-

The Canadian bank twice sweetened its bid for PrivateBancorp, raising the stakes. Now it must gain traction in the hypercompetitive Chicago market while hunting for more acquisitions.

June 23 -

CIBC plans to spend two years focusing on internal growth at PrivateBank except for some targeted wealth management acquisitions, but ultimately capital outlays or takeovers will be necessary to meet its growth ambitions.

June 23 -

Byline Bancorp's decision to go public sends a message that it plans to dangle a more liquid stock in front of potential sellers. It also provides a way for certain shareholders to cash out.

June 20 -

The offering would be a big milestone for Byline Bancorp, which was recapitalized in 2013 by a group led by former Banco Popular North America CEO Roberto Herencia.

June 19 -

The Illinois company agreed to pay $44 million to buy Guaranty Bank, the biggest institution based in Cedar Rapids, Iowa.

June 9 -

The bank is the second failure in Illinois so far in 2017. Seaway Bank was closed in late January.

May 26 -

Canadian Imperial Bank of Commerce increased its offer for PrivateBancorp Inc. by $3 a share in cash to offset the decline in the bidder's stock price.

May 4 -

The regulator also provided updates on investment performance, expenses, CAMEL codes and more.

April 20 -

Yman Vien says she lost her job at American Metro Bancorp because of her gender. The bank says the move was tied to poor decisions that led to a regulatory order in 2009.

April 13 -

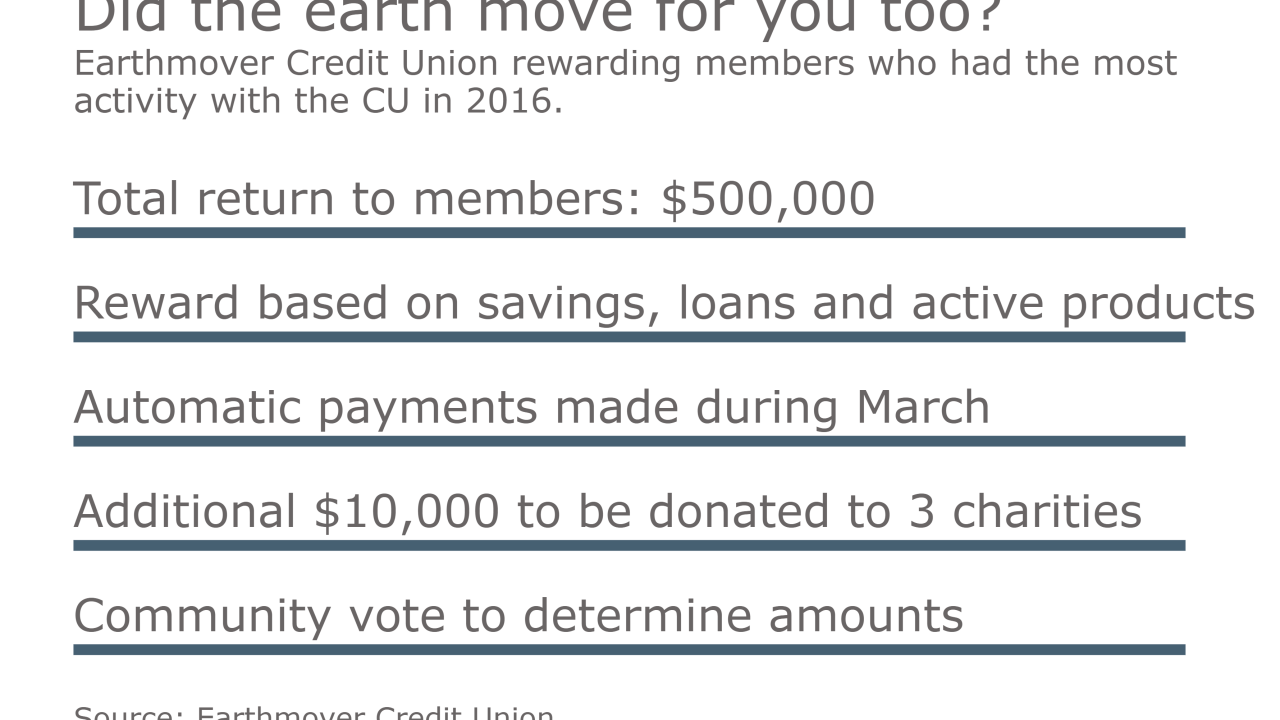

CU is rewarding members for activity in savings, loans and active products.

