Regions Bank

Regions Bank

Regions Financial is a regional bank headquartered in Alabama, with branches primarily in the Southeastern and Midwestern United States. Regions primarily provides traditional commercial and retail banking and also offers mortgage services, asset management, wealth management, securities brokerage, insurance, and trust services.

-

Regions Financial is taking steps across its 1,500-branch network to embrace consumers with autism and train its staff to help them. Business development, not just compassion, is part of the motivation.

May 10 -

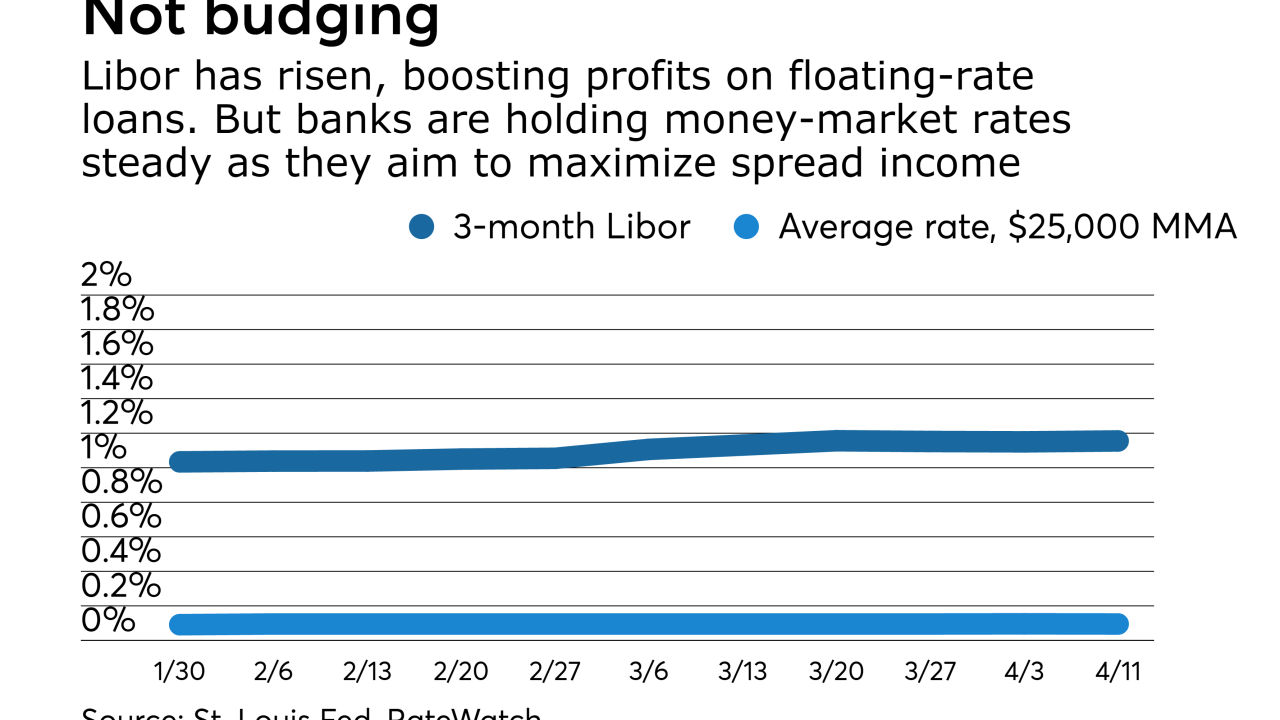

Even with net interest margins improving, banks are reluctant to raise rates on deposits until more floating-rate loans reprice. But how long can they wait before depositors start demanding higher yields?

April 24 -

The hand-wringing over business lending has overshadowed the fact that consumer lending — particularly for regional banks — has become a strong and steady engine of growth.

April 18 -

The Birmingham, Ala., company's profit climbed 8% as higher market interest rates and investment securities balances offset lower average loan balances.

April 18 -

Amala Duggirala said she was attracted to Regions because of its digital products and commitment to innovation.

April 11 -

Banks of all stripes are cheering what the Federal Reserve’s accelerated rate increases promise for net interest income, but big banks and small banks have conflicting notions about how they want to price deposits in the coming months.

March 15 -

The number of auto loans classified as delinquent rose sharply in the fourth quarter, raising further questions about whether the segment is getting overheated.

March 8 -

The number of auto loans classified as delinquent rose sharply in the fourth quarter, raising further questions about whether the segment is getting overheated.

March 7 -

Vacancies and rent-slashing have some banks worried that certain markets are overheating, but others say the decline in nonperforming loans is a sign the sector has never been healthier.

March 3 -

Regions Financial in Alabama promoted an in-house attorney to oversee its corporate governance practices.

February 10