-

The technology company's move in Georgia could widen its processing relationships with merchants, but the company insists it won't become a traditional financial institution.

January 13 -

The move means companies can give consumers options other than ACH transactions or debit cards to receive disbursements for insurance claims, health care or gig work.

August 20 -

The bank is forming a joint venture with Fiserv to promote digital payments. It's a market that has evolved substantially — and become far more competitive — since Deutsche left it in 2012.

June 29 -

About 100 small banks have signed up for technology provided by the core software vendor Fiserv and the cryptocurrency custodian NYDIG that allows customers to buy, sell and hold bitcoin through their bank accounts.

June 23 -

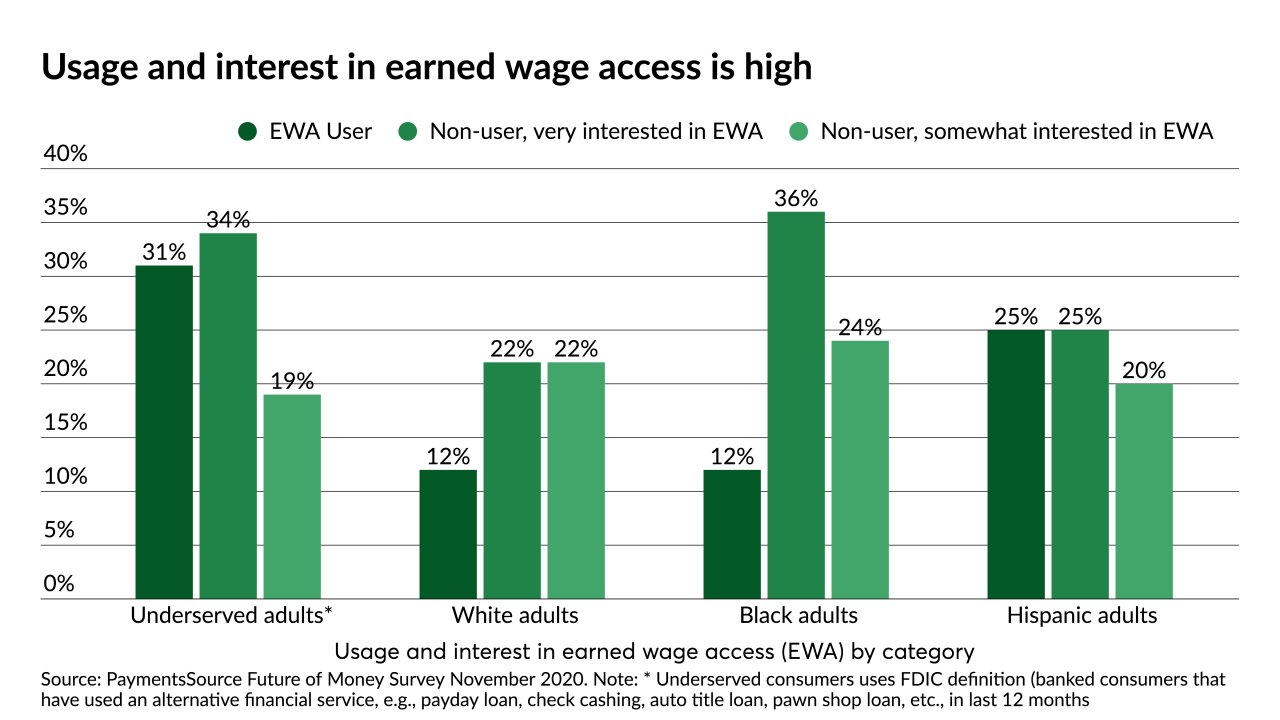

Fiserv is joining the increasingly crowded market for earned wage access in partnership with Instant Financial.

April 29 -

The tech vendor allows merchants using the Clover point-of-sale platform to accept PayPal and Venmo payments, a move that serves the company's continuing focus on full omnichannel experiences for its merchants.

April 27 -

It isn't lost on Fiserv that consumers increasingly are moving to digital financial services. Its deal to acquire Ondot Systems, a digital card solutions platform, aims to capitalize on the shift.

December 16 -

There’s no PSD2-style law requiring banks in the U.S. to share data with third-party payment apps, but the market is progressing as if there will be one, leaving some smaller banks at a disadvantage.

September 30 -

The pandemic-driven move to electronic payments isn't slowing down, and card issuers are finding an eager group of innovators promising a speedy migration to digital card production.

September 8 -

Many community banks, like Peoples Community in Wisconsin, say they proceeded despite the technological challenges presented by social distancing because the crisis has exposed the shortcomings of their digital systems.

September 3 -

A court denied part of Fiserv's motion to dismiss the suit involving Bessemer System Federal Credit Union.

July 15 -

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

June 5 -

Customers normally receive debit and credit cards inside a branch. Now banks are shifting the process to their drive-throughs and finding alternative ways for cardholders to key in their PINs.

May 21 -

Complaints to the CFPB hit an all-time high, with mortgage servicers getting much of the fire; Frank Bisignano details his priorities as Fiserv’s new CEO; lenders worry they could be stuck with billions in Paycheck Protection Program loans; and more from this week’s most-read stories.

May 15 -

Incoming chief Frank Bisignano downplays any pressure to find $1.2 billion in cost cuts promised to shareholders from the acquisition of First Data. Instead he emphasized his track record of producing revenue growth and pledged to keep funding innovation projects.

May 13 -

When Fiserv purchased First Data in 2019, it was part of an industrywide push to combine bank and merchant technology under one roof. A year later, a key piece of First Data’s technology — and its top executive — have become Fiserv’s path through the coronavirus crisis.

May 8 -

Bisignano, who engineered a technology-driven recovery at First Data before it was acquired by Fiserv last year, will take Fiserv's top job as the company forges its coronavirus strategy.

May 7 -

Payments technology provider Fiserv is acquiring independent software vendor Bypass Mobile to boost its multi-channel capabilities for sports, entertainment and restaurant verticals.

March 18 -

For the past decade, the drive for modern restaurant point-of-sale terminals and software has turned into a highly competitive race seeking new looks and ideas.

March 2 -

Fiserv completed a PIN on Mobile transaction using only an app on a consumer grade handset, and plans to pilot the technology in Europe and Asia.

February 18