With the coronavirus pandemic forcing far more e-commerce transactions — and thus, more spending on cards instead of cash — loyalty and rewards are vital to creating lasting consumer habits.

A merchant’s payment provider can play a decisive role in determining whether the merchant is able to ensure business continuity during force majeure events, says Credorax’s Igal Rotem.

Millions of Americans have yet to receive their stimulus checks, leading progressives to demand reforms improving underbanked consumers’ access to the financial system.

The lender’s offices in the U.S., Canada and the U.K. will remain shut to all nonessential staff at least through the Labor Day holiday on Sept. 7, CEO Richard Fairbank wrote in an internal memo.

The agencies issued a rule to better enable banks to participate in two of the Federal Reserve’s lending facilities and “support the flow of credit to households and businesses.”

As special IG for the Treasury’s allocation of $500 billion in aid, Brian Miller could look into funding for Fed credit facilities. But Democrats on the Senate Banking Committee questioned his independence.

The Conference of State Bank Supervisors says parts of the plan are an overreach, while the agency should think twice about developing the proposal during the coronavirus pandemic.

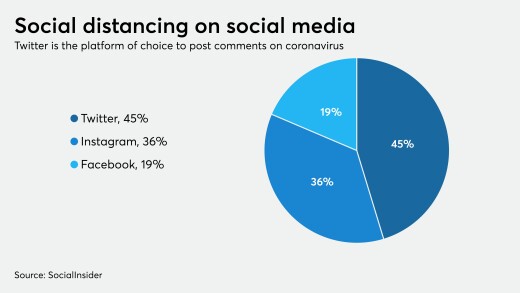

Since the coronavirus pandemic began, banks have seen customer posts more than double across their social media platforms. Here's how they are responding to the demand — and the anger.

-

With the coronavirus pandemic forcing far more e-commerce transactions — and thus, more spending on cards instead of cash — loyalty and rewards are vital to creating lasting consumer habits.

May 6 -

A merchant’s payment provider can play a decisive role in determining whether the merchant is able to ensure business continuity during force majeure events, says Credorax’s Igal Rotem.

May 6 Credorax

Credorax -

Millions of Americans have yet to receive their stimulus checks, leading progressives to demand reforms improving underbanked consumers’ access to the financial system.

May 5 -

The lender’s offices in the U.S., Canada and the U.K. will remain shut to all nonessential staff at least through the Labor Day holiday on Sept. 7, CEO Richard Fairbank wrote in an internal memo.

May 5 -

The agencies issued a rule to better enable banks to participate in two of the Federal Reserve’s lending facilities and “support the flow of credit to households and businesses.”

May 5 -

As special IG for the Treasury’s allocation of $500 billion in aid, Brian Miller could look into funding for Fed credit facilities. But Democrats on the Senate Banking Committee questioned his independence.

May 5 -

The Conference of State Bank Supervisors says parts of the plan are an overreach, while the agency should think twice about developing the proposal during the coronavirus pandemic.

May 5