The pandemic and the Black Lives Matter protests have changed the way banks interact with their customers, communities and employees. Here's how.

The pandemic will accelerate the drive toward a supervision process in which both regulators and banks will need the digital tools that enable sophisticated remote exams. Expect a heightened focus, too, on customers' financial health.

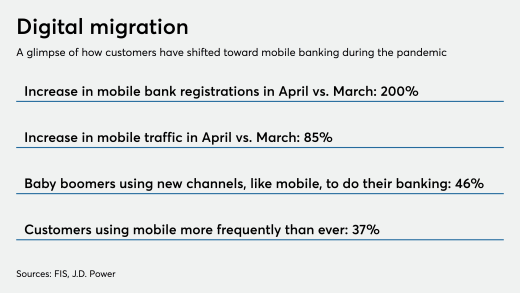

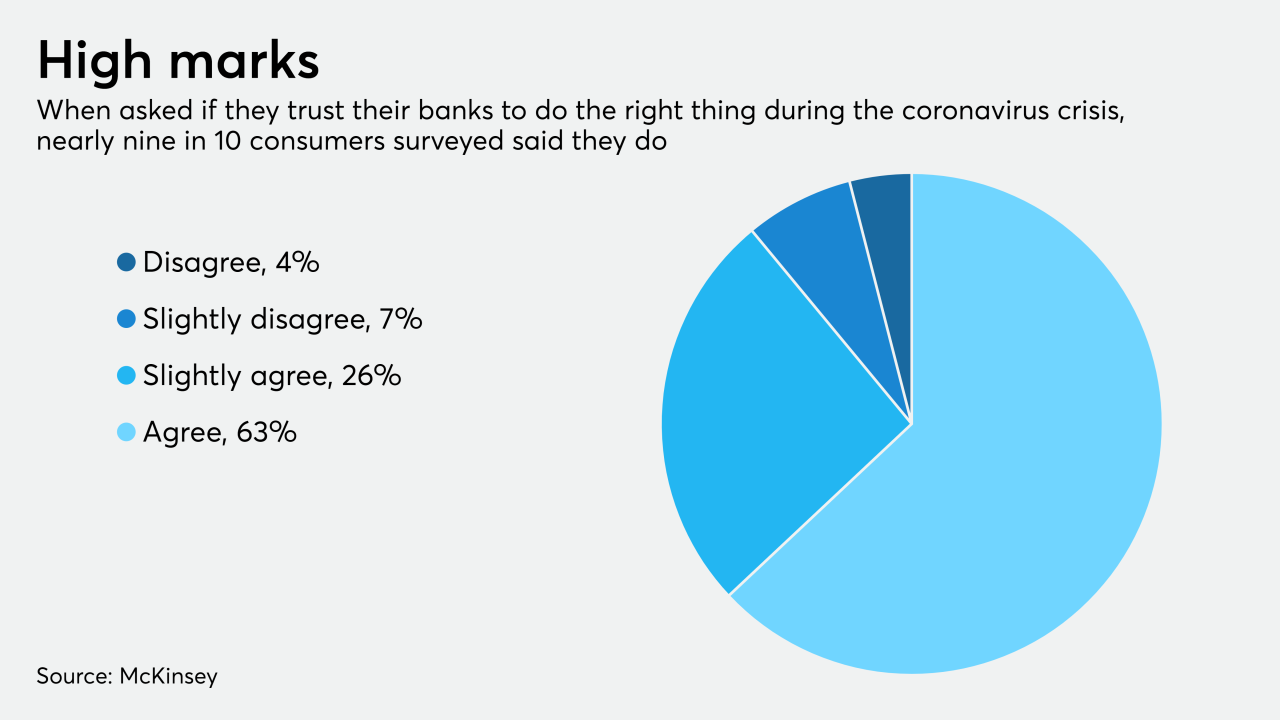

The coronavirus crisis led to "the greatest acceleration of digital banking in history." Here's what to expect next.

A new CFPB rule will expedite the forbearance and loss-mitigation process for consumers suffering financial hardship from the pandemic.

Challengers like Joust, Lili and NorthOne that offer banking services to freelancers and small-business owners are getting record levels of new customers as the traditional workforce thins.

Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

Rather than funnel mortgage and rent payments through consumers, the federal government should instead deal directly with landlords, utilities and banks, suggests Howard Newman, managing partner of Pine Brook Partners.

In a new twist on an old scam, cybercriminals have tried to get thousands of people to surrender their Wells bank account information by sending authentic-looking emails containing malicious links that lead to a fake website bearing the company's name.

-

The pandemic and the Black Lives Matter protests have changed the way banks interact with their customers, communities and employees. Here's how.

June 23 -

The pandemic will accelerate the drive toward a supervision process in which both regulators and banks will need the digital tools that enable sophisticated remote exams. Expect a heightened focus, too, on customers' financial health.

June 23 -

The coronavirus crisis led to "the greatest acceleration of digital banking in history." Here's what to expect next.

June 23 -

A new CFPB rule will expedite the forbearance and loss-mitigation process for consumers suffering financial hardship from the pandemic.

June 23 -

Challengers like Joust, Lili and NorthOne that offer banking services to freelancers and small-business owners are getting record levels of new customers as the traditional workforce thins.

June 23 -

Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

June 23 -

Rather than funnel mortgage and rent payments through consumers, the federal government should instead deal directly with landlords, utilities and banks, suggests Howard Newman, managing partner of Pine Brook Partners.

June 23