-

The central bank and other agencies have come under pressure to be transparent about their use of funds authorized by the recent pandemic rescue law.

April 23 -

The value of serving a specific employer or a limited field of membership has diminished over the years. COVID-19 is just the latest crisis that shows how dangerous this concentration can be.

April 23 -

Banks had an opportunity to delay compliance with the new accounting standard, but many opted to move forward to get ahead of credit issues that could arise from the coronavirus outbreak.

April 22 -

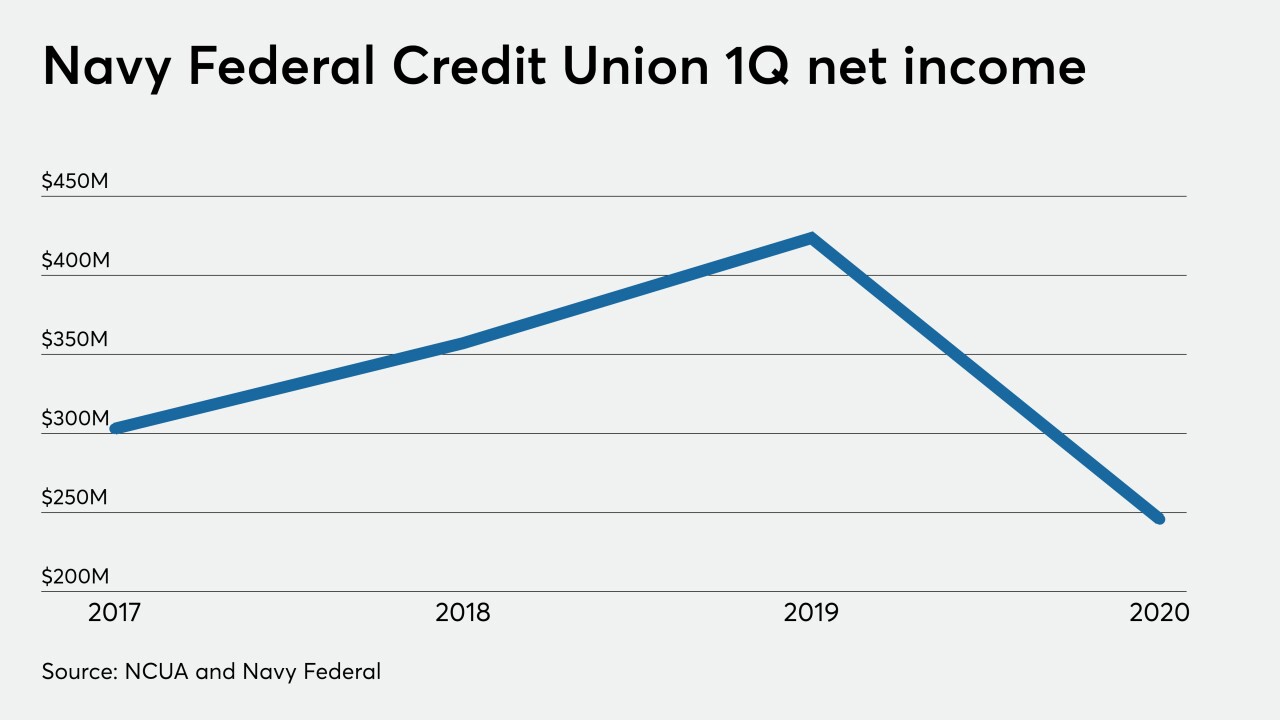

The largest credit union in the world increased its provision by 28% from a year earlier.

April 22 -

The pandemic won’t halt the Cincinnati bank's plan to open about 100 branches in the Southeast, but features could be added to accommodate social distancing.

April 21 -

The Los Angeles regional bank recorded the $1.5 billion noncash charge after its stock price ended March below its tangible book value.

April 21 -

First Horizon still plans to complete its merger with Iberiabank on time, CEO Bryan Jordan said during the Tennessee company's earnings call.

April 21 -

Venture capital investment has plummeted in many coronavirus-ravaged economies, but larger, profitable fintech firms with the right digital products might still score funding.

April 20 -

The Dallas company also reported a first-quarter loss after the coronavirus outbreak caused "significant deterioration" in its economic outlook.

