Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

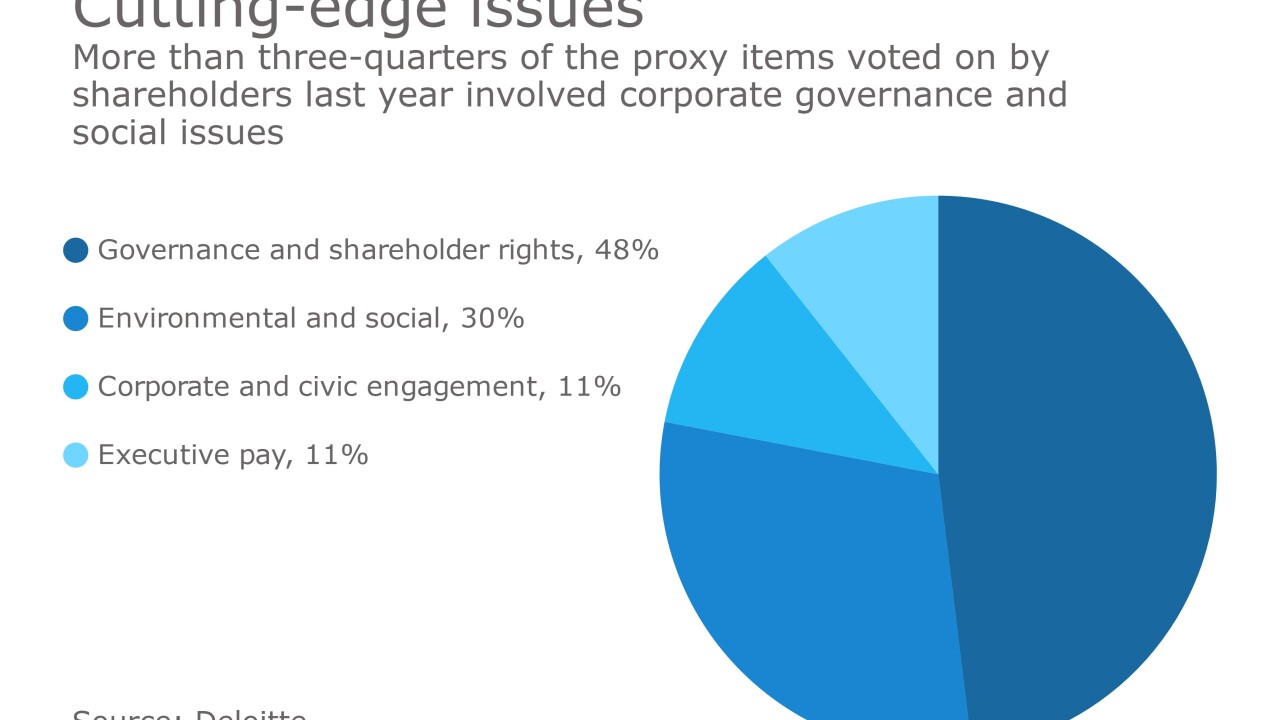

Investors concerned about the impact on banking of climate change, the pay gap and ethics matters are pushing back against a coalition of the heads of the biggest U.S. banks and other public companies that wants to limit small investors’ access to proxy ballots.

March 30 -

Wells Fargo & Co. is expanding its ExpressSend remittance payout network in India to include Axis Bank and, beginning next month, expanding a free-transfer promotion previously available only for those sending at least $500.

March 30 -

Low scores make it harder for banks to get regulatory OKs to expand, but Wells is in retrenchment mode anyway.

March 29 -

Digital currency proponents now pin their hopes on a bitcoin futures contract; bank reaches $110 million settlement with customers over phony accounts but gets "needs to improve" CRA rating.

March 29 -

Proposals to split the chairman and CEO roles at banks have rarely succeeded. But new developments — including a proposal to require separate roles for the next generation of managers — are helping concerned shareholders slowly make inroads.

March 28 -

Wells Fargo engaged in an "extensive and pervasive pattern" of discriminatory and illegal lending practices for years, the OCC said in slashing a key rating of how the bank serves communities.

March 28 -

The settlement, which requires judicial approval, will cover customers' fees and other costs related to about 2 million unauthorized accounts.

March 28 -

With a "needs to improve" rating, Wells Fargo is now subject to a wide range of regulatory restrictions on things like branch openings and M&A.

March 28 -

Community banks, big commercial banks and Wall Street investment houses are finding common ground in small-business loan funds that help Main Street, minimize potential losses on credit extended to young companies and sometimes lead to new business prospects.

March 27 -

As banks work to integrate their mobile apps with their physical channels, the march toward universal cardless ATM technology continues.

March 27