-

Some established financial technology companies like Robinhood are said to be refusing to accept funds from accounts at young digital-only banks that they say are growing too fast to deter fraud. The companies being blocked respond that it’s an unfair, scattershot approach.

December 20 -

The consumer bureau asked for public feedback about payment platforms as part of a focus on the Silicon Valley giants’ financial services aspirations. But comment letters so far have been dominated by users complaining that they lost money on the big-bank-owned peer-to-peer network.

December 20 -

The Pennsylvania bank run by Sam Sidhu is updating its platform to support real-time payments for cryptocurrency companies and will offer embedded finance and banking-as-a-service to fintechs.

December 16 -

Asenso Finance and a community development financial institution, the National Asian American Coalition, have developed a loan aimed at borrowers with limited credit histories. The underwriting relies in part on alternative data and borrowers are required to take financial literacy courses.

December 15 -

An audit found most of the biggest banks and largest community banks fail to meet basic Americans with Disabilities Act rules for website and app readability. U.S. Bank does more than most to make digital channels accessible.

December 13 -

A new survey of industry executives finds substantial interest in cryptocurrencies and mergers but anxiety about competition from large technology companies.

December 13 -

Through its partnership with Visa, the California credit union lets members receive digital replacements for lost cards almost instantly and add digital cards to mobile wallets like Apple Pay.

December 10 -

Goldman Sachs, which already runs Apple Card and part of its consumer banking operation on AWS’s cloud, will now host market data there for hedge funds and other institutional clients.

December 9 -

-

Like many smaller financial institutions, Centra Credit Union in Indiana is trying to reduce its tech-maintenance burden by shifting some applications to the cloud, starting with data analytics.

December 3 -

Coming out of the pandemic, traditional banks will have just two years to update their business models or they risk falling behind more innovative peers and aggressive upstarts, the consulting giant warns in a new report.

