Artificial intelligence

Artificial intelligence

-

Regulators have taken a critical look at AML controls and handed out significant fines to financial institutions found to be lacking, according to Chad Hetherington, global vice president of professional services for NICE Actimize.

March 15 -

Software startups say bringing borrowers, builders and lenders onto one digital platform can remove some of the risks lenders faced during the crisis.

March 14 -

Leading investors say too many traditional financial institutions, out of their depth in fintech investment, end up imposing controls that slow down otherwise nimble young companies.

March 13 -

Merchant terminals—the longtime bedrock technology of the payments industry—are rapidly evolving, and few people have a better view than Jennifer Miles, executive vice president of North America for France-based payment terminal maker Ingenico.

March 12 -

Whenever Facebook adds something that more closely ties its network to shopping, service or payments, it has an immediate ripple effect. And Marketplace is becoming a major part of Facebook’s influence.

March 12 -

As machine learning generally benefits from lots of examples, by the time a model can be implemented to tackle the new threat, the threat has generally moved on, so frequent updates to models are necessary, writes Oliver Tearle, head of research at The ai Corporation

March 11 -

The lab works with more than 200 data scientists to create access to affordable credit and help financial firms match products to customers, the company says.

March 7 -

Financial institutions must manage compliance budgets without losing sight of primary functions and quality control, writes Chad Hetherington, global vice president of professional services for NICE Actimize.

March 5 -

There are a number of actions financial institutions should take to improve their application of machine learning and data analytics technologies.

March 1 -

A data-driven approach, regardless of human or machine involvement, is a state that organizations need to move to in order to maximize detection in the present and to ease the transition to a more primarily machine-driven future, writes Oliver Tearle, head of research at The ai Corporation.

March 1 -

The companies have teamed up on a product to help banks, especially small ones, give customers more accurate insights into their own financial health.

February 28 -

ComplyAdvantage, Cinnamon and Zoovu recently raised millions of dollars to fuel expansion of their automated risk management, data-scanning and customer service products geared toward financial services companies.

February 22 -

Crooks are using techniques that move quickly, making AI a good bet when searching through many layers of transaction data, according to Jie Wu, a director at GoodData.

February 19 - Overcoming cultural fears remains top challenge with AI adoption

To take full advantage of AI’s opportunities, employers must understand and overcome lingering doubts from their employees.

February 15 -

The financial services industry has plenty of tasks, such as card issuance, that can benefit from the automation that artificial intelligence brings, writes Jie Wu, a director at GoodData.

February 12 -

The bank and card program provider is starting to use AI in many areas, but it's also trying to build paths forward for employees whose jobs will be affected.

February 11 -

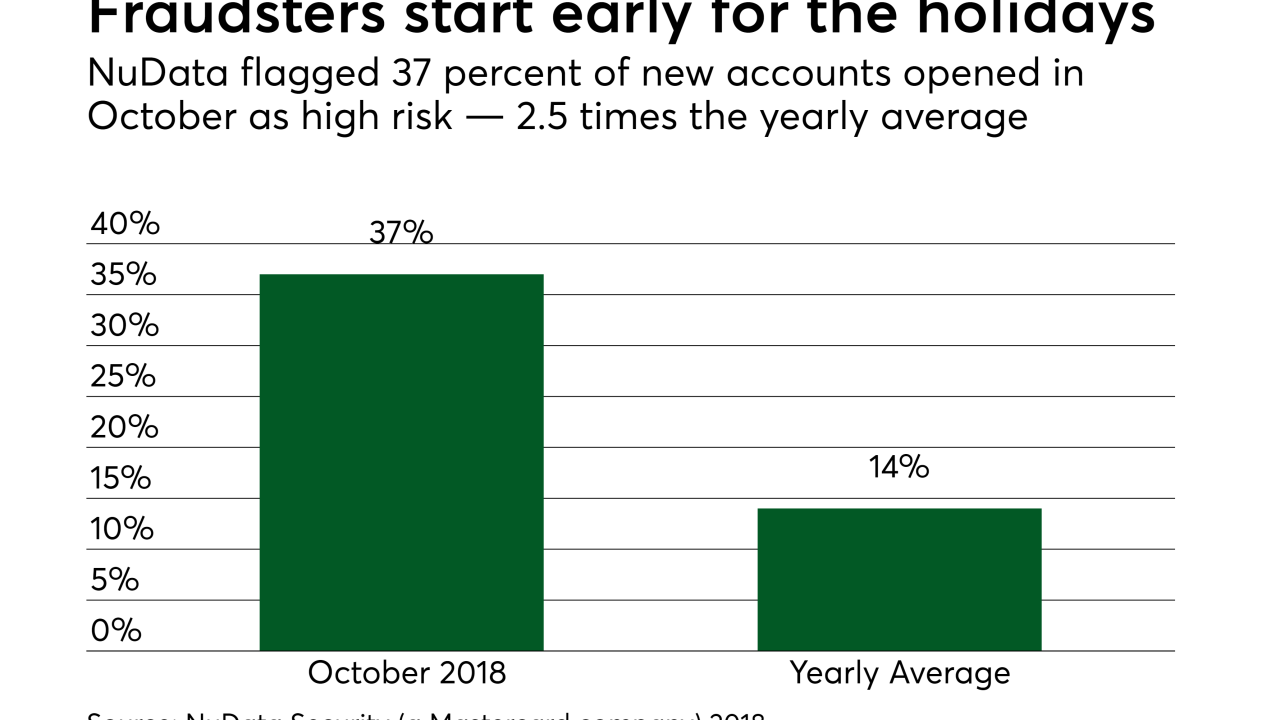

Technology companies have pushed machine learning as a way to combat a fraud threat that's increasing in size and sophistication, and there are signs emerging security innovation is making a difference.

February 11 -

The order coincides with concerns about China’s ambitions to dominate the sector and the likelihood of disruption for workers as the technology automates millions of jobs.

February 11 -

A bounty of stolen payment credentials and complex processing makes online travel booking a crook's delight, but machine learning could be the tonic to combat a wave of fraud.

February 8 -

Technology investors are bulldozing cash into blockchain and artificial intelligence, but the “why” is just starting to emerge, as is the true nature of the innovation.

February 8