-

The company will record a $300 million charge to cover the elimination of three data centers and book $125 million in broader severance costs.

May 31 -

Financial Institutions in Warsaw, N.Y., has replaced earlier plans for a typical stock sale with an at-the-market program.

May 31 -

The company was set to sell a 24% stake in itself to buy two Tennessee banks but has restructured the arrangement to avoid a potential conflict cited by a regulator.

May 30 -

Retail banking chief Mary Mack made several changes, including restructuring leadership in the Western region, where some of the worst incidents in the Wells scandal were said to have occurred.

May 30 -

Grow Financial alleges that a former employee stole private credit union information and passed it on to GTE prior to obtaining a job there.

May 26 -

Bay Area CU launches Business Banking Division to increase, diversify loan portfolio.

May 24 -

The $3.2 billion-asset company is making a bigger push into northern Indiana with its agreement to buy Lafayette Community Bancorp.

May 24 -

Management reports assets, membership continue to grow into 2017.

May 23 -

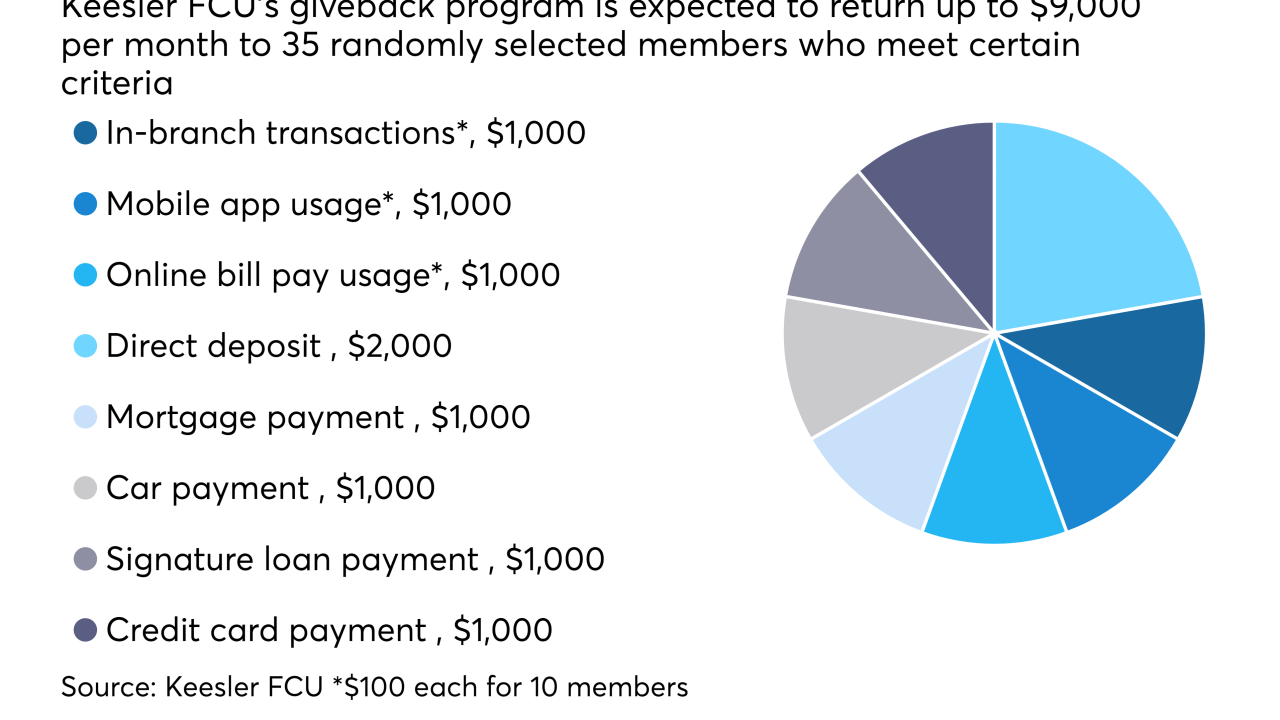

A new initiative at Keesler FCU will return as much as $108,000 in givebacks to members during its first year, but do CUs get any real value from returning that much money to their membership?

May 23 -

The rising regional player has also appointed new chairs for four board committees as it prepares for the retirement of several long-serving directors.

May 23 -

The merger is expected to be completed by year-end, and the combined institution will have assets of more than $1.2 billion, serving more than 105,000 members.

May 22 -

In a world where confidence is rewarded more than indecision, businesses risk elevating confident leaders who overestimate their abilities. In banking, that can have harmful effects.

May 22 IBM Global Business Services

IBM Global Business Services -

The company agreed to buy Commerce Bancshares, which has three branches in Boston.

May 22 -

First Savings Financial in Indiana and Dime Community in New York are keen on making more SBA loans as a way to diversify revenue and generate fees through loan sales.

May 19 -

Financial Institutions in western New York withdrew plans to raise $40 million.

May 19 -

Readers opine on legacy core systems, the negative messaging around the Troubled Asset Relief Program, Jamie Dimon defending his Trump ties, and more.

May 19 -

The credit union will partner with the YMCA of Northwest North Carolina on a two-year health and well-being research study funded by a grant from the Robert Wood Johnson Foundation.

May 18 -

The German bank posted two consecutive years of losses partly because of misconduct fines tied to the Libor and other scandals.

May 18 -

Fifteen participants will be chosen for the two-year innovation curriculum.

May 17 -

Dakotas group elects new leadership, Altura promotes new chiefs and other new hires, promotions and appointments.