-

The coronavirus e-commerce push is likely to be permanent as consumers get used to digital payments, but that also gives rise to new fraud threats.

April 9 -

The Fed's actions are designed to ensure the flow of credit to midsize businesses and state and local governments hit hard by the economic impact of the coronavirus pandemic.

April 9 -

With the EMV liability shift date for automated fuel dispensers (AFD) looming, subject to any last-minute changes, we are seeing major changes at fuel sites across the USA. With close to 150,000 active fuel sites in the U.S. alone, there are a huge number of individual pumps that will need to be upgraded to accept chip and PIN cards.

April 9 The ai Corporation

The ai Corporation -

The industry is grappling with how to thank member-facing staff while also determining how newly mandated leave laws will impact them.

April 9 -

Upgrade's hybrid loan-card product can now be used without swiping as consumers and retail workers seek to minimize spread of novel coronavirus.

April 9 -

Fintechs, startups and bank-led projects were already working to excise generations of inefficiencies out of supply chains. The coronavirus has heightened the need for smooth payments.

April 9 -

With the government pumping trillions of new spending into the economy, experts are questioning the Federal Reserve's ability to keep prices stable.

April 8 -

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

April 8 -

The agency overhauled its system for the Paycheck Protection Program on Wednesday. Lenders hope it addresses the access issues and a crash that bedeviled the effort’s first week.

April 8 -

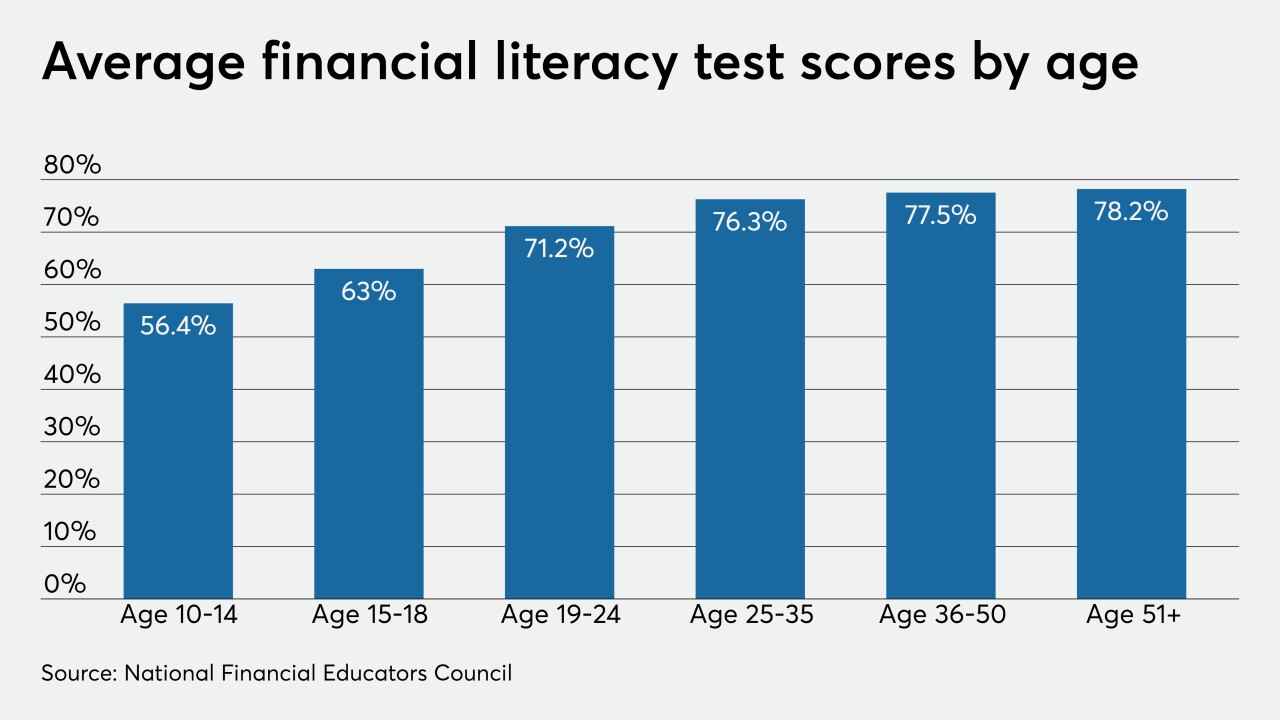

Older Americans also did fairly poorly by getting an average score equal to a C plus.

April 8