Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

MPOWER Financing announced a deal Tuesday with Bank of Lake Mills in Wisconsin that will enable the Washington, D.C.-based company to lend to students in all 50 states.

By Kevin WackJuly 25 -

In early fall, the central bank is expected to announce its next steps regarding how to improve the aging U.S. payments system.

By Kevin WackJuly 24 -

For the last two years, the central bank has allowed the private sector to drive a process aimed at modernizing the nation's payments system. Now the Fed will have to determine what its own role will be.

By Kevin WackJuly 21 -

The McLean, Va., lender, which has substantial exposure to subprime consumer loans, also added to its provision for credit losses.

By Kevin WackJuly 20 -

An influential task force established by the central bank envisions a future in which the U.S. has multiple real-time payment systems, and in a new report it lays out a series of actions that will be necessary to stitch them together.

By Kevin WackJuly 20 -

Though a 33% decline in net income was attributable to large one-time gains that the credit card issuer recorded in the second quarter of 2016, Amex faces major challenges in the pursuit of growth opportunities.

By Kevin WackJuly 19 -

The marketplace lender's application for an industrial bank charter is under fire from small banks and progressives, who say it could violate the barrier between banking and commerce and shut out middle-class and lower-income consumers.

By Kevin WackJuly 19 -

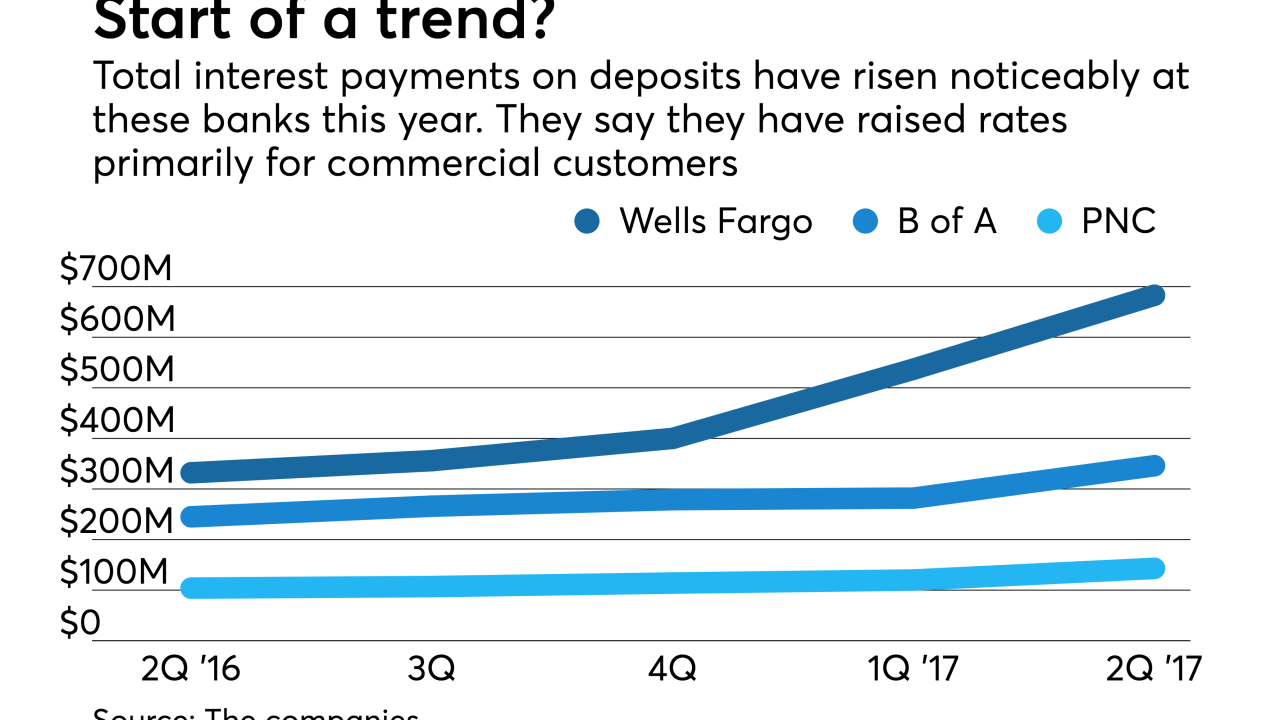

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

By Andy PetersJuly 18 -

The firm’s latest financial outlook suggests an opportunity to earn profits comparable to those recorded by large, well-established credit card issuers.

By Kevin WackJuly 18 -

The phony-sales scandal forced a reckoning over an organizational structure that had long encouraged autonomy for the bank’s various business units.

By Kevin WackJuly 14