-

When BankMobile, the brainchild of Jay Sidhu and his daughter Luvleen, relaunches on a new platform in January, security especially for the onboarding process will be completely redesigned.

December 8 -

A preview of the next version of Moven's personal financial management app finds a new direction helping people understand the trade-offs they make between short-term and long-term financial goals.

December 6 -

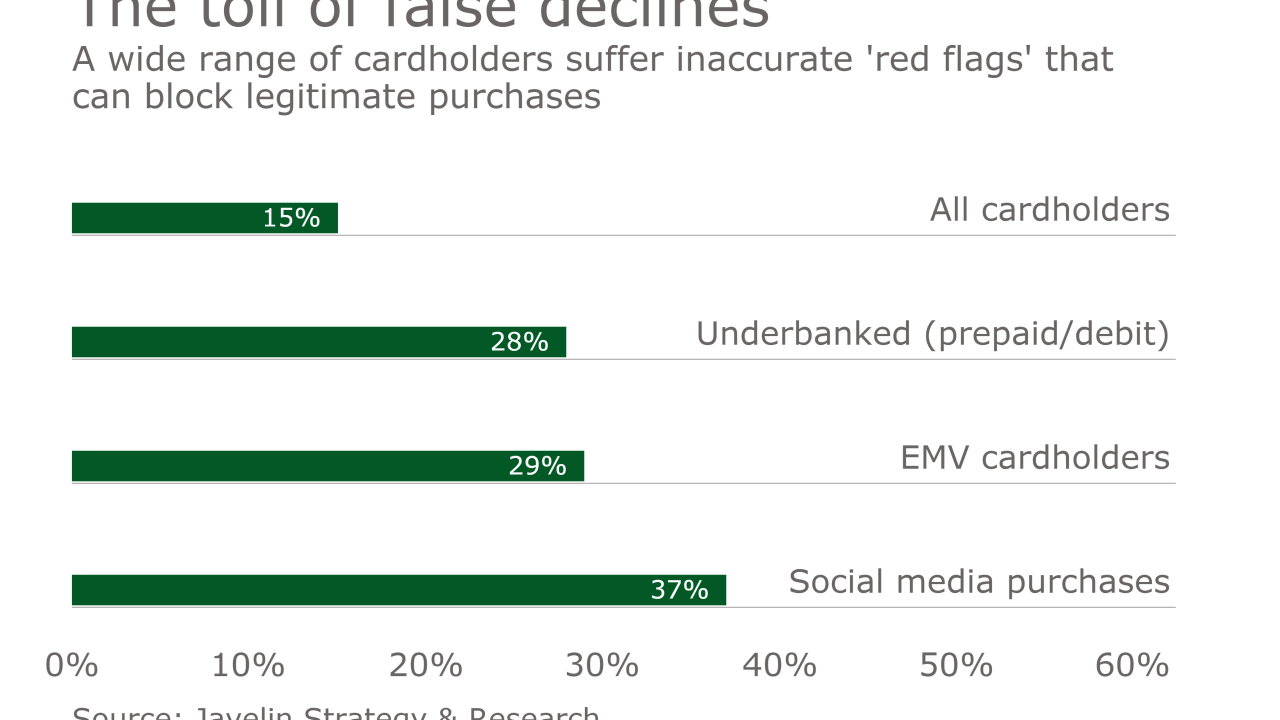

Inaccurate rejections of legitimate transactions aren't a new problem, and companies can't always use past transaction data to spot future risk on a large scale. Artificial intelligence can change the game.

