-

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

The Golden Contract Coalition, formed in mid-2016 to get community banks better deals with the “big three” core systems vendors, said banks need help with buying from fintech sellers as well.

March 7 -

Fiserv is rolling out a fraud-detection and decisioning service for issuers from Mastercard that aims to increase the accuracy of card transactions they approve or reject based on potential fraud.

March 6 -

The Ontario-based CU will use Fiserv’s DNA platform to automate workflows.

February 27 -

AI technologies can satisfy the growing demand for real-time, self-service experiences in a variety of ways, from supporting more voice-enabled payments and transactions to automating complex decision making and product recommendations, writes Marc West, chief technology officer at Fiserv.

February 20 Fiserv

Fiserv -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7 -

Walmart is the first major merchant to add Fiserv’s Accel signature debit service following the debit network’s recent expansion of routing options, in a move to cut costs for card acceptance.

February 5 -

A voice banking feature was the overwhelming winner in the Speed Round competition at this year's CUNA Technology Council Conference, but it remains to be seen how widely that technology will be adopted in 2018 and beyond.

December 26 -

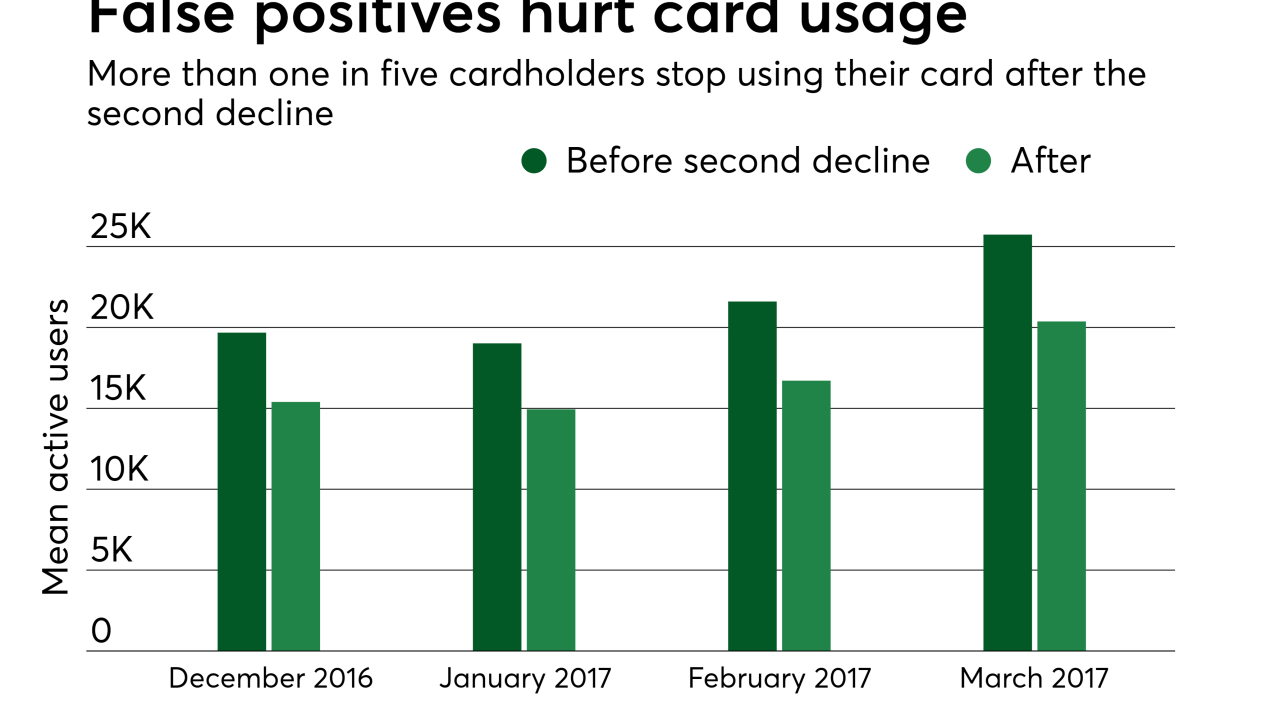

Card usage drops off fast after a false positive. In many cases, two false positives cause consumers to abandon a card permanently.

December 8 -

The big four core vendors have had little incentive to innovate in recent years. But newer competition will force them to update their technology if they wish to survive the digital age.

October 6 CCG Catalyst

CCG Catalyst -

Digital mortgages transform the customer experience with slick user interfaces and data integrations that streamline the process of getting a borrower hooked up with a lender. Now it's time to disrupt the rest of the process.

September 20 -

The $870 million credit union made the move as part of its "member-centric technology strategy."

September 19 -

Fiserv's acquisition of U.K.-based real-time payments provider Dovetail Group Ltd. is a move made with a global vision in mind.

August 21 -

Removing friction across channels and payment types not only leads to a transformative digital banking experience, it also helps ensure those positive outcomes translate to business success for financial institutions, writes Mark Little, senior user experience researcher for digital channels at Fiserv.

August 21 Fiserv

Fiserv -

The number of channels consumers use to pay their bills is unlikely to decrease anytime soon, so billers that are able to check off every bill payment channel will enjoy a competitive advantage, writes Jim Lester, senior vice president of product management and strategy for biller solutions at Fiserv.

July 14 Fiserv

Fiserv -

The two companies have created a robo-adviser with financial literacy tools to help people understand the basics of investing as they assemble their first portfolio.

June 26 -

This morning it was announced that Fiserv is to acquire UK mobile payments veteran Monitise for 70 million pounds ($88.72 million). This is quite a bargain considering that at its peak, Monitise was valued at around 2 billion pounds. But beyond the firesale price tag, what exactly does Fiserv get out of this?

June 13 -

The credit union was credited with "pioneering" use of biometrics capabilities in-branch.

May 25 -

All six credit unions will utilize Fiserv’s DNA core platform, extending contracts with the technology provider that go on for more than 20 years.

April 19 -

It's hard enough lobbying for big changes on Capitol Hill, but sometimes it only gets harder when it comes time to actually implement them.

March 3