-

Criminals attempted to defraud five credit unions – including two of the nation's largest – of at least $1 million.

March 1 -

Leading a credit union can be exhausting. Implementing these best practices can help ease the burden.

March 1 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

Credit unions must walk a fine line between making interactions for members as easy as possible while also providing robust protection against evolving cybersecurity threats.

February 28 IDology

IDology -

The root of the credit reporting sector’s problems may be its dominance by a handful of big firms, lawmakers from both parties said at a hearing.

February 27 -

The CEO of the nation's biggest bank gave the fintech props for revolutionizing payments and then building off its success to provide a whole range of services to small-business clients.

February 26 -

The root of the credit reporting sector’s problems may be its dominance by a handful of big firms, lawmakers from both parties said at a hearing.

February 26 -

From cybersecurity to capital, here's what the next NCUA board might (or might not) do on a host of issues.

February 26 -

The Senate Banking Committee will likely vote on Todd Harper and Rodney Hood's nominations to the federal regulator, while lawmakers hold hearings on a host of credit union priorities.

February 25 -

As large banks put stronger fraud monitoring and authentication technology in place, fraudsters have been turning to small banks, like Kennebunk Bank on the coast of Maine. Here's how it fought back.

February 21 -

Transaction Network Services has entered a partnership with cloud-based mobile commerce provider P97 to provide a managed tokenization service for mobile and in-vehicle payments.

February 19 -

With real-time payments advancing, processors need to shore up security, according to David Worthington, vice president of payments at Rambus.

February 19 Rambus

Rambus -

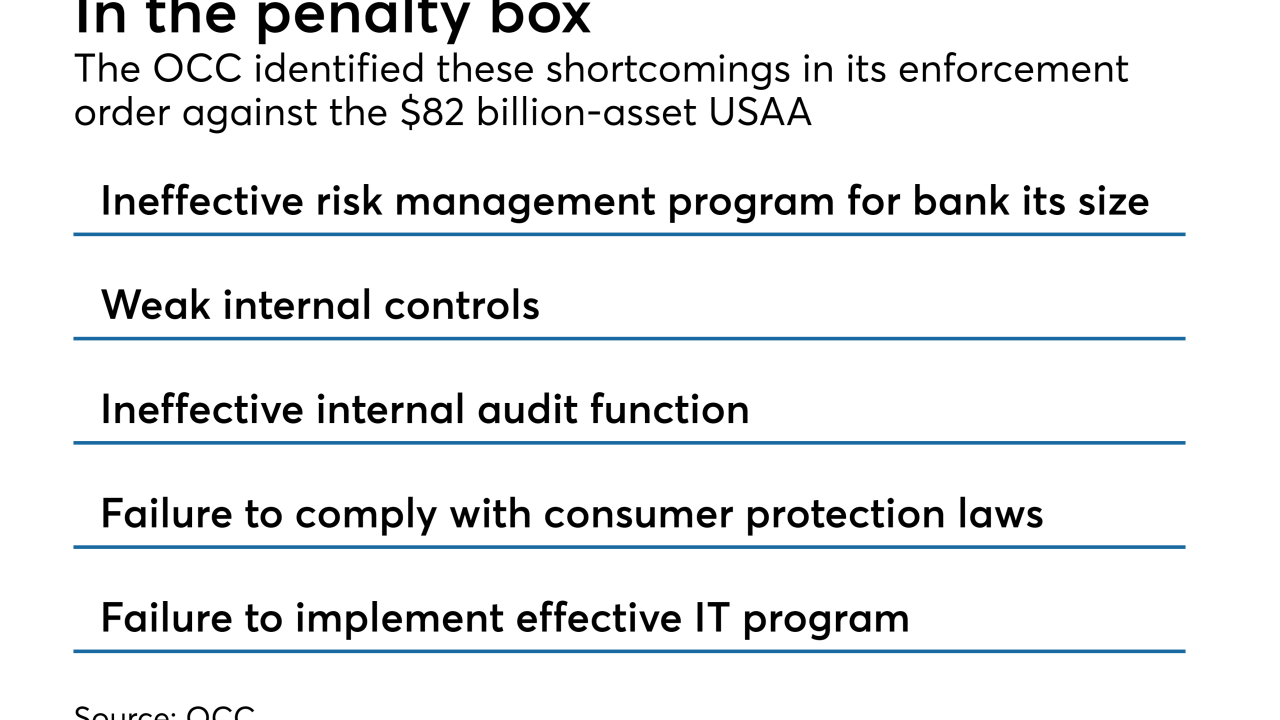

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

Banks want to encourage innovation by extending access to outside developers, but customer data remains vulnerable while in use by an application.

February 15 -

Unauthorized exposure of any type of customer data, for any period of time, is a serious issue, writes Carl Wright, chief commercial officer of AttackIQ.

February 15 AttackIQ

AttackIQ -

The Credit Union National Association and several institutions sued the fast food business after a data breach in 2016.

February 14 -

The top Republican and Democrat on the Senate Banking Committee are asking for stakeholders to weigh in on data collection issues as lawmakers consider legislative responses to recent breaches.

February 13 -

A security breach that left 24 million mortgage documents unprotected on a server is rekindling concerns about the risks posed by fourth parties.

February 13 -

The emails were disguised as being sent from BSA executives at other institutions and claimed that a member’s transfer was halted due to suspected money laundering.

February 13 -

The quest to implement a broadly accepted digital ID solution may take years, but Jumio is hoping to get headway with a new authentication service leveraging video selfies.

February 12 -

As another possible shutdown looms, concerns about furloughed workers’ credit histories have shifted the reform discussion away from data security.

February 11