-

Readers slam credit unions’ ever-inclusive membership criteria, weigh in on the OCC’s proposed fintech charter, encourage a rewrite of the CRA, and more.

July 14 -

First Citizens is pressuring KS Bancorp to sell even though the banks' operations overlap in many markets in eastern North Carolina.

July 13 -

The North Carolina company could issue $200 million in new securities over time to fund acquisitions and other investments.

July 13 -

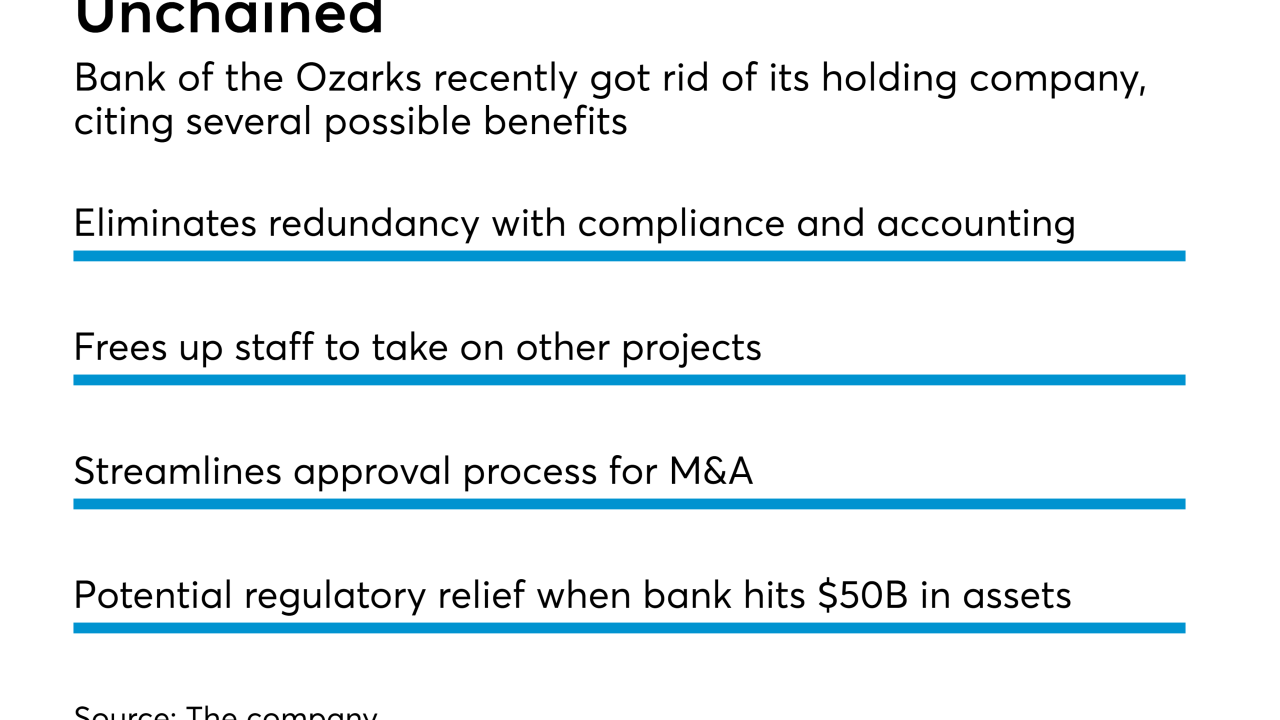

Bank of the Ozarks recently dissolved its holding company in a move that goes against modern banking strategy. There are, however, strong arguments for other institutions to follow the bank's lead.

July 12 -

The Treasury Department will take a huge hit when Cecil Bancorp sells its bank, while 1st Mariner Bank in Baltimore will see its equity stake completely wiped out. Cecil opted for bankruptcy court when it was unable to resolve an impasse over its trust-preferred stock.

July 11 -

The subprime business lender halted new business and laid off scores of employees after recording higher-than-expected losses.

July 6 -

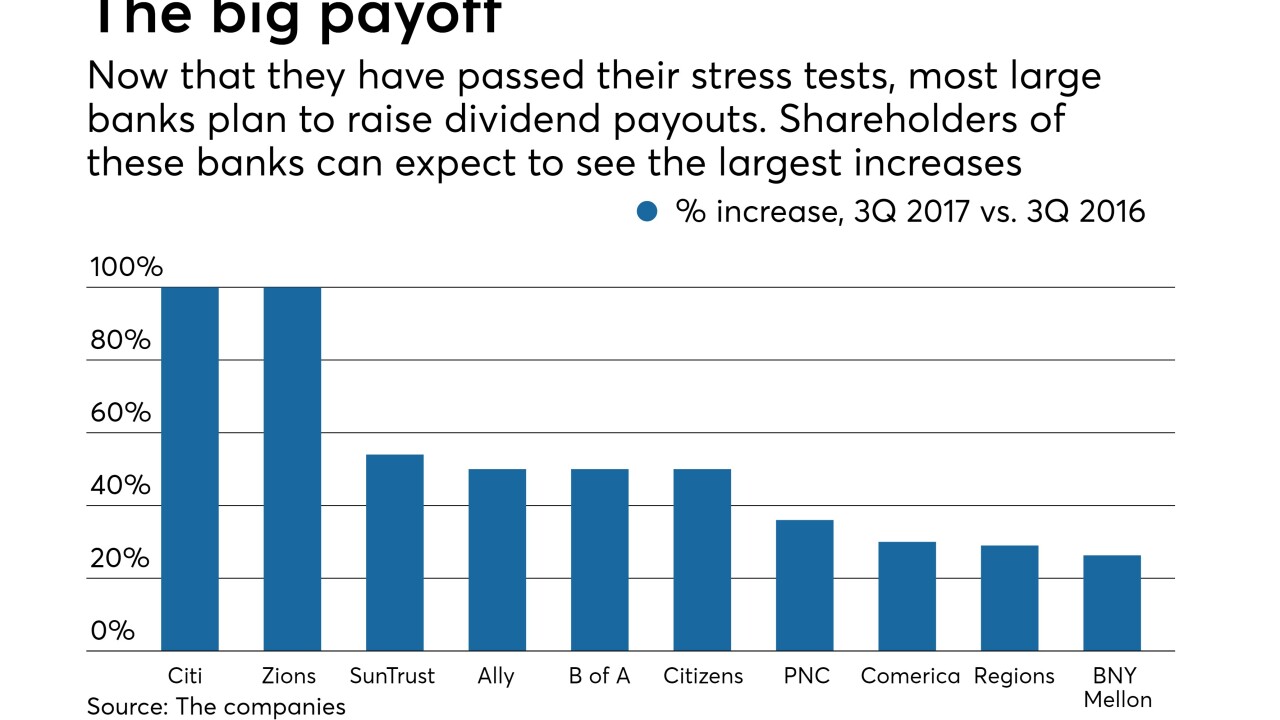

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

The North Carolina company's purchase of Chattahoochee Bank will add a branch and loan production office to its existing operations in northern Georgia.

June 28 -

The $231 million-asset Virginia bank will also double its legal lending limit when it buys CCB Bancshares.

June 28 -

The Georgia bank will pay $124 million for Four Oaks Fincorp, buying a bank with a large operation in Raleigh, N.C.

June 27