-

During a panel discussion Tuesday, regulators said they are trying not to crack down too hard on sales incentive programs and fix problems that bankers have identified with the exam system.

March 21 -

The Federal Deposit Insurance Corp. said the Deposit Insurance Fund is projected to reach 1.35% of insured deposits next year, well ahead of a 2020 deadline.

March 21 -

Banking regulators on Tuesday called for a raft of regulatory changes, including streamlining capital, reporting and appraisal rules in order to reduce compliance burden.

March 21 - Finance and investment-related court cases

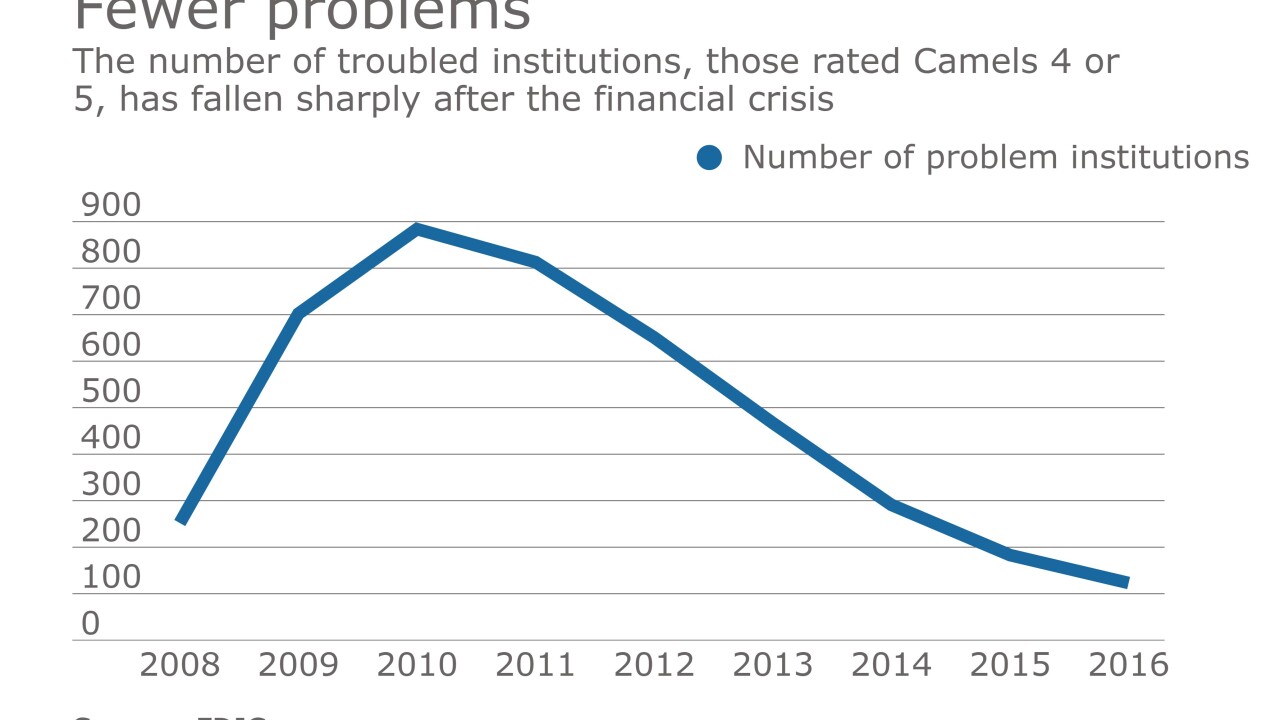

A bank took the unusual step of suing the FDIC over its Camels rating of 4 in a case that could set an important precedent for the industry.

March 20 -

U.S. bank regulators have tentatively agreed to ease an appraisal requirement that could help commercial real estate borrowers, said people familiar with talks among the agencies.

March 20 -

Thomas Vartanian, a corporate lawyer and former regulator, is a noted critic of the Dodd-Frank Act who is reportedly being considered for a key spot in the Trump administration.

March 14 -

A broad range of industry players are panning an October proposal by bank regulators that would impose new cybersecurity requirements on big banks, arguing it will only slow them down.

March 1 -

Although the news was mostly positive, the Federal Deposit Insurance Corp.'s Quarterly Banking Profile revealed potential warning signs for financial institutions.

March 1 -

The FDIC said banking industry profits rose nearly 5% to $171 billion last year; at the same time, the agency's chairman says higher rates may expose bad loans at smaller banks.

March 1 -

Banks had a largely positive fourth quarter, but the Federal Deposit Insurance Corp. still saw signs of concern ahead, including slower overall loan growth.

February 28