Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The bank's new Control Tower app is designed to empower customers to track where their financial data is stored and to simplify their control over where it goes and what is done with it.

July 19 -

The bank’s once-vaunted bond trading unit reports its second bad quarterly performance in a row; Cordray tells OCC it’s too late to stop rule prohibiting mandatory arbitration.

July 19 -

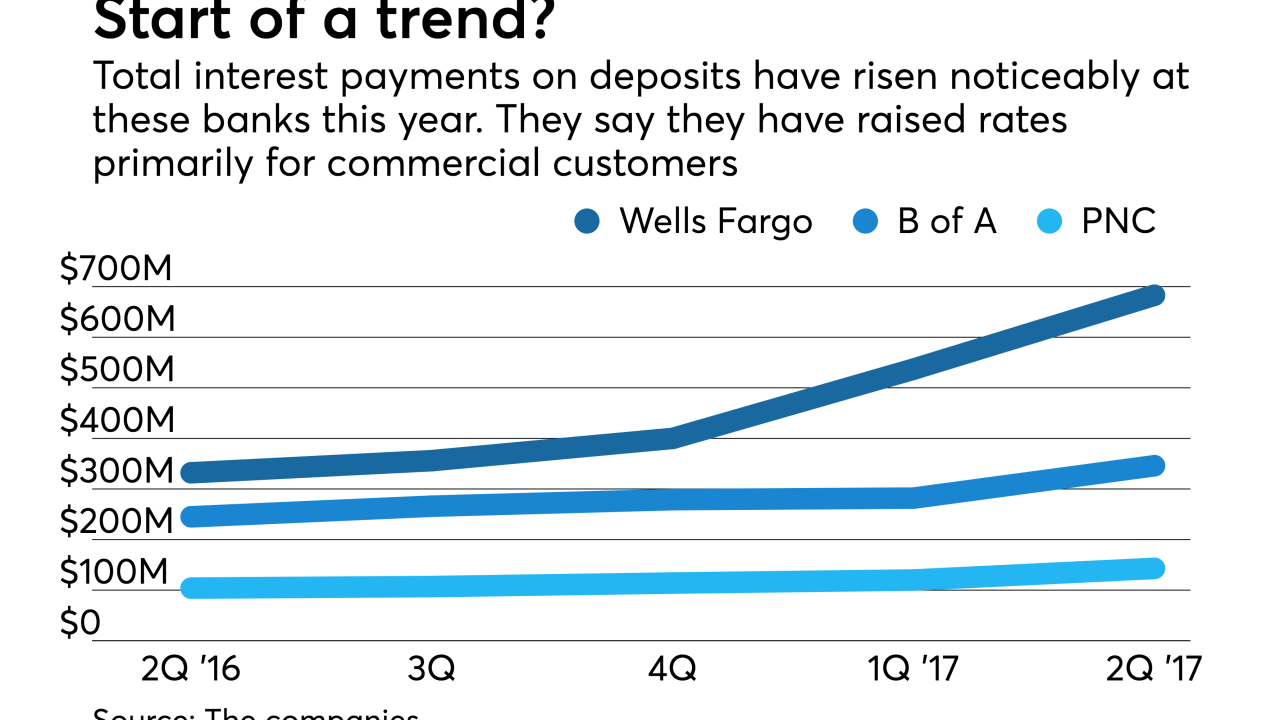

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

Investors blame Washington gridlock, lowered expectations for price drop; Wells Fargo looks to narrow its focus as it jettisons some units.

July 17 -

The phony-sales scandal forced a reckoning over an organizational structure that had long encouraged autonomy for the bank’s various business units.

July 14 -

On the first big day of 2Q results, bankers said their investments in middle-market lending have started paying off. JPMorgan Chase and PNC have added commercial loan officers in new markets across the country.

July 14 -

Wells Fargo's new car loans dropped by almost half in the second quarter, while its automotive portfolio fell to the lowest level in two years after the San Francisco-based company tightened underwriting standards.

July 14 -

JPMorgan Chase, Citigroup and Wells Fargo release earnings Friday; Cordray says acting comptroller’s claim that new consumer agency’s rule endangers banks has “no basis.”

July 14 -

What's more, loan officers' pay has dropped. At work behind these surprising trends is a blend of economic forces, technological change and pressure on banks and credit unions to pay entry-level employees better.

July 13 -

What's more, loan officers' pay has dropped. At work behind these surprising trends is a blend of economic forces, technological change and pressure on banks to pay entry-level employees better.

July 13