-

CFPB Director Richard Cordray is using the Equifax breach to suggest the CFPB be given power to examine credit reporting agencies for potential cybersecurity lapses.

October 10 -

An organized crime ring in Eastern Europe has orchestrated sophisticated cyber and physical attacks that have drained millions of dollars from banks in Russia, and FIs in other countries could be targeted next.

October 10 -

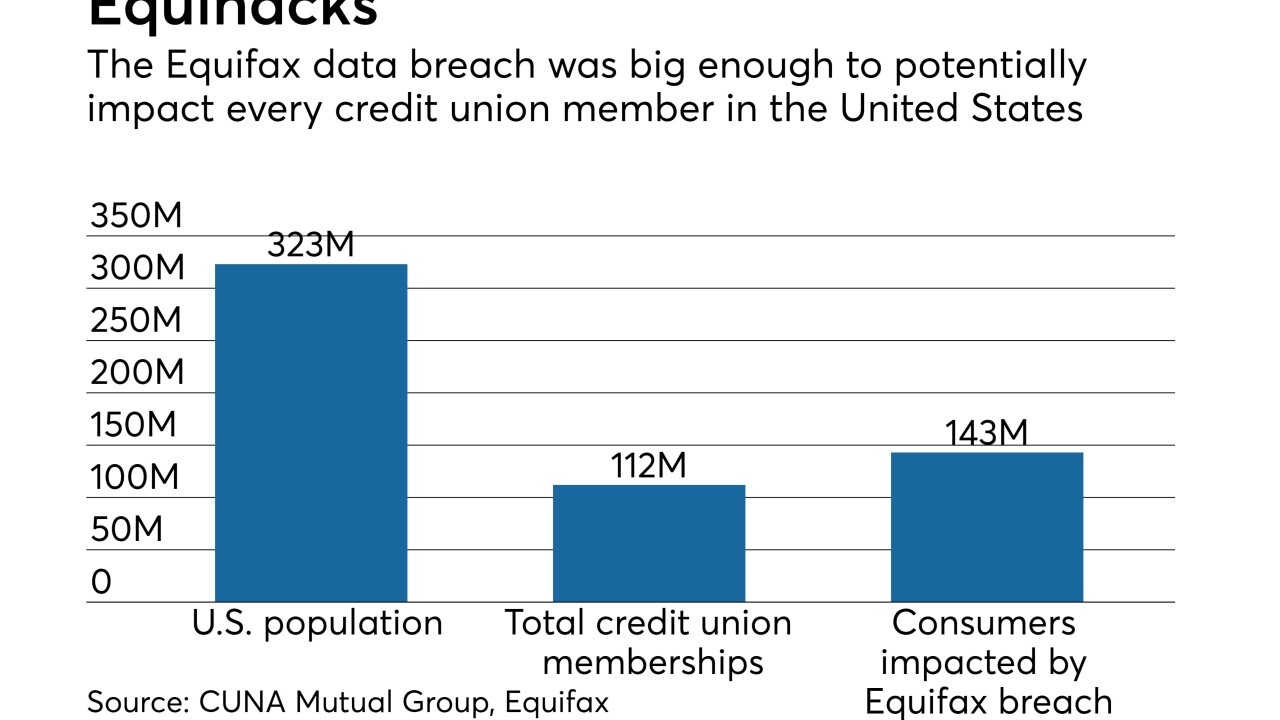

The massive data breach impacted nearly half of all Americans, and credit unions will now need to be on guard for a variety of fraud types that could arise as a result.

October 10 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

An organized crime ring in Eastern Europe has orchestrated sophisticated cyber and physical attacks that have drained millions of dollars from banks in Russia, and banks in other countries could be targeted next.

October 10 -

Equifax Inc. has seen no evidence that the cyberattackers who got access to sensitive information on 145 million U.S. consumers worked for the company, former Chief Executive Officer Richard Smith said.

October 5 -

Day two of Equifax hearing focuses as much on business model as on the data breach; Fed chair again says she supports bank rules that are not "unduly burdensome."

October 5 -

Tel Aviv is home to some of the world's top cybersecurity talent, the bank said.

October 4 -

Former Equifax CEO blames one employee’s mistake for the massive hack; Warren calls Sloan “incompetent” and says he should be fired.

October 4 -

Credit bureaus can address identity theft by advancing the robustness of their security processes and abandoning outdated systems that rely on our personal information, writes Jason Brvenik, chief technology officer for NSS Labs.

October 4 NSS Labs

NSS Labs -

Richard Smith came to Capitol Hill this week to speak about the massive breach at Equifax, but it was clear Tuesday that he will be defending the entire credit reporting industry.

October 3 -

Richard Smith came to Capitol Hill this week to speak about the massive breach at Equifax, but it was clear Tuesday that he will be defending the entire credit reporting industry.

October 3 -

The Trump administration is exploring ways to replace the use of Social Security numbers as the main method of assuring people’s identities in the wake of consumer credit agency Equifax Inc.’s massive data breach.

October 3 -

Federal Reserve Gov. Jerome Powell said capital levels have been well calibrated but that some changes to the capital rules may be in order to make compliance easier.

October 3 -

Losses in sales and penalties from chargebacks may hurt business' sustainability, writes Monica Eaton-Cardone, chief operating officer at Cargebacks911 and Global Risk Technologies.

October 3 Chargebacks911

Chargebacks911 -

Former Equifax CEO and Wells Fargo chief both expected to issue mea culpas to Congress; Goldman apparently likes digital currency.

October 3 -

The recent Equifax breach wasn't just a failing of one company's digital defenses — it exposed a fundamental weakness of how the entire financial services industry handles consumer identity. What's surprising is how deep the problem goes.

October 3 -

Equifax Inc.’s former chief executive officer said the credit-reporting company didn’t meet its responsibility to protect sensitive consumer information, confirming that the failure to fix a software vulnerability months ago led to the theft of more than 140 million Americans’ personal data.

October 2 -

Canada's banking industry has issued a warning to government about giving Canadians more control of their own banking data: proceed with caution.

October 2 -

Equifax mismanaged its recovery by asking for personal information to determine if a user was affected and then issuing a predictable PIN code to those who requested a credit lock, moves that diluted confidence in the company, writes Timothy Crosby, senior security consultant for Spohn Security Solutions.

October 2 Spohn Security Solutions

Spohn Security Solutions -

Though many of its policies were in place before news of the Equifax breach came out, Mountain America Credit Union is doubling down on its approach to protecting member data.

October 2