-

Janet Garufis has spent of the past year working to ease the regulatory burden on community banks.

September 25 -

Under Michelle Di Gangi, small and midsize business lending has become a significant driver of profits at Bank of the West.

September 25 -

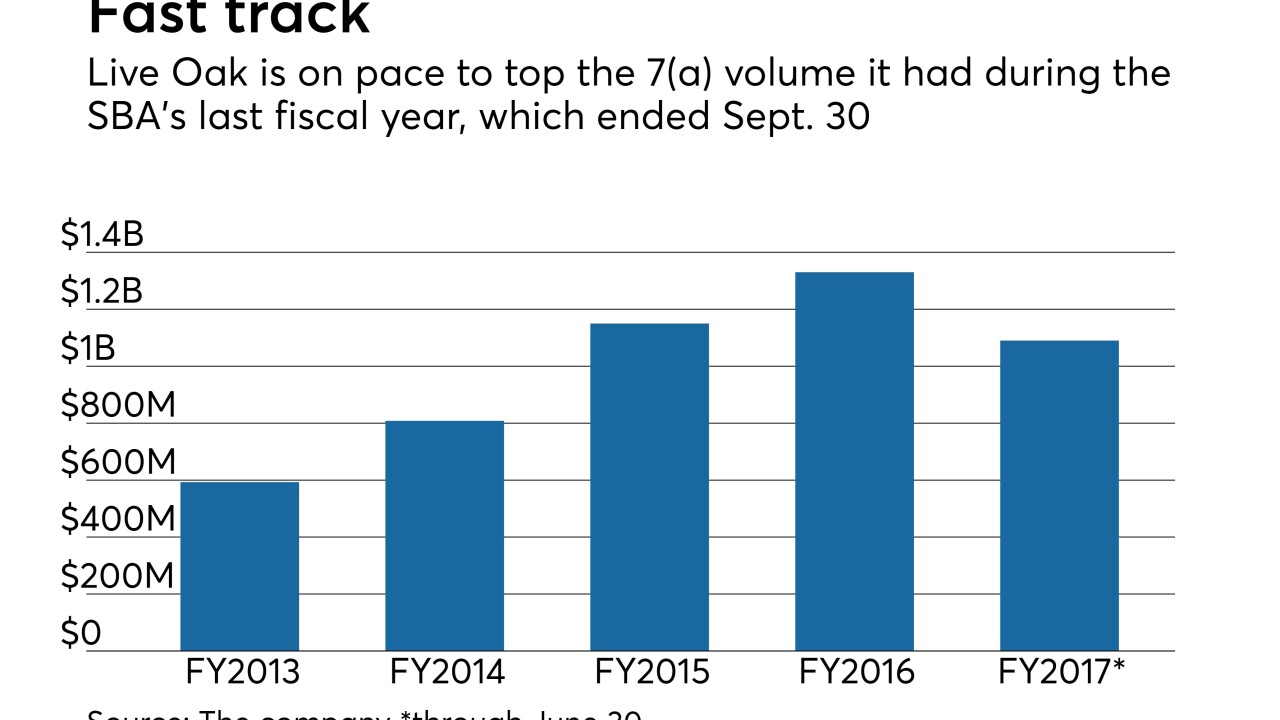

Live Oak Bancshares is used to finding ways to make small-business loans, but its new M&A operation was formed after two bankers pitched the plan to Live Oak's management.

September 22 -

Why Square says banks have nothing to fear in its bid for an ILC charter and IEX's Sara Furber explains why you should not fear the big jobs. Plus, workplaces women like and Lena Waithe on using your superpowers.

September 21

-

The agency and the National Association of Federally-Insured Credit Unions plan to boost efforts to get more credit unions involved with SBA lending.

September 20 -

The democratic nominee has supported regulatory relief and small business lending for CUs

September 19 -

Trade group will work with U.S. Small Business Administration to expand accessibility of SBA products to credit unions.

September 14 -

The agency has earmarked all funds from a Hurricane Harvey recovery package for direct relief, despite calls to get more bankers involved in the process. It remains to be seen how the agency will handle the cleanup for Hurricane Irma.

September 11 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

Given the scale of damage to the region’s homes and cars, bankers are guarding against an expected spike in missed payments by extending loan terms, deferring payments and making other concessions.

September 7 -

Karen Mills, former head of the Small Business Administration, says the glut of online lenders could help entrepreneurs obtain funds quickly.

September 5 -

The agency has a relatively new program designed to quickly get funds into disaster-stricken areas. The problem is that many bankers don't know it exists.

August 30 -

The designation allows the $1 billion credit union to process SBA loans within 36 hours and to approve them without sending them to the agency first.

August 29 -

Federal Reserve Chair Janet Yellen defended post-crisis reforms but allowed that further adjustments may be necessary to reduce adverse effects on small businesses and subprime borrowers.

August 25 -

Readers weigh in on a proposal to ease the leverage ratio, how post-crisis regulations have influenced lending, a CFPB overdraft fee study, and more.

August 11 -

JPMorgan CEO Dimon says banks are putting Silicon Valley to shame … in terms of diversity; Uber’s plan to replace its CEO with a woman seems to be sputtering; and Yellen’s potential successors also are all men.

August 10

-

The largest banks are approving small-business loan applications at the fastest rate since the recession, a sign that that they are willing to assume more risk and taking seriously the threat of competition from online lenders.

August 9 -

As banks press for deregulation, the debate over whether high bank capital standards are inhibiting loan growth has taken center stage.

August 8 -

Young businesses often prefer banks, especially community banks, over online lenders. However, traditional lenders need to make quicker decisions, simplify the application process and make other improvements, these customers say.

August 8 -

The online lender said it is on track to hit its goal of becoming profitable by yearend. It also extended a partnership agreement with JPMorgan Chase.

August 7