KeyCorp

KeyCorp

With assets of over $170 billion, Ohio-based KeyCorp's bank footprint spans 16 states, but it is predominantly concentrated in its two largest markets: Ohio and New York. KeyCorp is primarily focused on serving middle-market commercial clients through a hybrid community/corporate bank model.

-

Her primary job is advising senior executives on compliance, technology and data security matters, but Hosein is also making a mark as a champion for up-and-coming female leaders.

September 25 -

Chief Information Officer Amy Brady is revamping payments, commercial and consumer banking by not settling for the status quo.

September 25 -

Amy Brady, chief information officer at KeyCorp, has won praise for leading the company's integration with First Niagara following its July 2016 acquisition.

September 23 -

After being involved in more than 70 syndicated finance transactions involving noninvestment grade companies, KeyBanc Capital Markets has graduated to lead bookrunner status, under Amy Carlson.

September 23 -

Some are relying on a national, digital strategy. Others say the right balance of costs and growth comes from more traditional means such as targeted branch openings and out-of-market expansion.

September 12 -

KeyBank will deploy Mastercard's advanced transaction decisioning technology, boosting the card network's push into artificial intelligence-powered authorization.

August 24 -

In recent weeks, several banks and fintechs have added new branches or new units, and in the process brought aboard new leadership. Here's a roundup of key hires.

August 8 -

For the millions of consumers who file auto insurance claims every year, many of whom use digital tools such as mobile apps to submit them, the process grinds to a halt when it comes time to receive their payment.

July 30 -

Vipin Gupta, who was chief information officer at Key Community Bank, will oversee strategy for information technology at Toyota Financial Services.

July 25 -

While the regulatory environment is more accommodating for big deals, many regionals still have their reasons for staying on the sidelines.

July 19 -

The Cleveland company reported higher investment banking income and kept many expense items in check during the second quarter.

July 19 -

"Banks should be investing in innovation in this area or risk getting left behind," a fintech CEO warns.

July 3 -

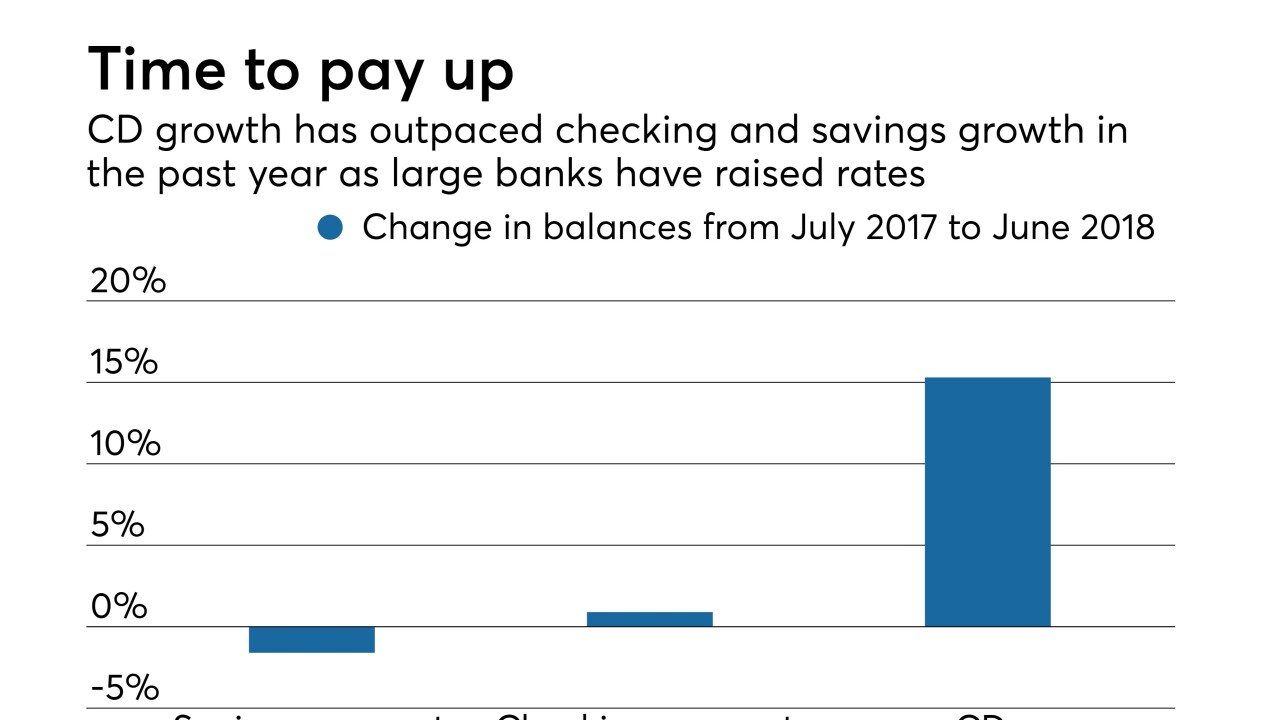

Competition for deposits is heating up as summer approaches, and banks are responding in all sorts of ways — from launching digital-only platforms to raising CD rates to reviving debit rewards. But rising interest rates could weaken demand for loans, especially mortgages.

June 14 -

Banks are making business customers happy with new digital billing services as machine learning meets the lockbox.

June 5 -

A number of credit unions and banks have been accused of operating websites that violate the Americans with Disabilities Act. Here’s why trial lawyers are targeting them and are expected to sue more.

May 21 -

Several dozen banks have been accused of operating websites that violate the Americans with Disabilities Act. Here’s why trial lawyers are targeting them and are expected to sue more.

May 21 -

Investing in technology has been an important focus for banks. But big questions remain about these investments, including how best to pay for them.

April 19 -

Banks should rethink even existing services, such as the branch experience, said top executives at the Oracle Industry Connect conference.

April 13 -

The Cleveland bank's CIO, Amy Brady, said it had to start replacing legacy systems now to position itself as a leader in the future.

April 11 -

The Cleveland company acquired the business through its 2016 purchase of First Niagara Financial Group.

March 29