-

Lenders have a role to play in the national reconciliation that must follow the recent racial unrest — providing greater access to capital for African Americans and other underserved groups so they can build wealth, activists said at a panel discussion hosted by Berkshire Bank in Boston.

June 5 -

Past is not prologue, and a successful strategy for becoming a top-performing bank in 2020 is very different from what it might have been just six months ago.

June 5

-

The Consumer Financial Protection Bureau seeks to address challenged posed by the sunset of the London interbank offered rate at the end of 2021.

June 4 -

Fallout from the coronavirus pandemic is pressuring banks that have relied on expansion efforts and fee income to produce outsize investor returns.

June 4 -

Faced with limited growth opportunities and potentially mounting loan losses, banks are getting aggressive — and creative — to boost profits.

June 3 -

The mobile bank raised $241 million in its Series D round of funding, and expects to receive approval from regulators to become a nationally chartered bank this summer.

June 3 -

Members of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

June 2 -

An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

June 2

-

Brian Brooks says coronavirus mandates, such as masks, could potentially harm banks; some recipients of the Treasury prepaid cards don’t believe they are for real.

June 2 -

The corporate credit union has begun transitioning nearly 600 clients to the new platform.

June 1 -

Thomas O'Brien will take the helm at Sterling Bancorp, which is dealing with internal control issues and probes by the OCC and Justice Department into its mortgage operations.

June 1 -

The closure of IBEW Local Union 712 Federal Credit Union marks the first CU to shut its doors in the wake of the coronavirus.

May 29 -

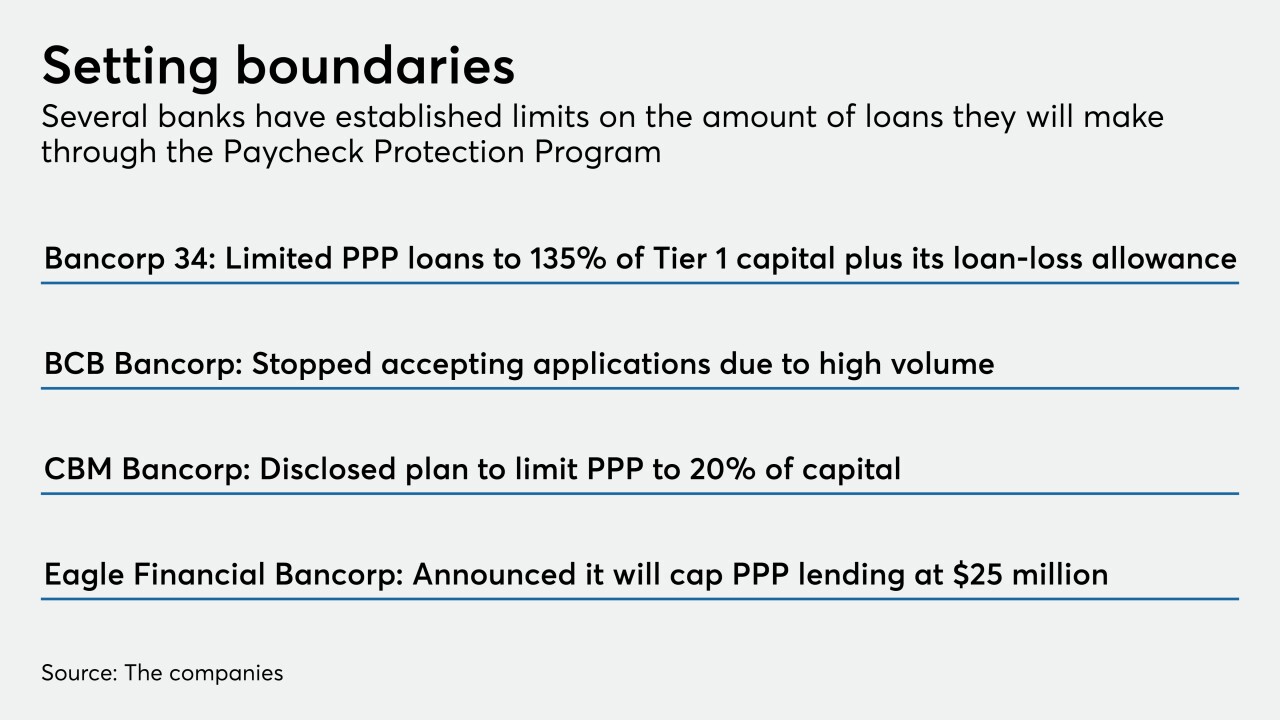

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

The new regulation is intended as a workaround for banks affected by the 2015 decision that created legal uncertainty for loans sold across state lines.

May 29 -

Starling Bank has raised £40 million (about $49 million) in its latest fundraiser as it steps up its support for small businesses, bringing its 2020 total to £100 million (about $123 million).

May 29 -

Minimizing outsourcing is one way to minimize uncertainty, making sure you’re the one in the driver’s seat of your plans.

May 29 Dating.com Group

Dating.com Group -

The latest Credit Union Trends Report from CUNA Mutual Group predicts interest rates will be at record lows for at least two years and earnings are also likely to take a hit from record-high unemployment.

May 28 -

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.

May 28 -

Sony has invested in digital transaction security firm MagicCube, citing it as the Sony Innovation Fund's first investment outside of Japan.

May 28 -

Banks would be wise to dust off their Great Recession playbook and shed nonperforming loans while growing through M&A.

May 28DebtX