The appointment ends a seven-month search for a permanent CEO. Milotich was named interim CEO in February following the resignation of former CEO and director Simon Khalaf.

Battery Ventures, a tech-focused investment firm, has agreed to acquire Physical Security Business Unit, part of the security division of Nice Systems, a vendor that focuses primarily on the financial services industry.

-

Amazon's buy now/pay later partnership with Affirm expands; NAFCU-CUNA merger gets affirmative vote from members; expense-reporting firm Navan rolls out European bank partnerships; and more in the weekly banking news roundup.

-

Taking the reins again as chief executive of Block following the recent departure of CEO Alyssa Henry, Jack Dorsey has launched internal changes to jump-start growth, eliminate silos and promote the use of artificial intelligence.

-

Companies such as Visa and Mastercard, as well as banks and retailers, are stepping up their investments in artificial intelligence to reach small businesses and spot new uses.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

Banking regulators and the Department of Justice must decide whether the blockbuster deal raises antitrust concerns. Looming over their analyses are questions about how broadly or narrowly to define the relevant markets.

The Consumer Financial Protection Bureau finalized a rule that will remove medical bills from credit reports to end what the bureau called "coercive debt collection practices."

-

The board’s original three-member structure was superior to the five-person model in use today. Here's why it should be reinstated.

-

BNPL providers earn most of their money from their merchant partnerships, not late fees, as their critics claim.

-

Under procedural changes recently adopted by the Consumer Financial Protection Bureau, the director could pursue more enforcement actions administratively without federal court approval. Financial firms may have a harder time defending themselves as a result.

-

In a letter Friday, U.S. Sens. Elizabeth Warren, D-Mass., Chuck Schumer, D-N.Y., and Cory Booker, D-N.J., called on Pulte to address housing unaffordability instead of concentrating on efforts to destabilize the Federal Reserve.

-

Finastra is the latest bank tech provider to bring stablecoins to cross-border payments, which experts say is a way banks can use blockchain post-GENIUS Act.

-

Federal Reserve Gov. Christopher Waller criticized his fellow Federal Open Market Committee members for not cutting interest rates in July, but said he is "hopeful" that easing monetary policy soon can keep the labor market from "deteriorating."

-

Federal Reserve Gov. Lisa Cook's lawsuit against President Trump is challenging his move to remove her from office because allegations against her do not constitute "cause." How courts weigh in could dictate the future of the central bank's independence from the White House.

-

As the holiday shopping season approaches, retailers are grappling with how to optimize their inventory and set prices amid higher tariffs. A new Wells Fargo report sheds light on how businesses are adapting.

-

On Thursday, the two banks disclosed a presentation that seeks to reinforce the strategic rationale behind the proposed $8.6 billion deal.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

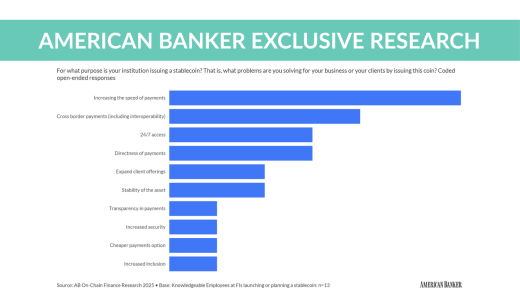

Banks and credit unions are steering away from stablecoins chiefly due to lack of customer demand, per new American Banker research.

Debra Cope is a freelance writer based in Washington, D.C. and former executive editor of American Banker.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado