege an ex-analyst made up sexual harassment claims against a colleague after he lost his job; and more in this week's banking news roundup.

-

The ongoing government shutdown prevented the Bureau of Labor Statistics from releasing its September jobs report Friday, but job growth appears to be softening. The lack of reliable government data comes as the Federal Reserve mulls further interest rate cuts.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor content from Fiserv

- Partner Insights from Clickatell

- Sponsor content from Accenture

- Partner Insights from Biz2X