-

Municipal IDs help marginalized groups, such as undocumented immigrants, open checking accounts and become credit union members but concerns over regulatory compliance linger.

March 15 -

The days of odd emails are gone. Phishing has become a complex big business for crooks, according to Rafael Lourenco, an executive vice president at ClearSale.

March 14 ClearSale

ClearSale -

Credit union executives are hitting the Hill on Wednesday to discuss their concerns with lawmakers as CUNA's Governmental Affairs Conference ends.

March 13 -

The Credit Union National Association is tackling a range of challenges during its Governmental Affairs Conference this week in Washington, D.C.

March 12 -

Two years ago, Ellen Richey became Visa's vice chairman and chief risk officer, propelled to this role by over a decade of work that fundamentally changed how the average consumer makes a payment. Richey plans to retire this summer, ending a 40-year career in law and risk management.

March 12 -

The past six years have been a whirlwind for King, who had no experience in the payments industry before becoming CEO of Featurespace, the fast-growing U.K. startup enabling banks to use machine-learning technology to block payment card fraud.

March 12 -

Cybersecurity is about protecting the house, the corporation, the people, process, technology and the data, writes Harley Lippman, founder and CEO of Genesis10.

March 12 Genesis10

Genesis10 -

The 2020 budget would add the Consumer Financial Protection Bureau and FSOC to congressional appropriations, charge lenders for FHA upgrades and require universities to have skin in the game on student loans.

March 11 -

A new regulation in the Golden State could provide a de facto national standard as Congress continues to stall on data breach legislation.

March 11 -

Lawmakers must hold merchants accountable when credit unions are left cleaning up the mess after data breaches.

March 11

-

The Bank of England is requiring Visa to appoint PwC as an independent third party to review the card brand’s progress in implementing recommendations that followed a 2018 outage in Europe.

March 8 -

BrightWise is a joint venture among the Iowa CU League, its holding company and LMG Security. The initiative aims to teach credit union professionals how to better protect their institutions.

March 8 -

There may be plenty of fish in the sea, but there's also plenty of phishers. In today's digitally-driven culture, many people find their future spouse by dating online — and there are even financial advantages to doing so — but there are also major risks.

March 6 -

Concerns about an economic slowdown, rising deposit prices and cybersecurity abound, a survey found.

March 5 -

Online retailers must accept hacking, malware and phishing as a reality of doing business in our digital world, but tokenization can make the prize less worthy for crooks, according to André Stoorvogel, director of product marketing for Rambus Payments.

March 5 Rambus

Rambus -

Coinbase Inc., one of the world’s largest cryptocurrency exchanges, is letting go of staff after the backlash it faced for purchasing a company allegedly linked to the sale of spyware to oppressive regimes.

March 5 -

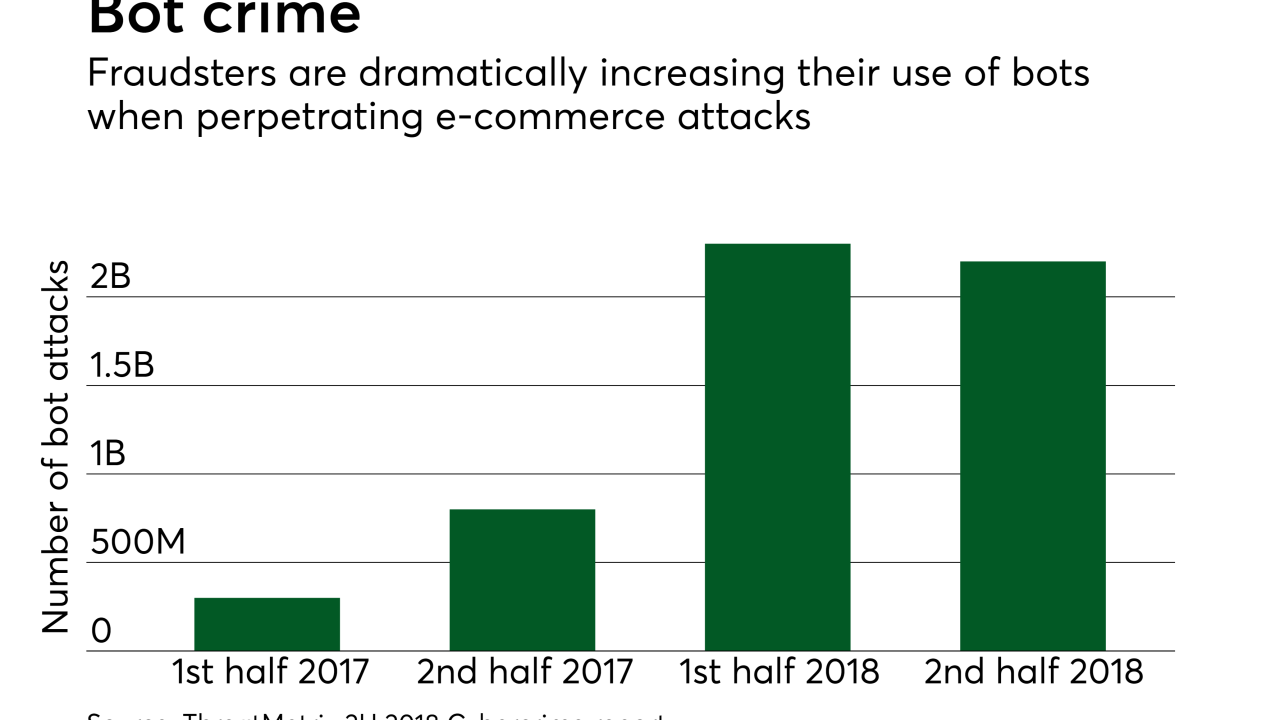

As companies invest heavily in artificial intelligence and other high-tech defenses, it is becoming more apparent that criminals are investing in equally powerful technology.

March 5 -

Coinbase, one of the best-known U.S. cryptocurrency exchanges, is facing a backlash after purchasing a company whose executives have been tied to an Italian firm accused of selling spyware to repressive governments.

March 4 -

Equifax's massive breach and Facebook's scandals have made data privacy a big issue for state and federal lawmakers. Here's why banks need to be worried.

March 3 -

California and others have passed consumer privacy laws, and lawmakers in Congress are beginning to address the issue. Here's an overview of the players and the proposals.

March 3