March 20 -

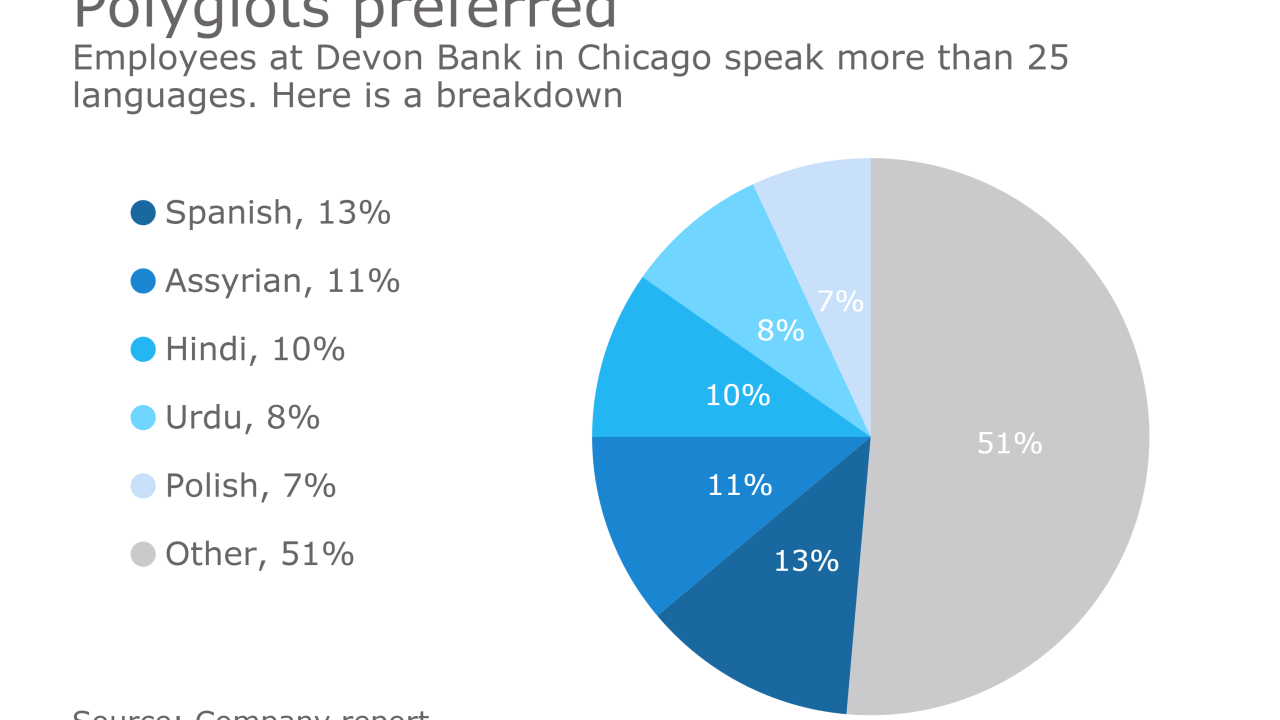

Devon Bank in Chicago has a long history serving immigrant groups in one of the nation's most diverse neighborhoods. Right now, its clients are worried about President Trump's actions on immigration and deportation.

March 16 -

First Busey will pay $133 million in cash and stock for Mid Illinois in a deal that should close later this year.

