Senate Banking Committee ranking member Elizabeth Warren, D-Mass., warned the Treasury Department and Federal Reserve in a Wednesday letter not to bail out cryptocurrency firms in the wake of sharp declines in digital asset values over the last several months.

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

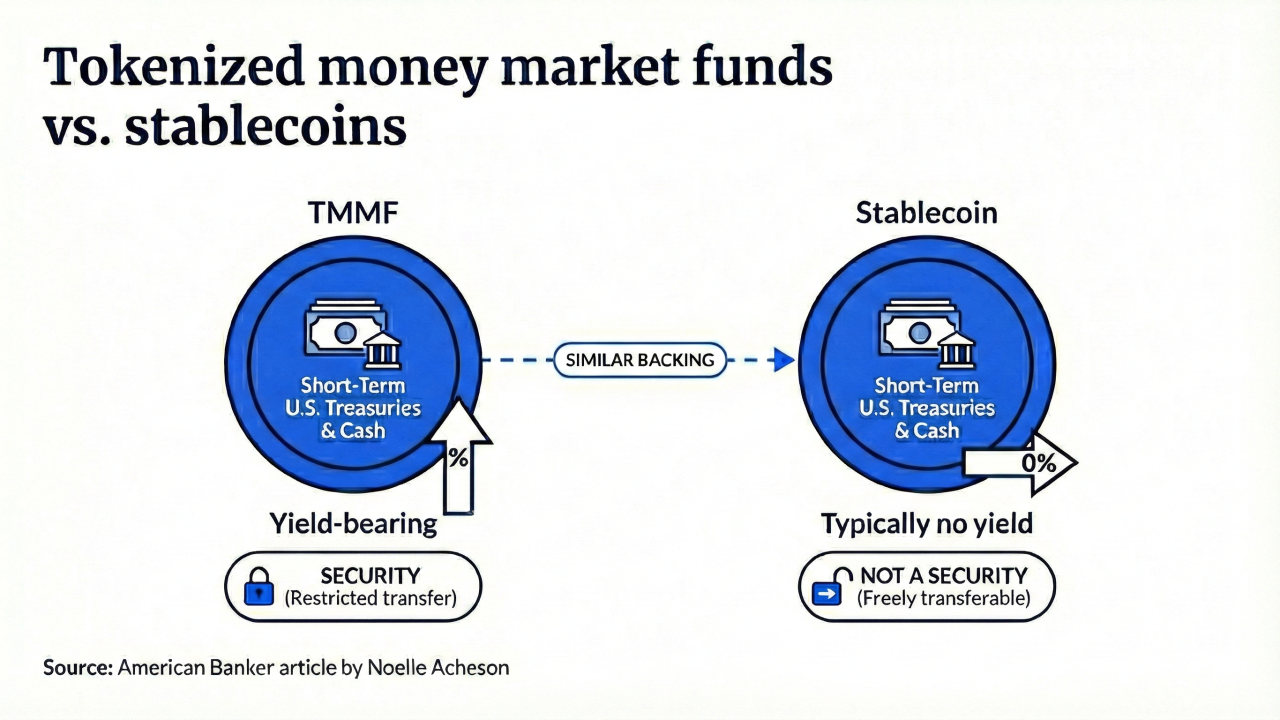

Tokenized money market funds are becoming more money-like — but, unlike the payment stablecoins that share the same backing, they are securities. Noelle Acheson looks at what this means for our understanding of money.

-

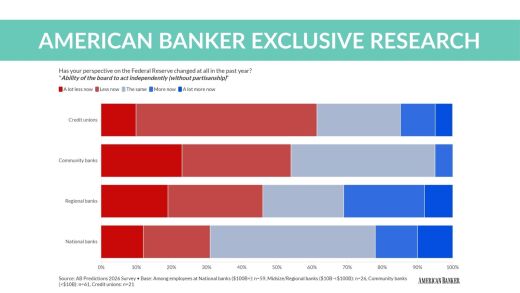

The Federal Reserve is moving quickly to implement its proposed "skinny" master account, giving state-chartered fintechs more access to the central bank's payment systems. But experts say a legal challenge to the rule is almost certain, regardless of where the Fed draws the line.

-

Adyen is powering payments on Uber's new ride-hailing kiosk at La Guardia airport in New York. For the fintech, it's an opportunity to advance payment personalization.

The Olympics are boosting spending in Italy, large-in-part thanks to Americans. In the U.K., Barclays is reportedly leading a meeting to seek support for an existing project. The meeting comes against the backdrop of geopolitical concerns and the dominance of American-based payment firms.

The Buffalo-based bank didn't specify the size of potential losses from a suit that grew out of the collapse of subprime auto lender Tricolor Holdings. M&T said its trust subsidiary will "vigorously defend itself" against claims by investors who allege that it should have protected them from alleged fraud.

Federal Reserve Vice Chair for Supervision Michelle Bowman said in comments Wednesday that the central bank plans to publish its Basel III endgame capital proposal for public comment before the end of March.

-

Doubling down on what has worked in the past — especially if it's still working now — may inadvertently trap banks into business models ill-suited for the future. Smart bankers make room for change before it is forced on them.

-

As artificial intelligence increasingly plays a role in the regulation of banks and other financial services firms, regulators need to be certain that these new systems aren't importing old biases into modern oversight.

-

Financial fraud in the U.S. has become so sophisticated that it now has its own internal economy, complete with supply chains and customer service. Banks need to wake up to the reality that the landscape has changed.

-

The Buffalo-based bank didn't specify the size of potential losses from a suit that grew out of the collapse of subprime auto lender Tricolor Holdings. M&T said its trust subsidiary will "vigorously defend itself" against claims by investors who allege that it should have protected them from alleged fraud.

-

The stablecoin arm of Stripe recently announced its conditional trust charter approval from the OCC and a partnership with business payments fintech Payoneer.

-

The New York City-based lender, whose roots lie in taxi lending, believes an expanded home-improvement loan operation will generate mid-teen loan growth this year.

-

Data breach extortion group ShinyHunters used social engineering to steal customer names, addresses and phone numbers from the blockchain lender.

-

Some observers say changes to MSR risk-weighting would have limited near-term impact and are unlikely to prompt banks to rush back.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

The 23rd annual ranking of women leaders in the banking industry.

-

- Partner Insights from LexisNexis® Risk Solutions

-

-