-

The San Antonio-based company has promoted Paul Vincent to president of its banking unit. Neeraj Singh, previously chief risk officer for Citi’s U.S. consumer bank, has joined the parent company as chief risk officer.

February 3 -

Corporate breaches facilitated by employees — often accidentally — rose significantly this year, and banks have been particularly hard hit. Here's why.

November 16 -

USAA Federal Savings Bank’s downgrade shows how customer mistreatment stemming from flaws in internal controls can hurt Community Reinvestment Act scores. Some want consumer compliance to carry more weight in the CRA calculus.

October 21 -

USAA's regulatory troubles now include OCC fine, CRA downgrade; Citi CEO Michael Corbat and CFO Mark Mason dodged questions on cost of risk overhaul; PNC unlikely to buy a digital bank, CEO Demchak says; and more from this week's most-read stories.

October 16 -

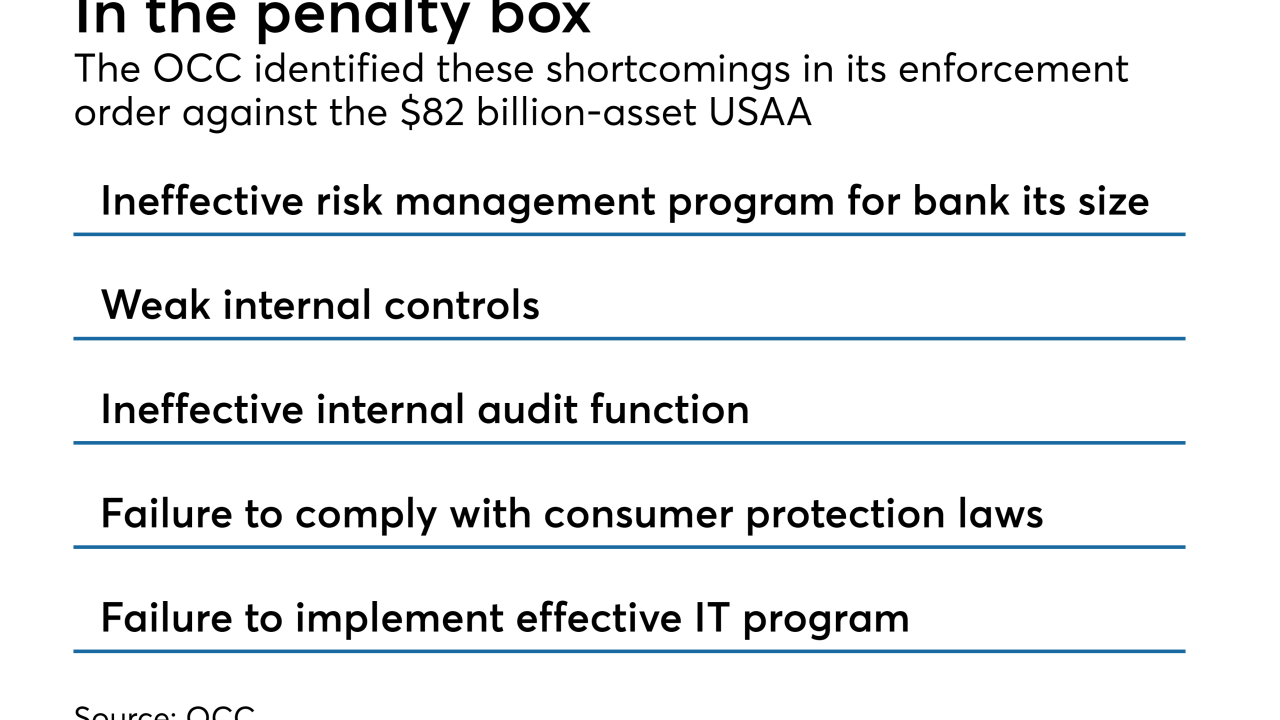

The $85 million penalty and the bank's "needs to improve" rating on its Community Reinvestment Act exam were tied to alleged violations of the Military Lending Act and Servicemembers Civil Relief Act.

October 14 -

The lawsuit follows two successful USAA suits against Wells Fargo that claimed infringement of patents.

October 2 -

Truist emphasizes high-touch, high-tech focus with new logo; Wells Fargo loses another patent lawsuit to USAA; what the Visa-Plaid merger means for banks, fintechs; and more from this week's most-read stories.

January 17 -

Wells was ordered to pay USAA $102.8 million for infringing on its mobile deposit patents. It follows a separate lawsuit loss in November also related to patents.

January 15 -

USAA won $200M from Wells Fargo in patent fight — will others be on the hook?; three takeaways from regulators' approval of the BB&T-SunTrust merger; don't believe the doom and gloom on Fannie, Freddie; and more from this week's most-read stories.

November 27 -

The remote deposit capture tech at the center of the dispute is used by 6,500 institutions. That may mean other institutions will have to pay licensing fees to USAA.

November 18 -

Severe attacks are on the rise in all sectors, including financial services. There are several specific defenses banks can employ to mitigate and recover from them.

October 28 -

Women executives headlined a number of key moves in the banking industry as summer wound down.

September 16 -

The San Antonio company named Judith Frey vice president of digital banking, Maria Alvarez Mann chief information officer for bank technology and Carri Arnold bank technology officer.

August 12 -

The internet giant's planned gaming service may create an omnichannel model for banks to emulate.

March 28

-

OCC orders USAA to improve risk management; White House's mixed signals complicate housing finance reform debate; Rhode Island bank snaps up dealmaking boutique; and more from this week's most-read stories.

February 22 -

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

The bank will pay over $15 million in restitution and fines to settle claims that it neglected stop-payment requests and reopened deposit accounts without customers' consent.

January 3 -

Most people who won't tell another human being they're broke, but they will tell a chatbot, said Patrick Kelly, assistant vice president for digital product development at USAA.

November 1 -

The San Antonio bank will refer customers seeking small-business loans to StreetShares, a financial startup that is similarly focused on serving veterans of the U.S. military.

October 16 -

Glassbox, a digital customer management company based in London, allows banks like JPMorgan Chase and Bank of America to use data and analytics to study customers' behavior.

October 4