Lenders must balance the financial risk of extending credit without explicit backing from the Small Business Administration against the reputational risk of delaying aid for needy borrowers.

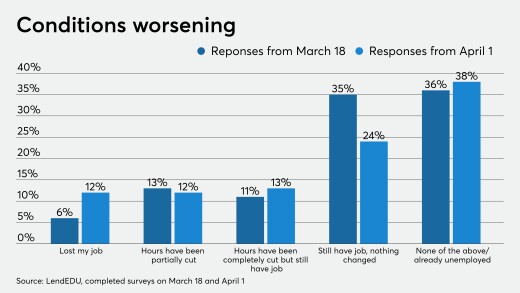

A new survey shows more Americans are tapping into their savings as job losses rise and the pandemic's impact on the economy gets worse.

For many small providers, the coronavirus pandemic means falling revenue and rising expenses, as many either shut their doors to new business or staff up to deal with COVID-19 patients. Bankers say that means helping them bridge the cash-flow gaps until they can get back to business as usual.

The coronavirus pandemic is likely to force a great leap forward in the fight to crush paper checks, which still account for about half of B2B payments, by moving more invoice payments online.

The central bank is creating a facility to provide financing to banks participating in the Small Business Administration’s Paycheck Protection Program.

After Congress temporarily lowered the leverage ratio used by smaller institutions, the federal agencies said they would allow a one-year transition before banks have to comply again with the regular standard.

Congress and financial regulators have implemented a number of measures to help the industry survive the financial impact of the pandemic, and a fourth phase of stimulus could be coming.

Few lenders are finding creative ways to provide much-needed financial advice and emergency services online.

-

Lenders must balance the financial risk of extending credit without explicit backing from the Small Business Administration against the reputational risk of delaying aid for needy borrowers.

April 6 -

A new survey shows more Americans are tapping into their savings as job losses rise and the pandemic's impact on the economy gets worse.

April 6 -

For many small providers, the coronavirus pandemic means falling revenue and rising expenses, as many either shut their doors to new business or staff up to deal with COVID-19 patients. Bankers say that means helping them bridge the cash-flow gaps until they can get back to business as usual.

April 6 -

The coronavirus pandemic is likely to force a great leap forward in the fight to crush paper checks, which still account for about half of B2B payments, by moving more invoice payments online.

April 6 -

The central bank is creating a facility to provide financing to banks participating in the Small Business Administration’s Paycheck Protection Program.

April 6 -

After Congress temporarily lowered the leverage ratio used by smaller institutions, the federal agencies said they would allow a one-year transition before banks have to comply again with the regular standard.

April 6 -

Congress and financial regulators have implemented a number of measures to help the industry survive the financial impact of the pandemic, and a fourth phase of stimulus could be coming.

April 6