-

The Indiana-based credit union made significant gains in membership, lending, assets and more.

March 20 -

The company has agreed to buy United Community Bancorp. With the $114 million deal it would add five branches in the Cincinnati area.

March 12 -

Members at the Indiana-based credit union have won nearly $18,000 by participating in Save to Win, which rewards members who save money with the credit union.

February 28 -

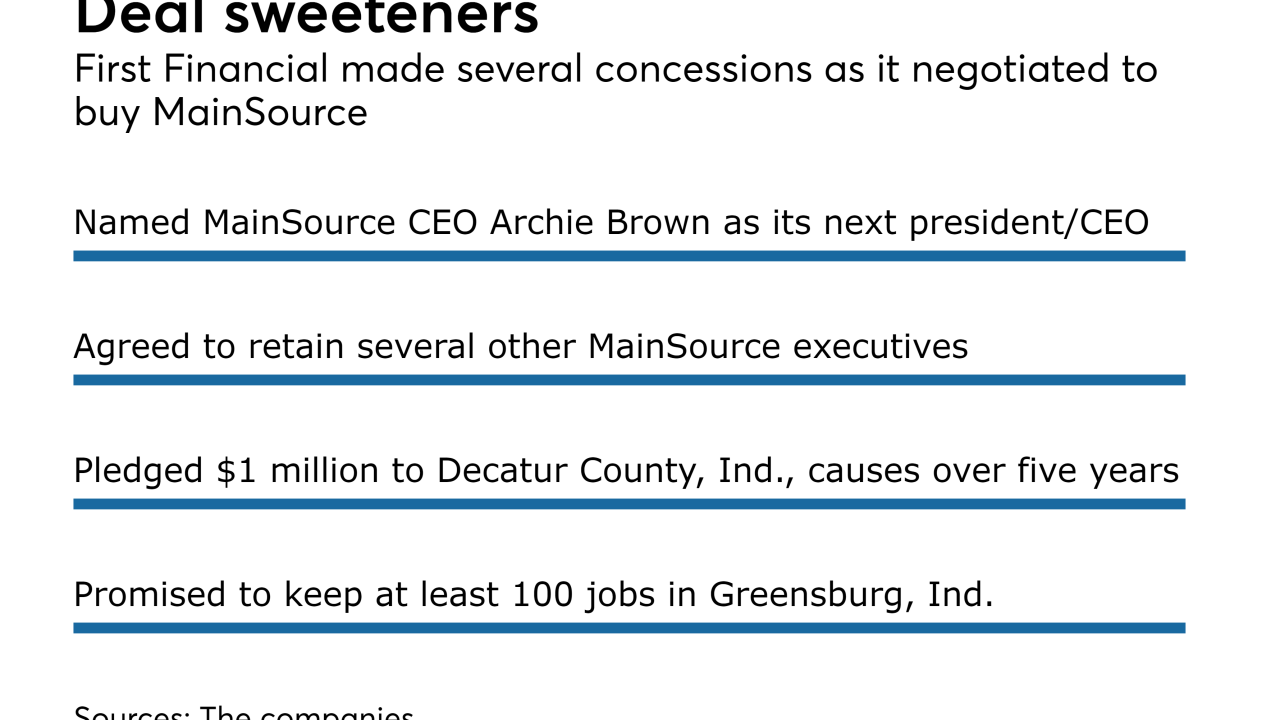

The Justice Department required the sales before signing off on MainSource's pending sale to First Financial in Cincinnati.

February 13 -

The divestitures are necessary to get the Justice Department to sign off on First Financial's $1 billion purchase of MainSource Financial.

January 29 -

The company, which agreed to pay $58 million for Foundation's parent, will gain five branches in Cincinnati.

January 10 -

Neff, who joined the company in 1999, gained oversight of retail banking with the promotion.

January 4 -

David Becker is trying to prove to investors that his Indiana bank can succeed over the long term. With the rise of online banking and fintech firms, Becker is a community banker worth watching in the new year.

December 26 -

Goshen, Ind.-based CU reports both membership, asset milestones.

November 3 -

TCU Insurance Agency acquires Winey Insurance Agency, adds clients.

October 24 -

The company will pay $66 million for the parent of BloomBank.

