Zions Bancorp.

Zions Bancorp.

Zions Bancorporation, National Association provides various banking and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. The company offers corporate banking services; commercial banking, including a focus on small- and medium-sized businesses; commercial real estate banking services; municipal and public finance services; retail banking, including residential mortgages; trust services; wealth management and private client banking services; and capital markets products and services.

-

The banks announced bonuses, wage hikes and charitable contributions resulting from the lower corporate tax rate enacted by Congress.

January 2 -

The holding company structure makes sense for large banks with complex business models and small banks looking to bulk up through acquisitions. But for a large swath of banks in the middle, the benefits are harder to spot.

December 14 -

The Dodd-Frank Act included a provision to lock some of the biggest firms into enhanced supervision even if they wanted to exit. But that grasp may not be as strong as it used to be.

December 4 -

On his last day at the agency, Keith Noreika called for scaling back the Bank Holding Company Act, arguing that it burdens banks with duplicative regulation and restricts their economic potential.

November 28 -

Bank ponders assisting customers trading digital currency futures; banks still face challenges despite a good third quarter.

November 22 -

Zions Bancorp. appears to have found a novel approach to escape the added requirements for banks above the Dodd-Frank Act's systemic $50 billion asset threshold, but other banks in a similar position are more likely to wait for Congress to address the issue rather than following suit.

November 20 -

The $65 billion-asset company intends to shed its holding company and then will petition regulators to reconsider its designation as a systemically important financial institution.

November 20 -

The Salt Lake City bank reported strong 3Q results despite unexpected expenses tied to hurricane damage in its Texas market, and it vowed to stay on track in meeting its cost-savings goals.

October 23 -

When Zions Bancorp. in Salt Lake City decided to consolidate its seven bank charters into one, executives knew they would have to work hard to retain their most talented employees amid all the disruption.

September 25 -

Jennifer Smith is overseeing a core conversion that is the largest tech project in Zions' history.

September 25 -

The Salt Lake City company also benefited from increases in investment securities and several large loan recoveries during the quarter.

July 25 -

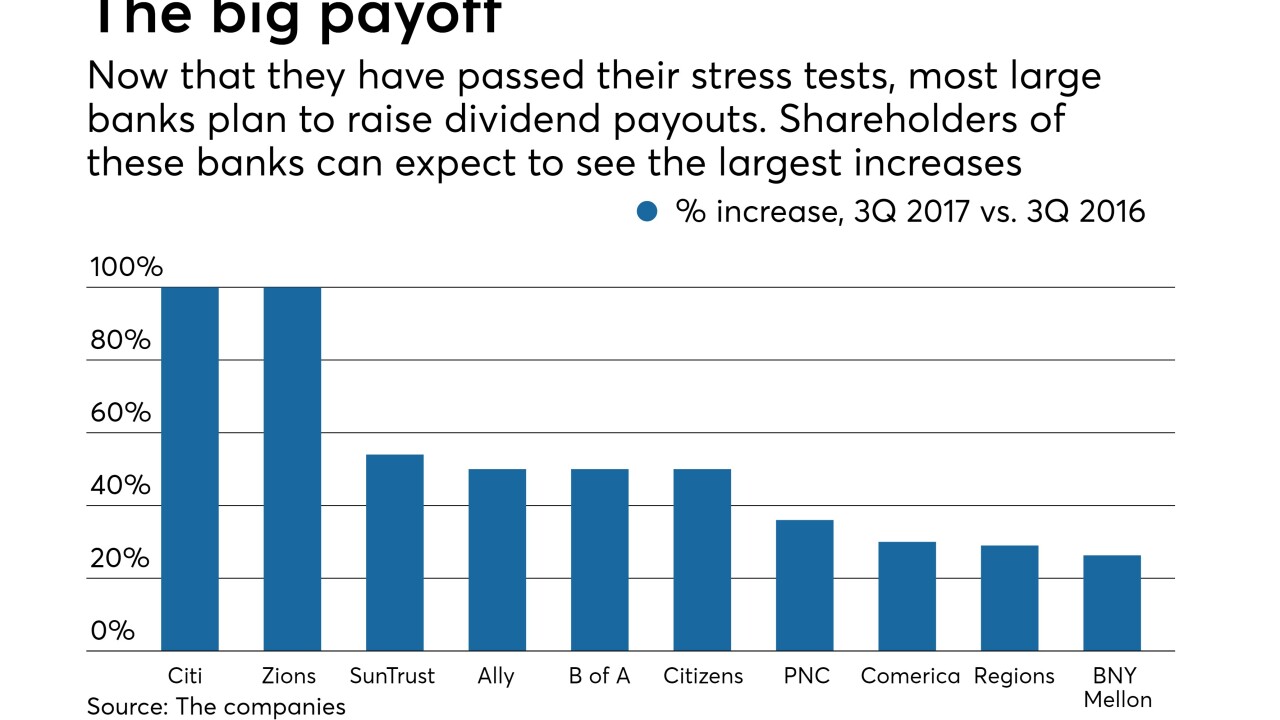

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

Oil prices are dropping again, but some lenders think now is the time to recommit to energy lending as long as they underwrite them a certain way for certain borrowers in certain regions.

