-

Nyca Partners is now an investor in enterprise blockchain, but in 2014 it had doubts about the technology.

June 22 -

It’s possible for a cryptocurrency to begin as a security and then transform into another type of asset, said William Hinman, who heads the regulator's division of corporation finance.

June 14 -

Janeffer Wacheke’s fresh-vegetable stall in Nairobi uses technology that’s helping crack a problem Kenyan banks have so far failed to solve -- measuring the creditworthiness of traders in the country’s $20 billion informal economy.

June 14 -

Wirecard has created a blockchain-based B2B application to streamline payments for merchants buying raw materials like coffee, crude oil and steel.

June 14 -

Users wishing to move holdings from, say, the Bitcoin to the Ethereum blockchain usually go to an exchange, and convert their Bitcoin into Ether. Along the way, they often pay sizable fees. Once interoperability becomes possible, some of these fees should disappear or decline

June 12 -

Guest hosts Jason Henrichs and JP Nicols interview Perianne Boring, founder and CEO of the Chamber of Digital Commerce, about blockchain trends and challenges.

June 12 -

Since addresses are recorded in the blockchain, it is possible to trace each transaction where the address was used, which aids in AML, according to Ron Teicher, CEO of EverCompliant.

June 11 EverCompliant

EverCompliant -

Merchants, banks, fintechs and card networks may crave digital payments' treasure trove of data over cash's simple anonymity, but any weakness in a centralized ecosystem threatens the entire network, as Visa learned late last week.

June 4 -

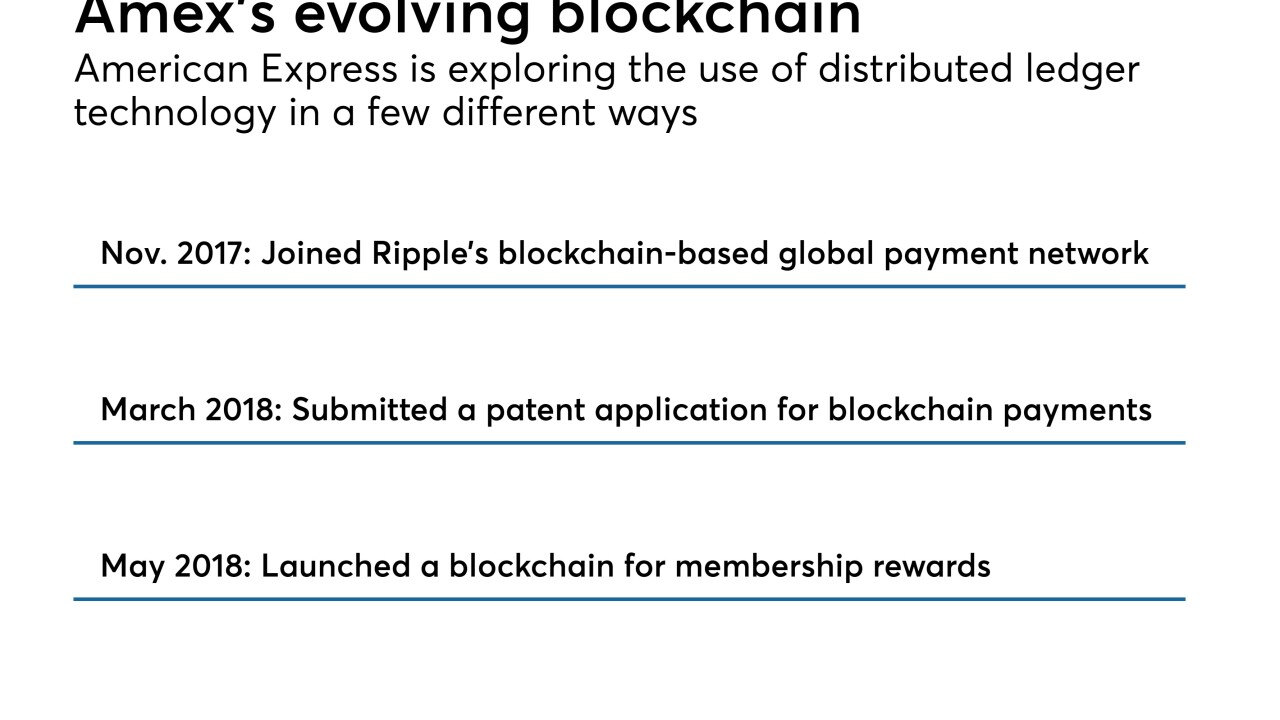

Talking with Shari Van Cleave, head of Wells Fargo Digital Labs; Citizens Financial makes a big move in mortgages in purchasing Franklin American; a rewards blockchain could give Amex access to a wealth of customer data; and more from this week's most-read stories.

June 1 -

Hyperledger, an open-source organization focused on blockchain technology, has added 16 members.

May 31 -

The credit card issuer has built a distributed ledger through which merchants create their own membership rewards and get access to detailed information on purchases and the success of promotions.

May 31 -

Latest: how a possible trade war might impact fintechs; how U.S. exchanges have adapted to blockchain tech.

May 29 -

Caroline Redmann was once flummoxed to hear herself called an "IT nerd," but today she wears it as a badge of honor.

May 29 -

Banks are at the forefront of blockchain innovation, disrupting cross-border payments, trade finance and product development worldwide.

May 25 -

Readers celebrate first quarter earnings, weigh in on banks using blockchain, slam a postal banking proposal and more.

May 24 -

American Express is putting its involvement in the Hyperledger Project to the test, deploying blockchain technology with Boxed to enable the digital warehouse merchant to customize a rewards plan for Amex cardholders.

May 24 -

Banks are at the forefront of blockchain innovation, disrupting cross-border payments, trade finance and product development worldwide.

May 21 -

Even as Jamie Dimon touts the female leadership at his company, it lags in one key area. But JPMorgan women are making strides in particular with blockchain initiatives, and Amber Baldet finally shares what she is working on. Plus, heels or flats?

May 18

-

Blockchain's potential for revolutionizing the world’s payment systems has captured the imagination in recent years, and last month Santander became the U.K.'s first bank to use the technology to create a new international payments service.

May 18 -

Fintechs attending Consensus 2018, the annual cryptocurrency event, said they found promise for a market still trying to find a path to unified operations and wider acceptance within financial services.

May 17