April 20 -

Executives say they can still meet their goal of $480 million in cost savings this year from the combination of BB&T and SunTrust despite unexpected expenses, unless the economy fails to rebound quickly.

April 20 -

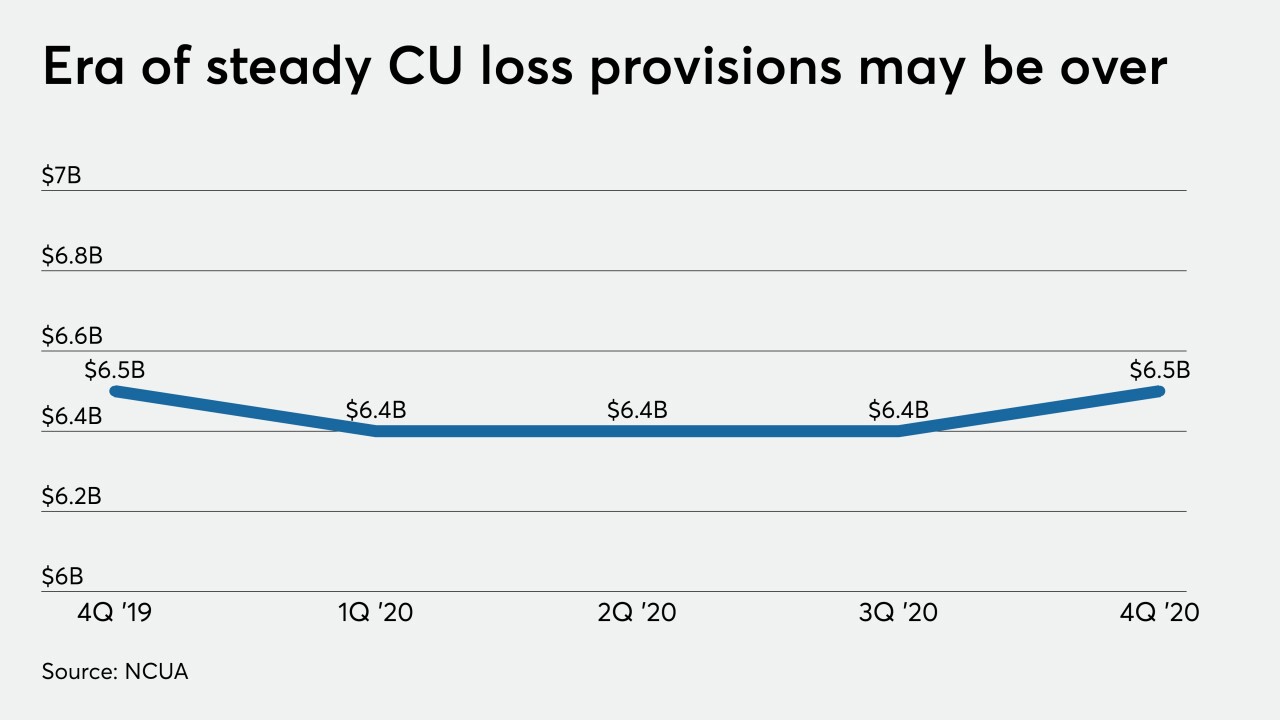

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

April 17 -

Wells Fargo tells business clients to consider other banks for emergency loans; JPMorgan Chase is temporarily reducing its exposure to the mortgage market; how TD Bank got a head start on pandemic preparations; and more from this week's most-read stories.

April 17 -

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

April 16 -

The National Credit Union Administration is giving lenders and borrowers extra time to complete appraisals to ensure mortgages are still being completed despite the pandemic.

April 16 -

Payments unicorn Stripe contends it has the financial power to apply its technology to coronavirus medical care, remote telework, business funding, and easier onboarding for companies that have been suddenly thrust into an internet existence.

April 16 -

Airwallex has raised $160 million in a Series D fundraising round to expand global payment offerings for small businesses and enterprises.

April 16 -

Wall Street trading arms benefited from first-quarter volatility, but it may not be enough to salvage future earnings; “unprecedented volume” of customers logging into their online bank accounts creates system overload at many banks.

April 16 -

The letter written by Rep. Maxine Waters, D-Calif., and Sen. Sherrod Brown, D-Ohio, was seen as a boost to Wall Street lobbying efforts seeking to quell the fallout of the coronavirus crisis on the mortgage market.

April 16