-

The Raleigh, North Carolina, institution's payout for 2019 was 12% higher than the previous year.

February 14 -

The tight labor market and public pressure to raise minimum wages are expected to nudge noninterest expenses upward in a year when the watchword is cost control.

February 13 -

The fintech, which translates foreign credit reports to help immigrants get loans, says it has raised millions from venture capital firms and celebrities like Alex Rodriguez and U2's The Edge because its product addresses important economic and social needs.

February 12 -

Bankers groups are keeping close tabs on a host of legislative and gubernatorial proposals, from prize-linked savings accounts in Iowa to rent control in Massachusetts to a slew of bills modeled after California's recently passed data privacy law.

February 11 -

Western Union's online strategy is paying off, as web transfers help overcome softness in troubled local markets.

February 11 -

The Rhode Island-based credit union also returned a patronage dividend to members for the 31st consecutive year.

February 11 -

Brandee McHale will be president of the Citi Foundation and oversee the company's community development, inclusive finance and impact investing teams.

February 10 -

Ed Skyler, the bank's global head of public affairs, says a newly established $150 million fund will make equity investments in firms seen as having a positive impact on society.

February 10 -

Whether it’s an online sale or a corporate supply chain, the need to silently transfer and convert currencies is inspiring a mix of rapid product development and investment.

February 10 -

The Indiana-based institution saw net income rise nearly more than 7% last year, along with other gains.

February 10 -

Point of sale credit can be an alluring option for consumers who are normally averse to taking on debt. The allure is also enough to draw support from one of Australia’s largest banks and the digital merchant acquiring giant Stripe.

February 10 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 7 Nations Lending Corp.

Nations Lending Corp. -

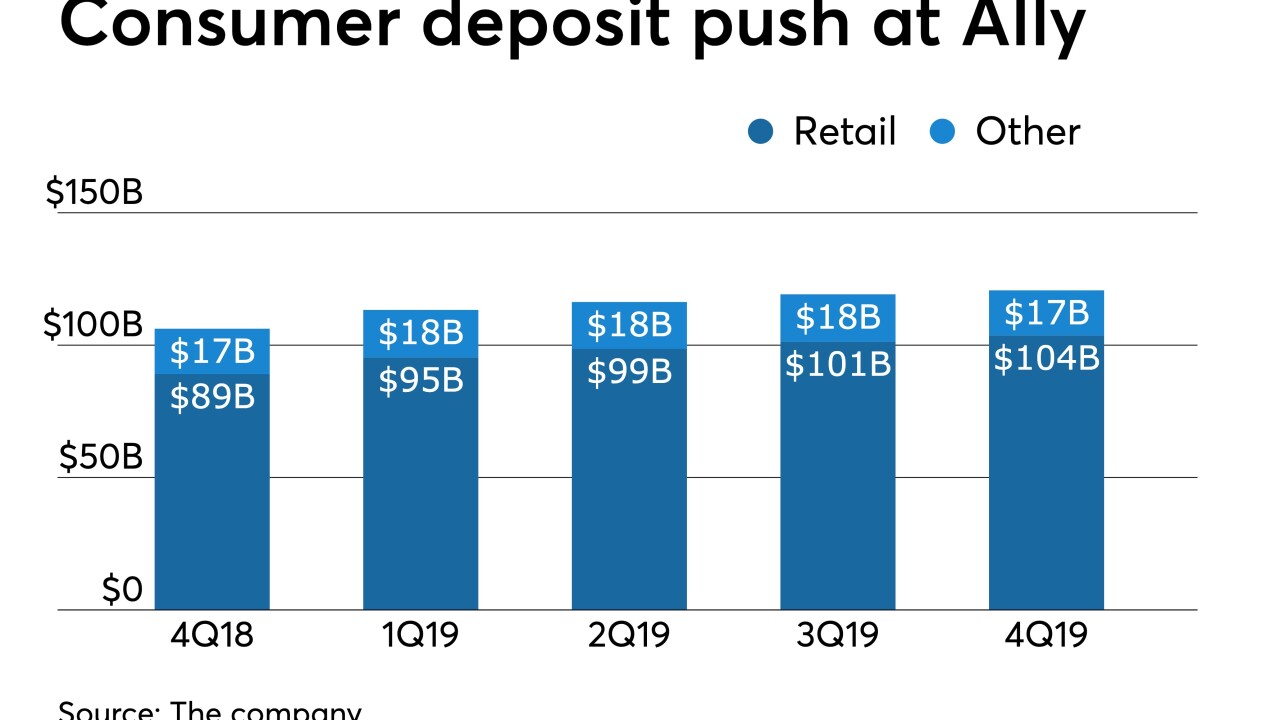

The digital-only bank found customers are anxious about their inability to set aside money, so it decided to offer automated savings tools, consumer chief Diane Morais says. It is one of the larger companies to do so.

February 7 -

Some of the year-over-year drop in net income can be attributed to higher-than-normal figures in 2018 and costs associated with opening three new branches in 2019.

February 7 -

The credit union can now serve consumers in two additional counties.

February 7 -

Fare payments software provider Masabi has completed an investment from Shell Ventures as an extension to the fintech's recent $20 million growth fund through Smedvig Capital and MMC Ventures.

February 6 -

The bank’s top shareholders want the chairman to quit if he won’t support the CEO; HSBC expected to go forward with job cuts while searching for permanent boss.

February 6 -

Organizers of Triad Business Bank have raised enough capital and have received approval from the FDIC.

February 5 -

The Mississippi company will pay $49 million for Traders & Farmers Bancshares.

February 5 -

An intraparty rift went public Wednesday over legislation that would impose a 36% rate limit on all consumer loans. Critics are concerned it would cut off minority borrowers’ access to small-dollar loans and hurt some community banks.

February 5