Real-time account messaging has been a standard feature for any big-bank customer in the last five years, but many small banks have only begun offering digital alerts to clients, reflecting the shift from branches to mobile and online banking even at the local level.

Experts say it’s not too late to begin adopting digital notifications, as such services afford community banks not only instant means of communicating with clients, but also a platform to expand their reach to other markets and appeal to younger clients.

Community banks “need to compete with the larger regionals and megabanks,” said Ron Strand-Sorrell, executive vice president and chief operating officer at Axiom Bank in Orlando, Fla. “Five years ago, something like this probably wasn’t even on the drawing board for community banks. But we have a very progressive CEO and board that know the importance of digital services.”

Axiom is one of several community banks that have adopted digital messaging, seeing it as a way to continue delivering the homespun comfort of Main Street to an increasingly digital customer base.

“We’re still a neighborhood bank, but we want to make things as convenient as possible for our customers,” Strand-Sorrell said. “Digital is extremely important for us.”

As part of its investment in digital, the $560 million-asset Axiom last year rolled out Notifi, a real-time alerts and messaging service from Fiserv. When relevant financial events occur, such as a low balance, a pending loan payment or a suspicious credit card transaction, it triggers the delivery of real-time alerts. Customers control their communication preferences and can choose to receive alerts via email, text, a secure online inbox, or push notifications delivered through their mobile banking app.

For Axiom, the service is a key part of its plan to expand regionally and nationally. It currently operates 23 branches, 22 of which are in Walmart retail locations. However, the bank is planning to open more traditional branches as it seeks to expand in markets such as Jacksonville and Tampa in Florida.

Further, Axiom has plans on pursuing a national customer base with an all-digital product later this year; it received a national charter last year.

“2017 was a year of build-out for us, and digital is a big component of that,” Strand-Sorrell said.

Real-time alerts are a crucial part of operating a digital bank and staying connecting with customers locally, he added.

“We can use it as a counseling tool to help strengthen relationships and improve a customer's financial health," he said. For example, anytime a customer is facing a negative situation, such as an overdrawn account, Notifi can send an alert when their balance is low.

More than 2,0000 Axiom customers set up alerts within the first three months the service was offered, and in December more than 100,000 alerts in total were sent to Axiom customers, Strand-Sorrell noted.

When it comes to real-time alerts and messaging, “it’s still a growing trend” and one that community banks such as Axiom can use to differentiate themselves, said Scott Tullio, partner, U.S. digital lead at the consulting firm Capco.

“Fortunately, or unfortunately, we now live in a world or ecosystem where your customers are becoming increasingly demanding and less patient, so you need to be able to react swiftly and efficiently,” Tullio said. “In general, empowering your organization to act fast will drive better customer experience — that’s what you want.”

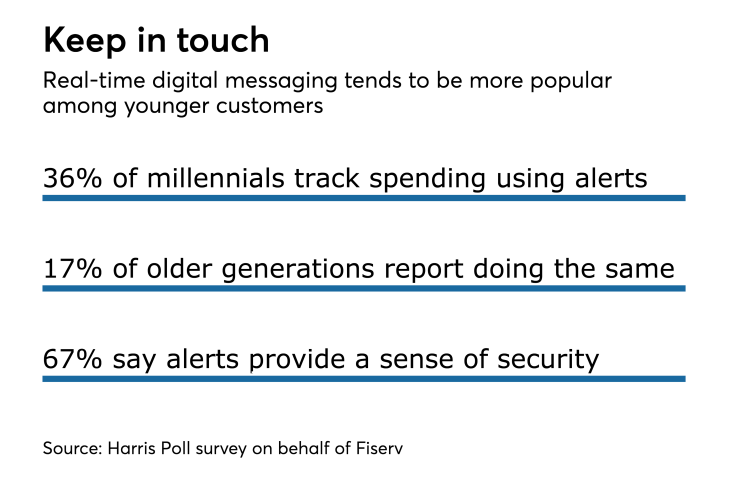

Real-time digital communications can also help banks attract the coveted millennial demographic, he added.

“I think investing in technology and analytics to get today’s data, and not yesterday’s, will pay dividends for banks,” Tullio said. “For instance, and very simply, I think real-time alerts can directly contribute to higher conversion rates. Millennials are about experience and instant action and knowing that you’re committed to them. Creating that positive impression … will consequently increase their likelihood of returning, and that’s key.”

That’s a big part of the reason Home Federal Bank in Grand Island, Neb., also began offering the real-time alerts last year.

“Millennials like to do everything on the phone,” said Lisa Harris, chief operating officer of the $280 million-asset Home Federal. “The world is very mobile and people want things on the go.”

-

There is seemingly endless research on the attitudes of millennials toward banks, but the major takeaway from all of it is that banks can't expect millennials to want to bank only one way.

March 16 -

Millennials care about more than money. So it's important for recruiting efforts to show what bankers do for their communities.

October 10 -

Just how digital are Millennials?

October 31

Such digital services can help community banks retain the aesthetic that makes them appealing while still meeting the digital needs of today’s modern customer, she added.

“People might not think a community bank can do this, but we can do these [digital] things and still be your hometown partner,” she said. “We still know the names of the people coming through the door [of the branches], so we can offer the best of both worlds.”

In addition to customer experience, real-time messaging can also help in other areas, such as fraud detection, Harris noted.

"We recently had a customer with an attempted wire fraud on an account,” she said. “We were able to show how real-time alerts could have protected this customer, and then activated alerts on the account."

Ultimately, it’s important for community banks to listen to customers and offer the digital services they desire, Axiom's Strand-Sorrell said.

“This is something our customers have been asking for,” he said. “Customers are looking for their bank to give them convenience.”