June 20 -

Following are notable cases where banks were tripped up by the Fed's stress tests either by flunking the numbers (or quantitative) part of the test or raising red flags on a qualitative basis.

June 19 -

Some executives are shrugging off recent defaults as isolated incidents, but others say states’ uneven embrace of the Affordable Care Act, as well as potential changes to the law itself, have escalated the risks in lending to health firms.

May 4 -

Even as units of a larger holding company, local banks fight the perception that they can’t provide sophisticated services like corporate or private banking. Executives say that unifying the brand will help Synovus better compete against larger players.

May 3 -

Zions beat expectations on several bits of good news, but it reported about $30 million of chargeoffs tied to a single commercial borrower.

April 24 -

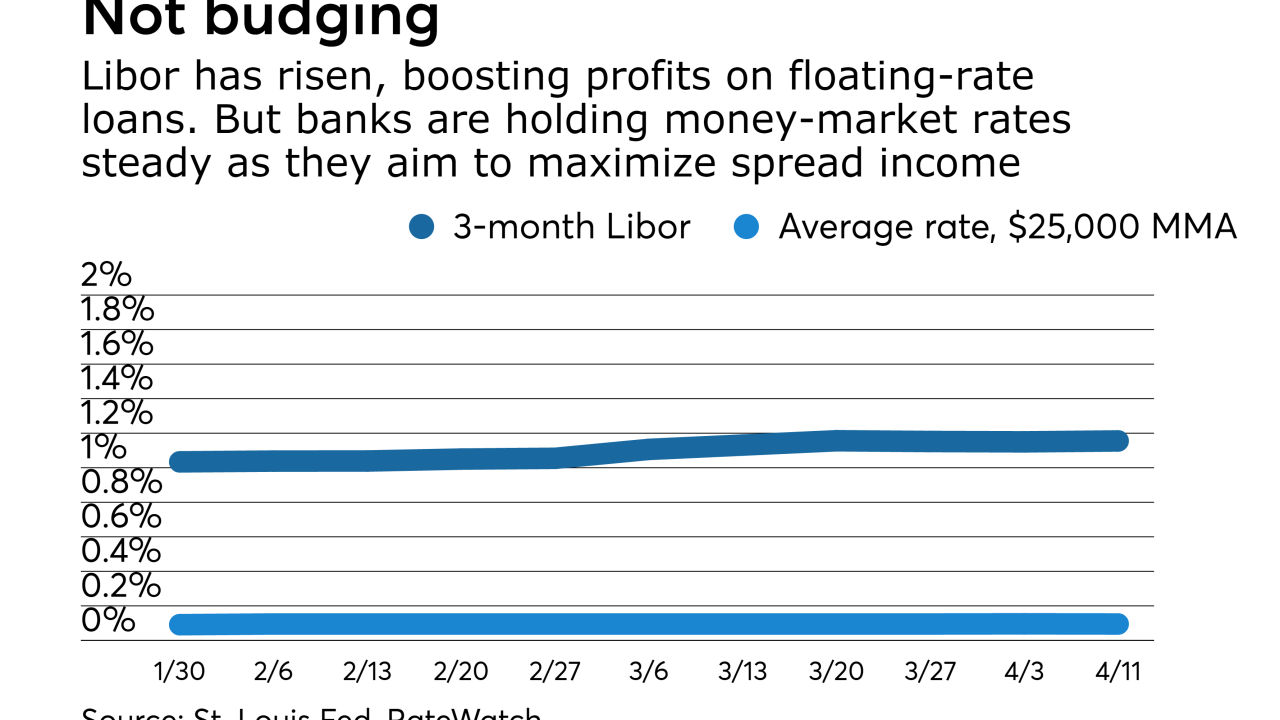

Even with net interest margins improving, banks are reluctant to raise rates on deposits until more floating-rate loans reprice. But how long can they wait before depositors start demanding higher yields?

April 24 -

Bank earnings could be hurt this year as big retailers close stores and file for bankruptcy. The situation has sparked a debate about how much CRE and C&I books will suffer just as lenders were putting other commercial woes behind them.

April 11 -

Vacancies and rent-slashing have some banks worried that certain markets are overheating, but others say the decline in nonperforming loans is a sign the sector has never been healthier.

March 3