-

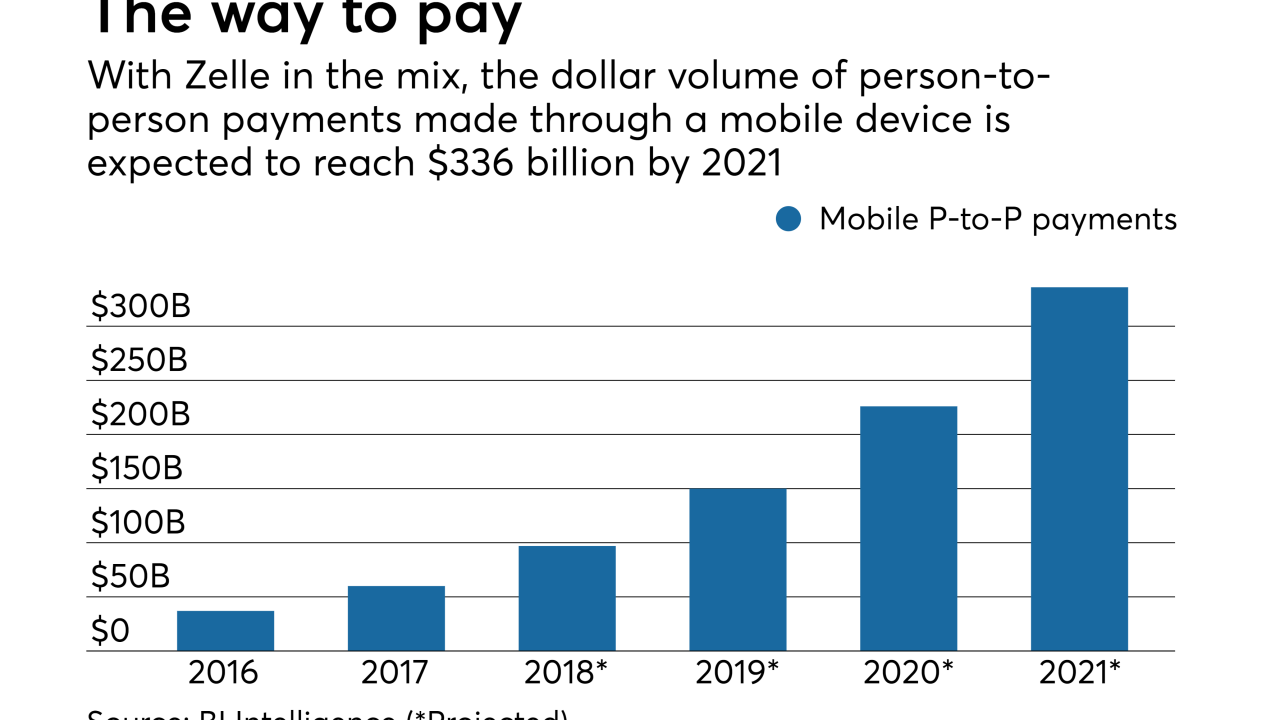

The P-to-P payments service promises to clear transactions in near-real time, but many consumers have complained that they have been unable access their money or even open accounts. Zelle has acknowledged the delays and says they are a result of its rigorous enrollment process.

January 17 -

Executives at U.S. Bancorp and Bank of America plan to use their tax savings to ramp up spending on new technology to stay competitive — but they sought to reassure investors that they would not abandon cost control.

January 17 -

Total loans rose 3% at the Minneapolis bank, but its net interest margin climbed 10 basis points. It also booked a one-time accounting gain of $910 million related to tax reform.

January 17 -

Cecere, 57, will succeed longtime executive Richard Davis, who has served as chairman since retiring as CEO last year.

January 16 -

The payments resolve a number of cases that date back to 2011 and were among the largest coordinated U.S. enforcement efforts in the years following the crisis.

January 12 -

U.S. Bank, Bank of America and other firms are looking toward the day when the ultimate virtual assistant arrives, one capable of being personalized and working on any device.

January 11 -

Consumers are on the cusp of a seismic change in our relationship with the automobile, one that will have significant implications for stakeholders in the banking and payments landscape.

January 9 -

The Minneapolis bank is the first bank to join Community Reinvestment Fund's online service that matches small-business borrowers who don’t qualify for bank loans with community development financial institutions.

January 8 -

Dueling blockchain stories — one arguing it was virtually useless, the other saying it could change real estate lending — seized the top spots this week, while readers also focused on tax reform aftermath and a key Senate retirement.

January 5 -

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

Commercial customers, including small businesses, seem ready to pay up to shift to faster, more sophisticated electronic invoicing and payments, and enterprising banks that provide them the technology to do so could find it lucrative.

January 2 -

The banks announced bonuses, wage hikes and charitable contributions resulting from the lower corporate tax rate enacted by Congress.

January 2 -

Some firms are investing in technology to help insurance clients shift to paperless payment processing.

December 14 -

Culture eats strategy for breakfast.

December 12 -

It’s only early December, but bank CEOs’ comments this week about tax reform, their thirst for deposits, consumer lending initiatives, and challenges in commercial lending offer a sneak peek at what’s coming when earnings season begins next month.

December 7 -

During an industry conference Tuesday, executives from PNC, Wells Fargo, JPMorgan Chase and elsewhere offered differing takes on whether the Republican tax plan will boost loan demand.

December 5 -

The nomination of Jelena McWilliams to chair the Federal Deposit Insurance Corp. moves the Trump administration one step closer to completing its team of regulatory appointments in its push to undo former President Obama's post-crisis policies.

December 1 -

One estimate says 3.5 million cybersecurity jobs will go unfilled by 2021. Banks are looking to military veterans, universities and even high schools to help fill the gap.

November 27 -

The House-passed tax bill would eliminate the New Markets Tax Credit while the Senate bill would not reauthorize it when it expires in two years. Bankers and other proponents say that if it is discontinued many economic development projects in rural and low-income communities won’t be funded.

November 17 -

It’s good to be a business lender with a long contact list. Loan growth is weak and the talent pool has been shrinking, so banks big and small are paying top dollar to get an edge.

November 16