March 13 -

State Bank of Texas, which bought the failed Seaway Bank in January, is selling nine branches to Self-Help Credit Union.

March 10 -

Premier Asset Management will add $550 million of assets under management to a platform that First Midwest has historically built with organic growth.

March 7 -

The Chicago company postponed a vote planned late last year after a surge in bank stocks changed the math behind the cash-and-stock transaction.

March 6 -

The move will more than double the size of Eldorado's branch network, while allowing MidCountry to exit the market.

February 22 -

The merger will create a bank with more than $4 billion in assets.

January 26 -

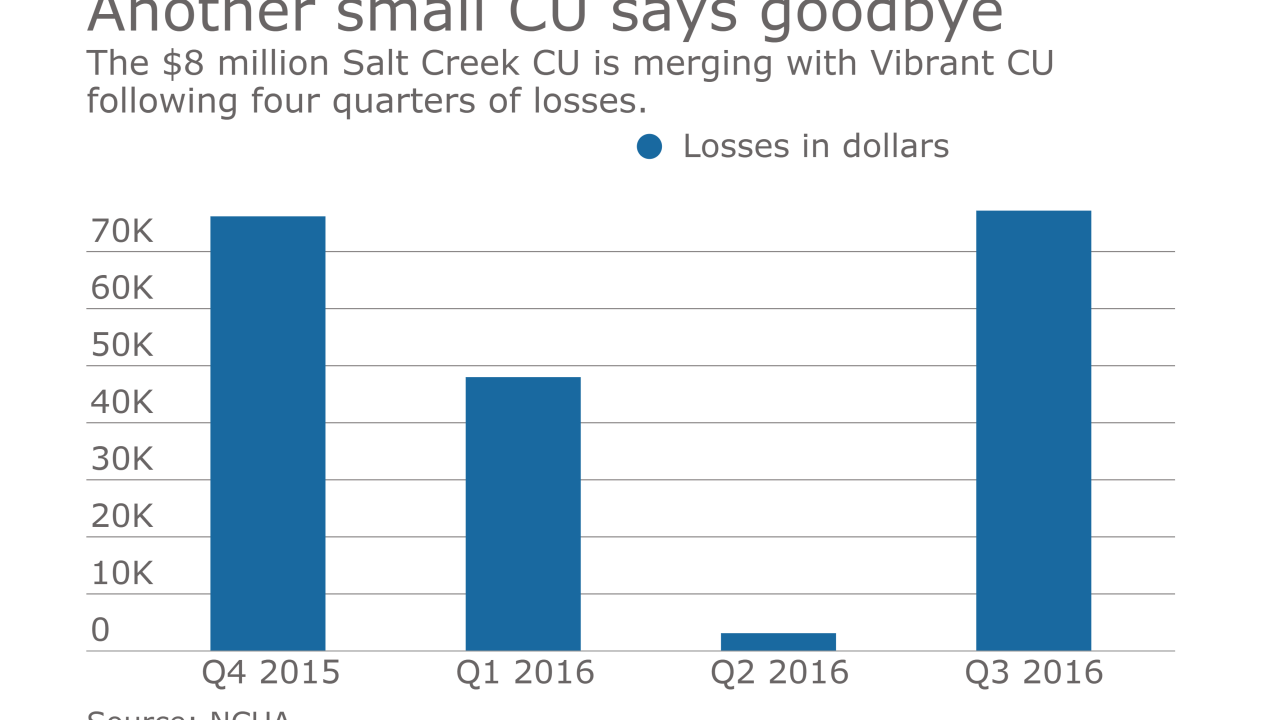

The $8 million credit union’s single office will become a branch

January 26 -

Five federally insured, low-income credit unions earned certification as community development financial institutions

January 24 -

Fourth-quarter profits at Wintrust Financial in Rosemont, Ill., climbed 54% to $54.6 million from a year earlier, helped largely by acquisitions and increases in mortgage banking and other fee income.

January 19