-

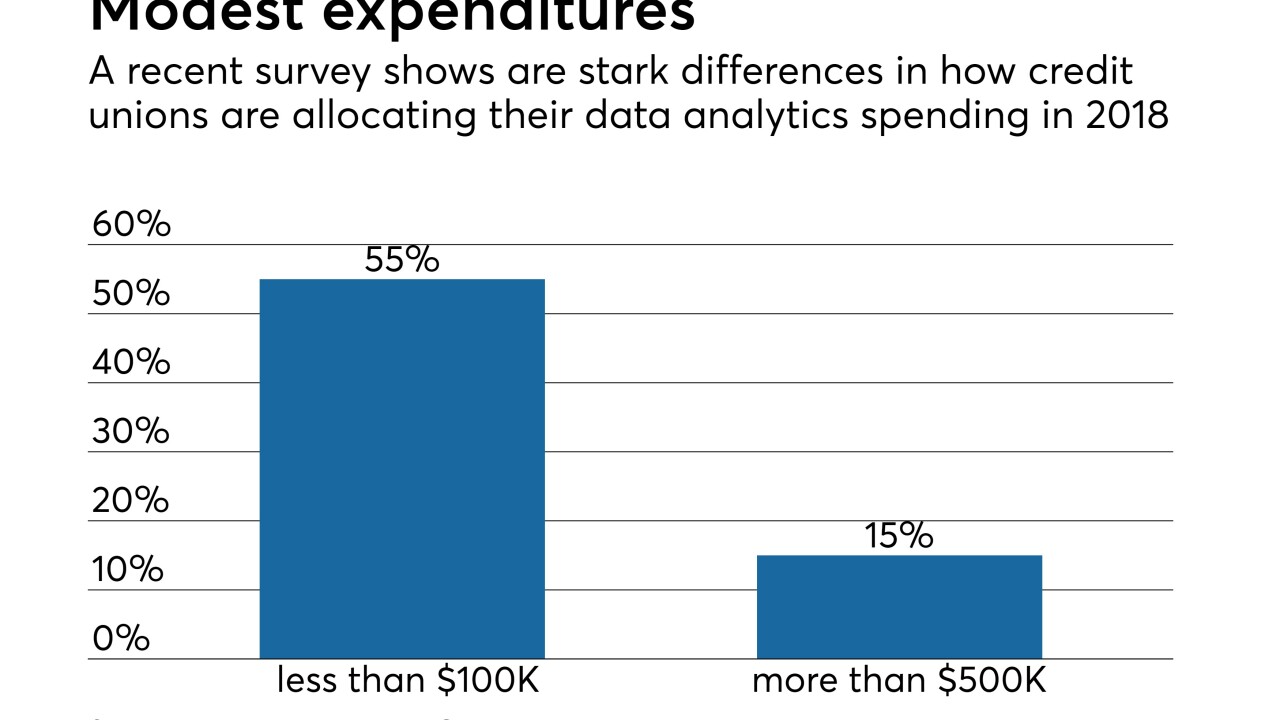

A recent report from Best Innovation Group reveals a significant number of credit unions don't have a data analytics plan, and many that do are putting off spending money on it.

November 8 -

To personalize products and services, banks are now tracking all sorts of alternative data sources, even the manner in which customers type in mobile banking apps.

October 3 -

Envestnet|Yodlee wants accessing data to be as simple as selecting a song to play, while bringing institutional analytic power to the bank branch level.

October 2 -

Fintech developers are trying to monetize data without scaring away privacy-conscious consumers — and, increasingly, to make sure bigger financial companies don't overstep the same boundaries.

September 24 -

Two of the credit union movement's biggest names are teaming up to help CUs better tackle big data.

September 13 -

Technology developers have little choice but to see big data deals like Mastercard’s reported collaboration with Google as an opportunity for deep, actionable analysis, setting aside the chilling effect of privacy concerns and a consumer buy in.

September 6 -

While the card networks have greatly benefited by the global boom in e-commerce, they are confronted with the corresponding growth in digital advertising. This will increasingly lead them to seek out data-sharing deals like Mastercard's reported arrangement with Google, which could prove vital to the networks' future survival.

September 5 -

The acquirer OLB Group is positioning itself as a data steward for a future in which merchants will have predictive data to inform decisions on financing.

July 18 -

With Walmart reportedly weighing bids from Capital One alongside incumbent Synchrony Financial to handle its private-label credit card account, Synchrony's use of data and artificial intelligence are more important than ever.

July 17 -

Credit unions know they need big data, but many aren't sure what to do with it.

June 26 -

In an advancing digital age, banks and merchants rarely question the data that advanced analytics and artificial intelligence can provide about their customers' financial and payments habits. But are they using data analytics to its fullest potential?

May 30 -

It can be difficult for financial services companies to glean customer insights from the abundance of information they have.

May 11 -

The Cleveland bank's CIO, Amy Brady, said it had to start replacing legacy systems now to position itself as a leader in the future.

April 11 -

Taking a data-driven approach to marketing not only helped pump up originations -- it also helped save members money.

October 26 -

Cleaning up bad data is expensive and time-consuming, but just leaving it alone costs even more. Here are strategies to improve the process.

October 17 MX

MX -

Using good, old-fashioned customer service and consultation to cut down on merchant attrition has been part of the acquiring playbook for years. But that playbook is long overdue for an update.

August 16 -

The $2.6 trillion-asset bank's recent commitment to digital lending augurs the development of a two-tier market for borrowers who want fast access to cash.

August 11 -

The CFPB and others believe alternative data could provide more credit to the unbanked. Small banks and credit unions, however, have lingering concerns about breaking from traditional underwriting.

June 20 -

The CFPB and others believe alternative data could provide more credit to the unbanked. Small banks and credit unions, however, have lingering concerns about breaking from traditional underwriting.

June 19 -

With such massive amounts of data bolstered by ubiquitous modes of distribution, the most meaningful fintech investment opportunities center around enabling a new truth equilibrium.

June 5 Santander Innoventures

Santander Innoventures