-

Discover leaned heavily on rewards to drive new card acquisitions and sales growth in the fourth quarter, but suffered a double whammy of rising reward costs and higher charge-offs, causing it to miss analyst earnings expectations.

January 25 -

Delinquencies, which are on the rise across financial services, clouded an otherwise solid quarter for Discover Financial Services.

January 24 -

Lawrence Weinbach will replace David Nelms, who had already stepped down as CEO. The transition will take place Jan. 1.

December 17 -

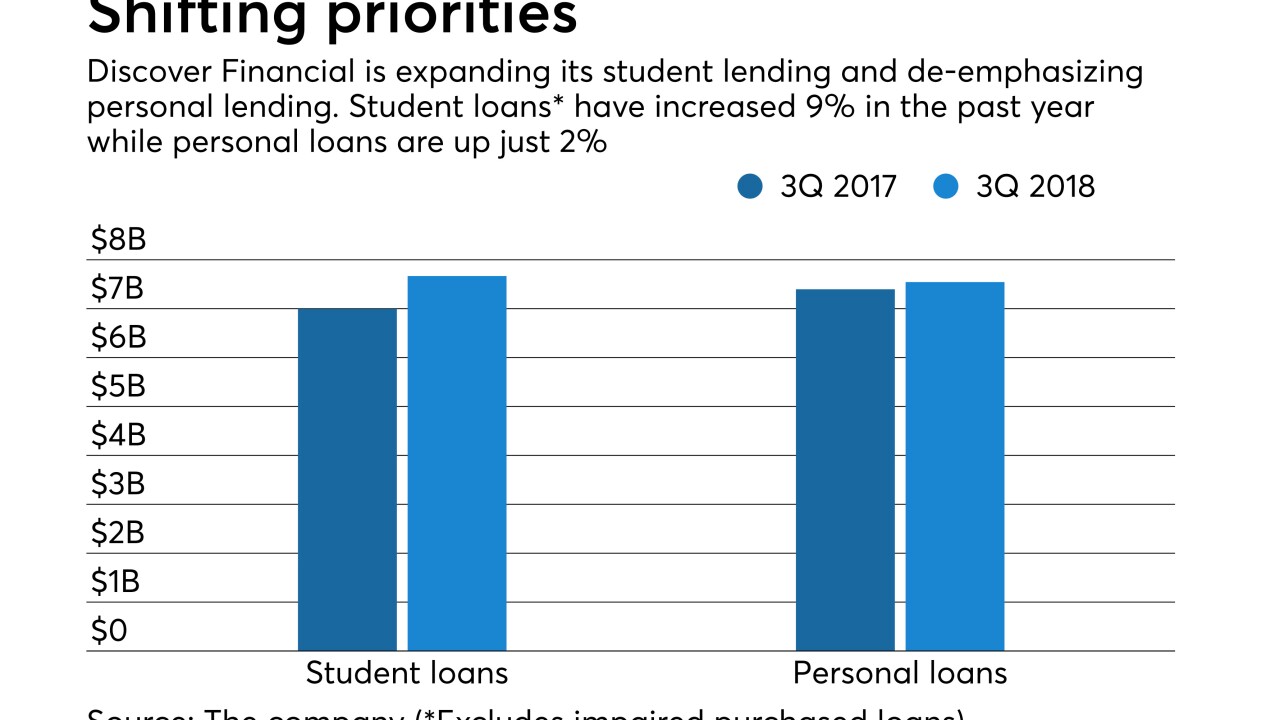

Personal loans are "tricky to underwrite" because consumer credit scores are high at the time of origination and then drift downward, says Roger Hochschild, who recently took over as the head of Discover Financial Services.

October 26 -

Double-digit gains in card volume offset an uptick in problem loans.

October 25 -

Offereins led to Discover's payments business to another year of strong growth while setting in motion a bold plan to disrupt the point-of-sale experience.

September 23 -

Four lenders, led by Sallie Mae, have long dominated the market for private student loans. But they could soon face new competition from Navient and Nelnet.

September 13 -

Digital banks dispute the notion that they can skimp on customer service because millennials are only shopping for low fees and high savings rates.

August 28 -

A smaller tax bill and a double-digit growth in card loans offset weakening credit quality at the Riverwoods, Ill., company.

July 26 -

The credit card lender reported a decline in pretax earnings, but a sharply reduced tax bill led to a 17% profit gain.

April 26 -

David Nelms said that many digital lenders do not understand how to underwrite personal loans properly, and he took a dig at their lack of profitability. The upstarts say their industry's ability to attract capital speaks for itself.

January 25 -

The credit card lender said late payments increased during the quarter but that it expects them to level off in 2018.

January 24 -

Through an arrangement with First Data and JCB International, Discover will expand its card acceptance at merchant locations in Hong Kong to better accommodate travelers carrying Discover cards.

January 18 -

The late-payment rate on loans frequently used to consolidate credit card debt hit its highest level in more than four years.

January 9 -

The San Francisco firm is the latest U.S. lender to tighten credit standards amid concerns that consumers are shouldering too much debt.

November 8 -

As more loans go bad across the credit card industry, the Riverwoods, Ill.-based company boosted its provision for loan losses by 51%.

October 24 -

Diane Offereins manages relationships with 1,000 merchants and 3,300 financial institutions.

September 25 -

The Equifax breach has millions of Americans now thinking about freezing their credit to guard against identity theft. But those who act could be cutting themselves off from the nation's vast credit economy.

September 19 -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30 -

Credit card issuers have been trying to outdo each other to offer the best rewards program. And it shows, as customer satisfaction rates with many (but not all) of their banks have never been higher in a yearly J.D. Power study. But they may not last forever.

August 17