Almost 15 months after its announcement, Capital One Financial Corp.'s takeover of Discover Financial Services was officially completed on Sunday, creating the largest credit-card issuer by loan volume in the US.

-

Terry Dolan, vice chair and chief administration officer at the Minnesota bank, had been at the company for more than 25 years.

March 31 -

While debit cards are less profitable, payment experts say they're still an important way to build relationships with consumers.

March 31 -

Former Capital One Multifamily executive Grace Huebscher departed recently and the Federal Housing Finance Agency appointed a successor amid broader reform.

March 31 -

The $381 million deal for Alabama-based Southern States Bancshares would give FB entree to the sprawling Atlanta market. CEO Christopher Holmes said the bank would likely focus on nearby suburban communities initially.

March 31 -

A new survey shows banks overwhelmingly support state laws that let them pause transactions to prevent elder financial abuse, despite shortcomings.

March 31 -

The Trump administration continues to battle the Consumer Financial Protection Bureau's union by seeking a stay of a preliminary injunction that reinstated the CFPB's workforce and contracts and preserved its data.

March 31 -

Small lenders across the country, including Forte Bank in Wisconsin, promoted and recruited chief executives in recent weeks.

March 31

Investors face yet another bumpy start to the trading week, although it's mounting concern over US debt rather than tariffs likely generating the volatility this time.

Almost 15 months after its announcement, Capital One Financial Corp.'s takeover of Discover Financial Services was officially completed on Sunday, creating the largest credit-card issuer by loan volume in the US.

Growing loans was a tall order in 2024, but banks that could do just that were able to outperform their peers.

Among banks with between $10 billion and $50 billion of assets, those that targeted narrow lending markets rose to the top.

Seven of the 20 top-performing banks with $2 billion to $10 billion of assets last year were based in Texas. But it's not about being bigger.

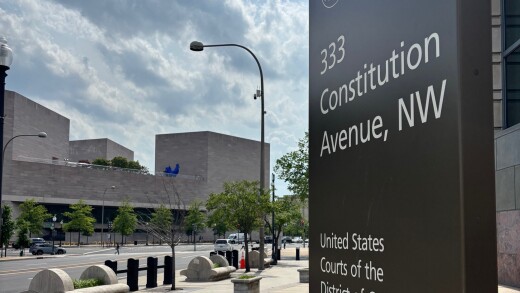

Firing 90% of the Consumer Financial Protection Bureau's staff and stripping it down to "the statutory studs" is lawful, an attorney for the CFPB told an appeals court.

The merger, which provides for $6.75 million in payments to three Space City Credit Union executives, had drawn criticism. But Space City members approved it by an 82% to 18% margin.

Standard Chartered Bank hired a new head of digital assets, Europe and Americas; Provident Financial Holdings has a new chief financial officer; Bank of America is opening four branches in Boise, Idaho; and more in this week's banking news roundup.

Almost 15 months after its announcement, Capital One Financial Corp.'s takeover of Discover Financial Services was officially completed on Sunday, creating the largest credit-card issuer by loan volume in the US.

Firing 90% of the Consumer Financial Protection Bureau's staff and stripping it down to "the statutory studs" is lawful, an attorney for the CFPB told an appeals court.

The merger, which provides for $6.75 million in payments to three Space City Credit Union executives, had drawn criticism. But Space City members approved it by an 82% to 18% margin.

Standard Chartered Bank hired a new head of digital assets, Europe and Americas; Provident Financial Holdings has a new chief financial officer; Bank of America is opening four branches in Boise, Idaho; and more in this week's banking news roundup.

Bankers are concerned about stablecoins gaining traction due to the passage of the GENIUS Act, and also continue to sound the alarm about the failure to resolve check fraud disputes, according to the latest quarterly survey from IntraFi.

Pulaski Savings Bank's failure will cost the FDIC's Deposit Insurance Fund 57.6% of its total assets.

The CEO of First Northwest Bancorp is promising to fight a lawsuit claiming the lender helped a client perpetrate a Ponzi scheme that bilked a hedge fund out of more than $100 million.

Most Influential Women in Payments honorees say the dramatic expansion in technology presents new opportunities and challenges as employers evolve away from traditional business models.

Honorees from American Banker's Most Influential Women in Payments discuss spotting tangible uses for innovation, rather than buying into hype.

Each year, American Banker recognizes the women who are advancing the payments industry in banking, retail, acquiring, processing and more.

-

John Buran shares how his New York bank and its small business customers are faring with tariff uncertainty — and how some have quickly changed suppliers and modified business plans — in the latest American Banker podcast.

July 15 -

Staking activities and stablecoins are two of the possible ways banks could have a role in decentralized finance, said Margaret Butler, head of the financial services practice at the law firm BakerHostetler and Kristiane Koontz, director of Treasury Services and Payments at Zions Bank, in interviews recorded at the Digital Banking Conference in June.

July 1

-

The Consumer Financial Protection Bureau said in a court filing that it plans to reverse its interpretive rule tightening standards for Pay in 4 buy now/pay later loans.

March 28 -

The San Francisco bank announced Monday that it has shed its fifth regulatory order this year — this one related to loss mitigation practices in its home lending business.

March 28 -

The Treasury Department told the OMB that all 11 programs in the CDFI Fund are statutorily mandated. The White House said "no final decisions have been made" about the programs.

March 28 -

The Federal Reserve, the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency say they will move to rescind a 2023 reform to the Community Reinvestment Act, citing litigation concerns about the rule.

March 28 -

The SEC had sued the cryptocurrency exchange for allegedly operating as an unregistered securities exchange, broker, dealer and clearing agency. The case was dropped with prejudice.

March 28