Federal Reserve Gov. Christopher Waller said Wednesday that the central bank will soon issue a request for information on a nascent proposal to offer "skinny" payment accounts to eligible institutions and is aiming to finalize a rule by the fourth quarter of 2026.

ATMs tend to run on older versions of the Windows operating system, which potentially makes them targets for ransomware that preys on such vulnerabilities.

-

Federal Reserve Chair Jerome Powell said reserve banks will no longer factor "reputational risk" into master account decisions. The crypto industry is encouraged by the commitment, but says more changes are needed.

-

The rollout of new technologies in point-of-sale retail payments in the U.S. has historically been slow, and consumer adoption of those new payment flows can be even slower. Can consumers' propensity for self checkout help push adoption?

-

CEO Cameron Bready told analysts that the company's changes in management structure, product reorganization and strategic retrenchments will show up in earnings later in 2025.

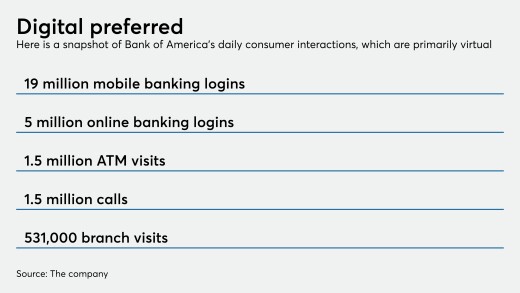

Bank of America is applying a familiar arsenal — including APIs and its popular virtual assistant, Erica — to online business banking, cross-border payments and cash management in an effort to modernize those services.

The top five bank M&A deals had an average deal value to tangible common equity ratio of nearly 185%.

Nissan Motor Acceptance Corp. has applied for an industrial loan company charter, joining General Motors and Ford in hoping for better prospects for approval under the Trump administration.

-

Getting appointees confirmed by the Senate can be a time-consuming and painstaking process in ideal circumstances, and doing it in an election year amid a scandal is far from ideal. Even so, the White House and Senate Democrats should be motivated to move fast.

-

The Bank for International Settlements' Innovation Hub is doing important work on integrating new technology into the global financial system. The next step is to bring both banks and nonbanks into the discussion.

-

Gaps in traditional means of assessing creditworthiness are being filled by new kinds of information, such as cash flow data. The result will be good for both banks and borrowers.

-

Sunrise Banks and other members of the Global Alliance for Banking on Values are encouraging their employees to train the generative AI models they use, so that the models understand values-based banking.

-

Industry groups and consumer advocates are continuing to push for regulators to interpret the GENIUS Act's prohibition on stablecoin interest as broadly as possible, while crypto firms push for a narrower interpretation, arguing that increased competition would benefit consumers.

-

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

-

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

-

In its latest financial stability report, the Federal Reserve found that asset valuations continue to be elevated and leverage levels remain high, especially among nonbanks like hedge funds and insurance firms.

-

Federal Reserve Board Gov. Stephen Miran said the growth of stablecoins and cryptocurrencies will likely impact monetary policy and could lead to lower interest rates.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The largest bank deal to be announced in 2025 is still on track to close in the first quarter of next year, Fifth Third CEO Tim Spence said. His comments came amid opposition to various aspects of the deal, as well as how it came together and the timeline for closing the transaction.

Tokenization initiatives are moving beyond proofs of concept toward institutional-scale deployment.

The 23rd annual ranking of women leaders in the banking industry.