October 5 -

The Indiana company's board knew what it wanted from a potential buyer, and that helped it as it negotiated one of this year's biggest bank deals.

September 26 -

The company is looking to raise about $115 million. A portion of the proceeds would help pay for Merchants' pending purchase of Joy State Bank.

September 26 -

The Indiana company could also use proceeds from the planned stock sale to pay off debt.

September 15 -

Proposed combination of General CU, Partners 1 FCU approved by both boards, member vote next.

September 6 -

Rising taxes, declining population and the political landscape in Illinois have led several bankers to put more money and resources into nearby states.

August 1 -

First Financial in Ohio is buying MainSource in Indiana — with a twist. MainSource's leader will become CEO.

July 26 -

The company agreed to buy MainSource Financial in Indiana for $1 billion, creating a Midwestern bank that will have more than 200 branches and $13 billion in assets.

July 26 -

While industry consolidation remains slow compared with previous years, certain regions are humming along with strong volume and improved pricing. Here’s a look at each region based on June 30 data from KBW and S&P Global Market Intelligence.

July 14 -

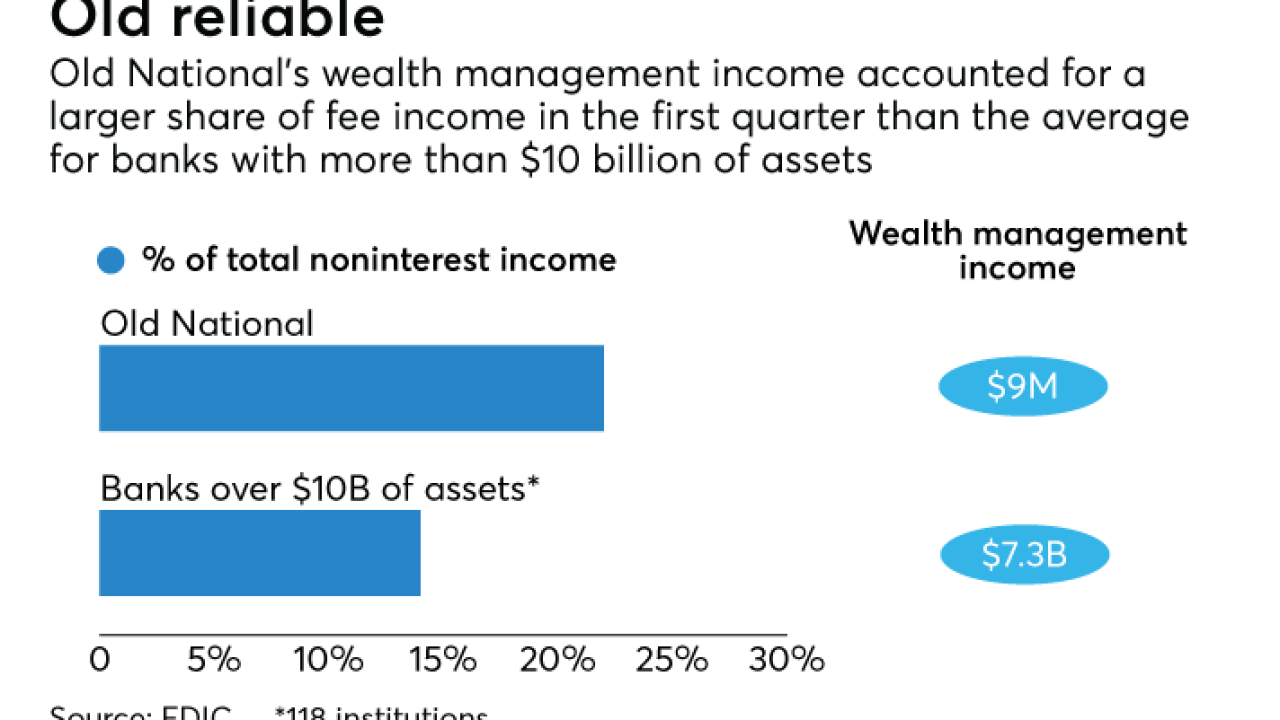

It might seem unusual for an Old National Bancorp to lure away a regional executive from the much larger Fifth Third, but not in wealth management, where competitiveness can be as much about emphasis as size.

July 3