December 3 - AB - Technology

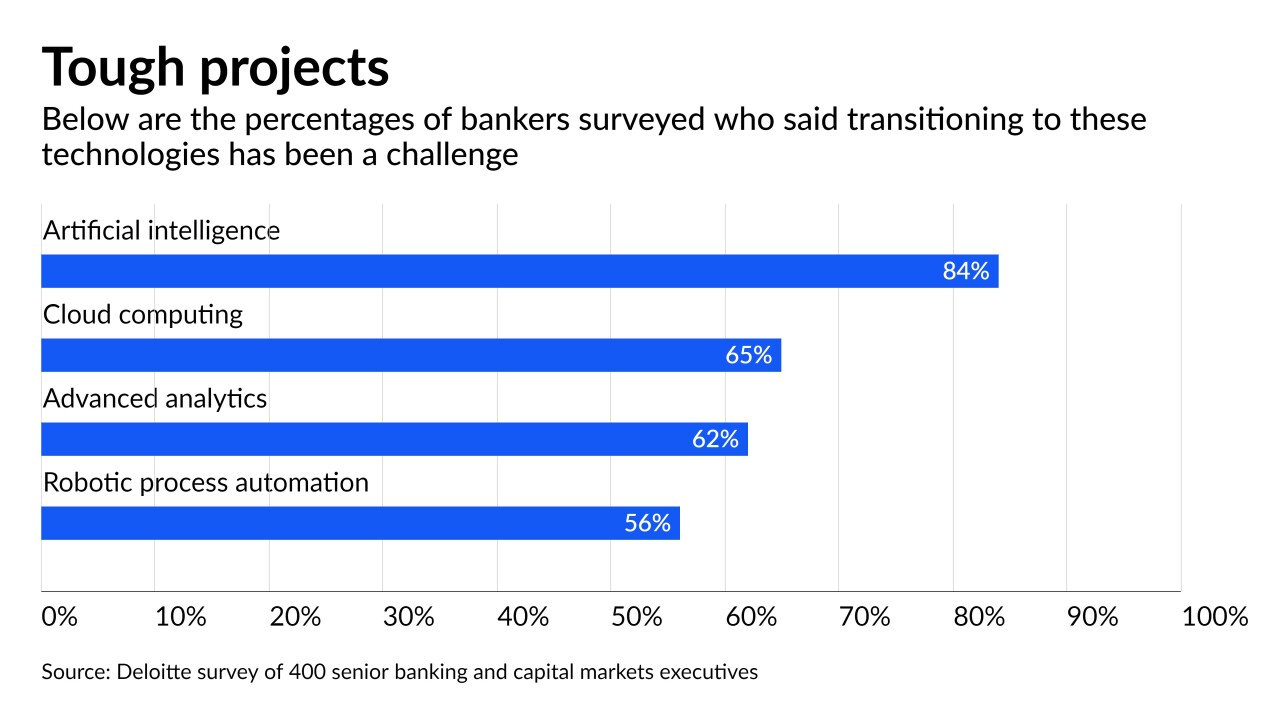

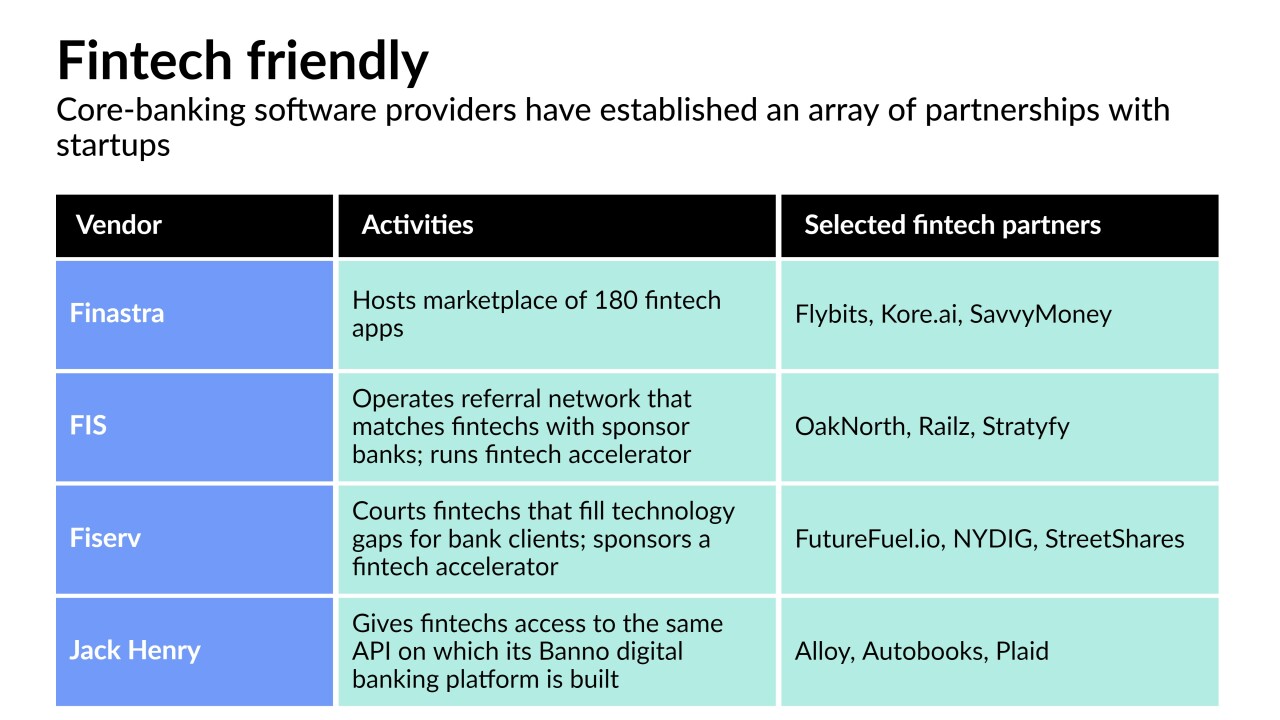

Fiserv, FIS, Jack Henry and Finastra, the top U.S. core banking software providers, are stepping up efforts to let banks plug innovative technology from younger fintechs into their legacy systems.

December 2 -

Bankers were given a chance to weigh in on a new breach notification proposal, and federal regulators apparently took their comments to heart before issuing the final rule.

November 30 -

Its goals are twofold: to be a financial intermediary between buyers and sellers on the Provenance blockchain and to use the technology to bring speed and efficiency to loans and other products.

November 29 -

A new report finds that financial companies are the most targeted by fraudsters seeking to steal usernames and passwords. They're fighting back with specialized tracking technology, special domain names and other increasingly sophisticated techniques.

November 23 -

-

The regional banks are moving past old-school collection calls, instead using emails, texts and on-screen messages to urge delinquent customers to repay debt. Modern communications are said to be more efficient and in keeping with Consumer Financial Protection Bureau debt-collection rules set to take effect Nov. 30.

November 22 -

N26 and Monzo halted or delayed expansion plans here largely because competition for customers was already intense and obtaining a banking license proved difficult.

November 19 -

Wilson created an app from scratch in the middle of a large merger, he's setting up “client journey rooms” where customers co-create technology with technologists, and he's moving the bank forward into cloud computing.

November 18 -