-

The numbers behind Fiserv's deal to acquire First Data are huge, particularly considering each company's existing tonnage still makes consolidation the best play when faced with nimble fintechs and mobile startups.

January 16 -

Fiserv will acquire First Data in an all-stock deal with a value of about $22 billion that will combine two of the financial services industry's largest technology and processing companies.

January 16 -

The deal, valued near $22 billion, will combine two of the financial services industry's largest tech and processing firms; both banks top expectations.

January 16 -

Banks using Fiserv technology will have access to an automated accounts receivable solution from DadeSystems that the companies say will improve accuracy and lower costs for business clients.

October 15 -

The $1.1 billion-asset credit union will move to Fiserv's DNA platform while implementing other services from the technology provider.

September 25 -

Fiserv Lending Solutions' rebrand to Sagent Lending Technologies reflects the company's focus on a more efficient process for mortgage and consumer lenders.

September 20 -

The company built a patch within 24 hours of being alerted to a vulnerability in messaging software used by many banks and credit unions. Fiserv is looking into how this happened while addressing speculation about whether consumer data is still threatened.

September 4 -

The company built a patch within 24 hours of being alerted to a vulnerability in messaging software used by many banks. Fiserv is looking into how this happened while addressing speculation about whether consumer data is still threatened.

August 31 -

Sioux Valley Community Credit Union and Coulee Dam FCU are set to convert to Fiserv's Portico platform.

June 26 -

Longtime payments industry executive Kim Crawford Goodman has been named president of card services at Fiserv, where she will oversee the payments and ATM services, including credit and debit processing.

April 12 -

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

The Golden Contract Coalition, formed in mid-2016 to get community banks better deals with the “big three” core systems vendors, said banks need help with buying from fintech sellers as well.

March 7 -

Fiserv is rolling out a fraud-detection and decisioning service for issuers from Mastercard that aims to increase the accuracy of card transactions they approve or reject based on potential fraud.

March 6 -

The Ontario-based CU will use Fiserv’s DNA platform to automate workflows.

February 27 -

AI technologies can satisfy the growing demand for real-time, self-service experiences in a variety of ways, from supporting more voice-enabled payments and transactions to automating complex decision making and product recommendations, writes Marc West, chief technology officer at Fiserv.

February 20 Fiserv

Fiserv -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7 -

Walmart is the first major merchant to add Fiserv’s Accel signature debit service following the debit network’s recent expansion of routing options, in a move to cut costs for card acceptance.

February 5 -

A voice banking feature was the overwhelming winner in the Speed Round competition at this year's CUNA Technology Council Conference, but it remains to be seen how widely that technology will be adopted in 2018 and beyond.

December 26 -

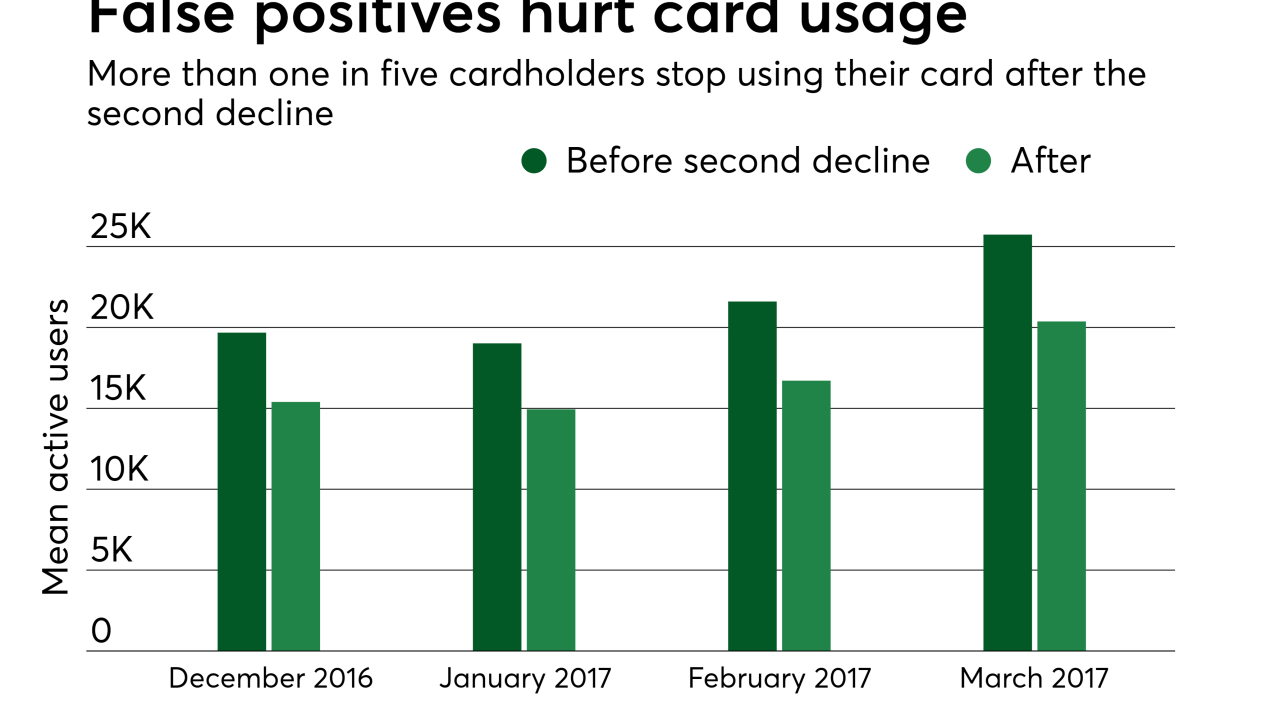

Card usage drops off fast after a false positive. In many cases, two false positives cause consumers to abandon a card permanently.

December 8 -

The big four core vendors have had little incentive to innovate in recent years. But newer competition will force them to update their technology if they wish to survive the digital age.

October 6 CCG Catalyst

CCG Catalyst