December 1 -

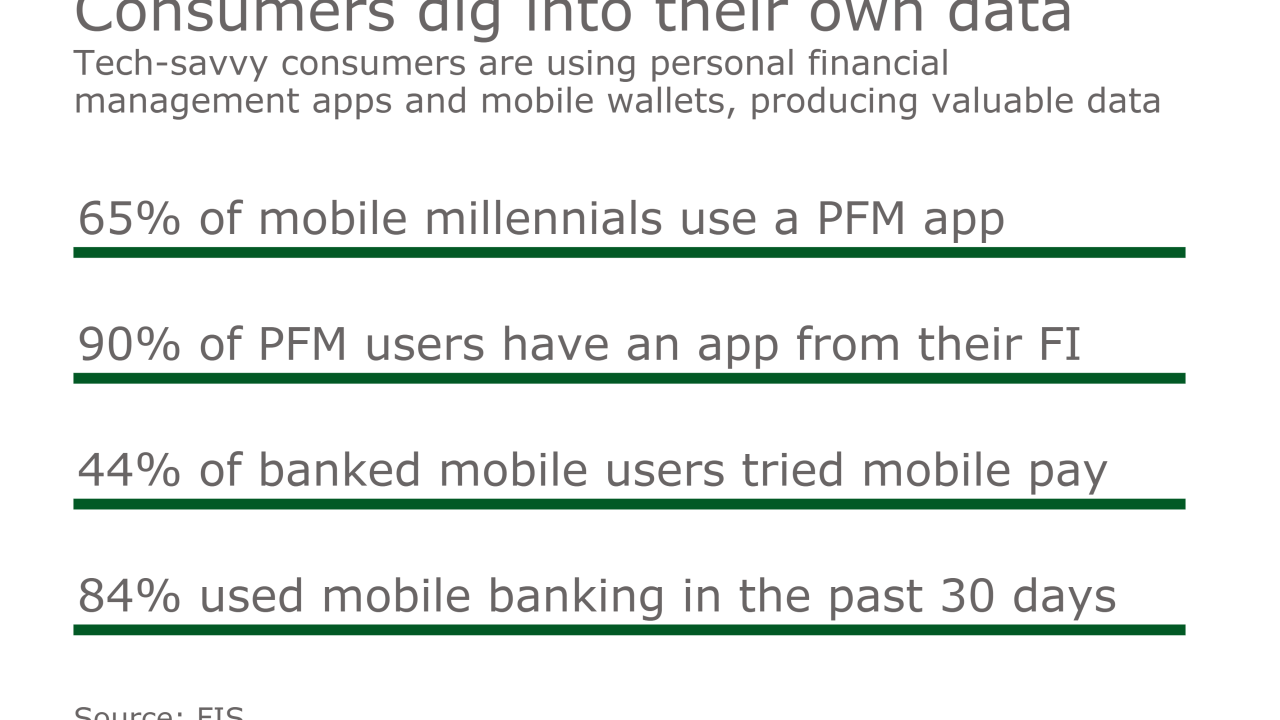

Big data was supposed to unleash a lot of powerful insights for banks, but many financial institutions still haven’t found a way to harness their own data because the amount of available information is so vast.

November 30 -

Consumers aren't just sharing the charming personal moments of their lives on social media — they're producing data that Israeli startup Feelter contends can revolutionize online shopping.

November 30 -

JPMorgan Chase seeks to reshape its business through technology, but there is a natural gap between the megabank and Silicon Valley startups. Larry Feinsmith's job is to bring the two together.

November 28 -

Belmont Savings in Massachusetts isn't trying to fire or replace its employees who work the phones pursuing sales leads, but it has made some technological investments to get more out of them.

November 23 -

Banks should focus on strategies to ensure their sales incentives programs actually help drive profits. Otherwise, their rewards programs are at risk of adding zero benefit to their bottom line.

November 18 New York Institute of Technology � Accounting and Business School

New York Institute of Technology � Accounting and Business School -

Behavioral biometrics has already stopped several million dollars worth of online banking fraud at National Westminster Bank in London.

November 17 -

With 14 million trades a day on Nasdaq and innumerable chats and emails, the stock market's risk and surveillance officers can't look at everything. Enter artificial intelligence.

November 15 -

Recipients of the 2016 FinTech Forward awards discuss the various factors that are keeping banks from fully embracing the digital world the way startups do.

November 7 -

Recipients of the 2016 FinTech Forward awards say banks and startups looking to collaborate can overcome their cultural differences by focusing on the customer experience and their complementary strengths.

November 4 -

Online lenders' struggle with fraud is driving them to join new networks designed to find links between fraudulent loan applications and signs of borrowers trying to obtain multiple loans simultaneously.

November 1 -

Recipients of the 2016 FinTech Forward awards discuss how evolving technology will reshape banking in the years ahead.

October 31 -

What matters is what the customer gets, not how they get it. Investing in digital distribution yields little unless banks are delivering the products and services that customers crave.

October 28 CEB

CEB -

"I'm both," could be the answer a mobile customer of USAA and perhaps other financial institutions gets in the not-too-distant future from a virtual assistant powered by artificial intelligence, key nuggets of customer-specific data and other technology.

October 25 -

Combining biometrics with device ID, social data, behavior patterns and other factors builds a strong foundation for artificial intelligence to conduct identity proofing and transaction authorization.

October 20 -

Our FinTech Forward Companies to Watch are helping banks step up their game by offering virtual assistance, better money management tools and other solutions.

October 5 -

Every merchant knows the saying: "Half the money I spend on advertising is wasted; the trouble is I don't know which half." But perhaps Visa knows.

October 3 -

The private student loan market is dominated by large players, but some community banks are turning to a third-party tech company to help them get in the game.

September 30