The 50 companies that made American Banker's annual list share insights into what makes their workplace culture enticing for potential new hires and current staff members.

The fintech topped American Banker's annual list this year. CEO Dave Buerger attributed the company's hands-off management style as one reason that draws in and keeps workers around.

Forty companies made the 2024 edition of American Banker's annual list of enviable workplace cultures in the financial technology space. Here is a look at some of what makes these firms employers of choice.

The core banking provider was No. 1 on American Banker's ranking of the Best Places to Work in Fintech this year. The company attributes this success to encouraging employees to hash out solutions to challenges.

The company has changed the dynamics of its meetings, created diversity metrics and deployed software to make job descriptions gender-neutral.

The company, which provides workplace investing programs to banks, is giving employees a say in some decisions and working with partners to recruit women and people of color.

The Texas fintech embraces a progressive culture and has taken steps during the pandemic to maintain a spirited vibe even as employees work remotely.

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

Small, often intangible quality-of-life perks are a big part of what makes some fintechs the best ones to work for.

The Utah fintech encourages a playful attitude by devoting the first floor of its offices to entertainment and comfort with video games, Ping- Pong, a pool table and a lounge area.

Without its funhouse office, annual trips or volunteering events, the executive found ways to engage his staff virtually.

-

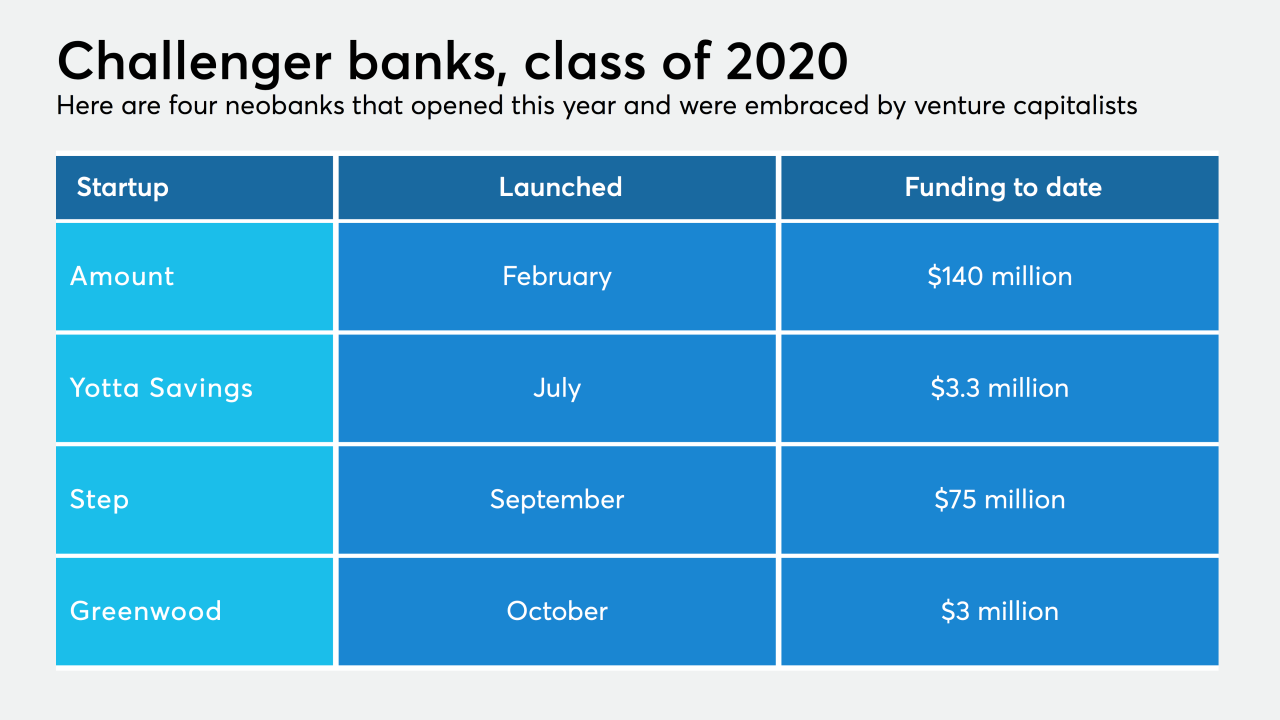

Fintech success stories have encouraged investors to back more startups, but newcomers will be hard-pressed to attract enough customers to compete while keeping expenses down.

December 7 -

The company aims to help borrowers apply for home loans in as little as 15 minutes by automating immediate validation of bank information used in qualification.

December 4 -

The banks will aim to attract new small-business customers by targeting the merchants that use Stripe's payment processing platform.

December 3 -

Visa insists that the Department of Justice, in objecting to its proposed $5.3 billion purchase of Plaid, fundamentally misunderstands the changing role of data in the payments industry.

December 3 -

Figure Technologies would only accept uninsured deposits, so it would not be subject to Fed or FDIC oversight. A major concern for banks is that the effort could open the door to incursions by bigger tech companies.

December 2 -

Especially in a remote environment, the ability to adapt within days to shifting call volumes, different call center locations, new agent groupings, or utilizing a configurable interactive voice response system cannot be underestimated, says Genpact's Jason Osborne.

December 2 Genpact

Genpact -

As it does with savings, Digit's algorithm calculates how much users can siphon off their earnings into retirement without missing the funds.

December 2